I’m not really sure where to start with this one. “Cannabis value investing” should say it all, but there is so much more to this story… at least from a personal perspective. I’ll try to keep this intro short, because I could get off topic very quickly.

As many of you know, I was an early investor in the cannabis industry. In fact, many readers joined me in several private cannabis investments. We made a lot of money on a couple different deals. And we also lost some money on one.

In addition to investing, I also hosted a large cannabis investor event in Denver, where we toured grows, processing facilities, and edible manufacturers. I was also on the ‘cannabis conference tour’ for about 4 years, where I attended nearly every industry gathering and did all the hand-shaking dog and pony shows.

I say all of this because “cannabis value investing” is like an oxymoron. For every one cannabis company that is currently in business, I could point to twenty that are out of business. And that’s conservative.

Of course, those failed businesses also meant billions of investor’s dollars down the drain. There are multiple cannabis companies that were once each worth billions but are now gone, or about to fail.

Even talking about investing in cannabis makes me cringe a little. It was (and still is) such a promising industry. And, well, it just got all screwed up for many, many reasons.

But now, there are some interesting opportunities popping up in cannabis…

Cannabis Consumers Have Only Increased

I used to write articles talking about how public sentiment around cannabis is changing. I’d always get emails replying back to me about how ‘out of touch I was with society,’ and that ‘middle America would never be in favor of drugs.’

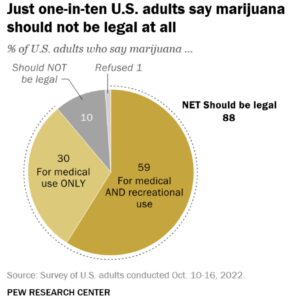

Well, that ship has sailed, and there is no going back. An overwhelming amount of the population now favors cannabis legalization. Furthermore, there are more Americans living in a state where you can recreationally consume cannabis, than not. (Recreational consumption means you can buy and consume cannabis without a license, just as if you were purchasing and consuming alcohol.)

Source: Pew Research Center

When it comes to actual consumers of cannabis, that rate has skyrocketed. According to a new poll from Gallup, half of the US population has at least tried marijuana, while one in six Americans consume the plant frequently.

Since 2022, more people in America consume cannabis than cigarettes. And when it comes to alcohol, “60 percent of cannabis users have cut back on alcohol consumption in the last 20 years.”

None of this is to say that cannabis is a wonder drug, or that there aren’t harmful effects from longterm or frequent use. Instead, all of this information is to point out that cannabis use has only increased, and users are highly unlikely to disappear anytime soon.

How to Invest in Cannabis

If you want to be a successful investor in cannabis, I recommend you get into a Time Machine and go back to 2015-ish and make some placements. Then, sell out of everything by January 2018. And never, ever return to the industry. I wish I was joking.

I said in the beginning of this article that I wouldn’t get distracted with side stories. So, I won’t dive into details… But let’s just say that if you are investing in a company that touches a cannabis plant, you are probably screwed. Between the IRS Section 280E tax code, the black market, and the fact that cannabis is still federally illegal, it has been nearly impossible to turn a profit for cannabis companies.

That’s why many investors have turned to ‘picks and shovels’ companies in the cannabis industry. Think packaging, data, and services that support the industry while avoiding any legal and regulatory barriers.

Two of the most well-known ‘picks and shovels’ cannabis companies are Weedmaps and Leafly. And that’s what we’re going to dive into…

Cannabis Value Investing Candidate #1

I saw a head line a couple weeks ago that caught my eye: Cannabis tech company Weedmaps posts $2 million profit after rough period

Cannabis and profits in the same sentence is usually an odd combo, but Weedmaps has historically been a unique company.

Founded in 2008, Weedmaps has a very complicated history. The company was essentially the first website to corner the market on cannabis dispensary referrals and was reportedly making hundreds of thousands of dollars per month in 2010.

Over the next decade, Weedmaps had a revolving door of executives and was acquired and sold back to the original founders. The company made all kinds of interesting transactions and ‘industry firsts,’ which included the first Museum of Weed. There could probably be a great Netflix series about the company.

One of the interesting transactions that Weedmaps made was their purchase of marijuana.com for an obnoxiously clever amount of $4.20 million. This equally cringe-worthy headline ran on TechCrunch in 2011. The marijuana[dot]com url still redirects to Weedmaps today.

Anyway, today Weedmaps is a publicly traded company on the NASDAQ and has seen its share price get absolutely obliterated. From a $1.5 billion valuation in 2021 to a $160 million valuation today, most investors in this company have been taken to the cleaners.

Cannabis Value Investing Candidate #2

Founded in 2010, Leafly was built to be a resource for different types of cannabis strains. The site evolved to feature tools such as a dispensary locator and education hub. Their website has an incredible amount of data, original content, and industry information that cater to the novice and experienced cannabis consumer.

Similar to Weedmaps, Leafly has a complicated past with multiple different company transactions and leadership changes. Despite these ups and downs, their website caters to an enormous amount of active users and has become an industry leader with many firsts (which includes being the first cannabis company to advertise in the New York Times).

Leafly’s original ad in the New York Times

Leafly went public on the NASDAQ in early 2022 with a nearly $400 million valuation. Since their IPO the company’s stock price has cratered, resulting in a present valuation of about $15 million.

Zombie Company or Value Investment?

For an investor, being trapped in a zombie company is one of the worst case scenarios. This is a situation where a company has a valuation that has dropped dramatically, has lots of debt, and/or has a nearly impossible hill to climb. What makes a zombie company unique is that despite massive challenges, they just won’t die.

That means investors don’t get a return on their investment, but they also can’t write off the company as a loss. Basically, it’s a trap with no exit.

Weedmaps and Leafly have had a decline in valuation since their IPO by 90% and 96%, respectively. Typically, when a company sees this kind of loss post IPO, there is no coming back. Either they bump along at their current valuation for years to come, or they eventually get bought out by a PE firm to go private, where they are chopped up and sold off.

However, here’s why Weedmaps and Leafly may be different…

Understanding Website Traffic

Although the future for Weedmaps and Leafly may look bleak according to their stock market performance, the bones of each company are unusually strong. Yes, it’s true that both companies have had an almost comical amount of past drama, but their core value is just as strong as ever.

To understand why these companies have extremely strong foundations, you need to look at their website analytics. In very simple terms, we need to look at the number of people that go to their websites and how they are getting there.

When it comes to website’s analytics and statistics, you’d think that it all comes down to numbers. However, creating a great website that attracts lots of traffic is more of an art form rather than a science. That’s because there are so many variables to account for.

A “good” website may check all of the boxes that are required to rank well on a search engine. Things like grammar, content quality, page load speed, and a clean site map are all important qualities a website needs in order to generate traffic.

A “great” website may have all of the above qualities plus the added value of excellent branding, addictive content, and a ‘clean’ overall user experience. This will ensure that website visitors not only land on the website, but they stay there for a while to consume content and make transactions.

Search engines (with the biggest and most important being Google) look at all of this data and then rank a website. Google, for example, collects dozens of datapoints for both websites and users to make their search process most efficient. So, if a website has all of the best datapoints (according to Google), the site will rank highly in search results.

Understanding Virtual Real Estate

Once a website has all of the necessary features and qualities (mentioned above) to rank well on a search engine, the next important issue is time. This means that a website that has been in existence for a long time has a higher reputation compared to a new website.

Search engines prioritize websites that have a strong track record. A website that has been live and functioning well for 20 years will have very strong analytics and statistics. It’s similar to a traditional company that has been around for many years with lots of happy customers.

A website with a strong history of creating great content and attracting lots of traffic is akin to prime real estate located in a busy downtown area. Think of a storefront on Rodeo Drive in Beverly Hills, or a building on New York’s Fifth Avenue. Even if the real estate is rundown and out of date, there is intrinsic value because of the location and surrounding (foot) traffic.

Cannabis Value Investing – Authority

In the traditional real estate world, there are lots of third party companies and tools that can be used to determine a property’s valuation. Typically ‘comparables,’ better known as ‘comps,’ are how properties are best valued.

In the world of websites there is a similar strategy. By comparing websites to other websites, there are all kinds of metrics that can be determined. And that’s exactly what I’m going to show you for both Weedmaps and Leafly.

First, we’ll use a “Website Authority Checker” which is measured by Ahrefs. Here are the results:

As you can see, both companies have similar domain ratings. You can try out this free tool yourself and read about the methodology HERE. The scores that both of these companies have are very impressive.

Cannabis Value Investing – Traffic Volume

Next, we’ll look at traffic for the month of July in 2023. I used Semrush to gather this data, which is a third party website traffic analyzer. You have to have a paid account to see this information, but I’ve taken screenshots of the main data points below.

We’ll start with Weedmaps:

As you can see, Weedmaps receives about 8 million visits per month, with a little over half of those visitors being unique individuals. What’s impressive is the average visit duration, at over 12 minutes.

Here is Leafly:

Leafly has more than double the amount of total visits compared to Weedmaps. With over 9 million unique monthly visitors, each visitor views about 2-1/2 pages and spends over 10 minutes total on site.

This data for both Weedmaps and Leafly is very impressive, but Leafly is clearly a leader here.

Cannabis Value Investing – Organic Traffic & Intent

The amazing thing about website data is that it’s so deep and complex. Nearly every metric you could possibly imagine is quantified. Not only can we see the volume of traffic that goes to a website, but we can also see its origination and behavior.

Again, we start with Weedmaps:

As you can see above, 2.5 million site visitors are finding Weedmaps organically. This means that someone is typing in a search term on a search engine and then clicking a link that goes to Weedmaps. Based on the previous total site traffic, we know that Weedmaps receives about 50% of its total traffic organically (2.5 million divided by 4.9 million unique visitors = 51%).

Now we look at Leafly:

Again, Leafly receives much more organic search traffic than Weedmaps. About 50% of Leafly’s total traffic is organic. This demonstrates the excellent content that Leafly possesses, as search engines often display Leafly as a top result for multiple key words.

What’s interesting for both Weedmaps and Leafly is that the “Keywords by Intent” data is almost identical. This data represents what the user is trying to do with their search term. The last category, “transactional,” is typically the most important for an e-commerce site because it represents potential buyers.

Company Assets versus Business Performance

Based on all of the data that I shared above (and there is a lot more behind the scenes), I would argue that both Leafly and Weedmaps have some of the best assets in the entire industry. Of course it’s an apple to oranges comparison, when we look at other companies that have physical real estate or physical products. But, how many companies do you know of that receive millions of visitors every month?

Now, just because a company has great assets doesn’t mean they are running a good business. For example, imagine you had a prime storefront on 5th Avenue in New York. Thousands of people walk by everyday, so you’d be guaranteed to have at least some people walk into your store.

But imagine, if the store smelled like dead fish, or the employees were rude, or maybe the payment processor never worked. There’d be a lot of foot traffic into your store, but not many conversions into sales. This is exactly the same concept with a website. If you struggle to convert visitors into customers, then your business will struggle as well.

In 2022 Leafly did about $47 million in revenue, while Weedmaps brought in $215 million. I’ve tried to read their financials, but since they are using different accounting measures and the profits/expenses aren’t itemized, it’s nearly impossible to compare (anyone out there that can help, give me a holler!).

Regardless, it’s obvious that Weedmaps has built a better mousetrap. Weedmaps has half the traffic of Leafly, yet they generate over four times more revenue.

I would argue that Leafly has better assets while Weedmaps has a better business. But, that’s all relative because they both lost money in 2022! Weedmaps ended the year with a $83 million loss and Leafly was in the hole by $28 million.

But There’s Still Value!

There’s no nice way to say it. Both Weedmaps and Leafly need complete overhauls. Extreme, chop-style transformations.

If every single person at Weedmaps and Leafly were fired (executives included), and both websites were kept alive to run banner ads, both companies would be more successful than they are now. Both companies are generating MILLIONS of free site visits (organic traffic), yet they are both losing money.

I’m not saying that’s the solution, but the fact that that would work is alarming.

Of course there are all kinds of behind the scenes if’s, and’s, but’s, and other bullsheeet. But if either company doesn’t make drastic changes soon, they will be ensuring their existence as zombies well into the future.

Now, all of that said, Leafly appears to be VERY undervalued right now. The company has very little debt, a market cap of $15 million, and excellent assets. Just the website alone, I believe, is worth more than what they’re trading for.

Is it worth a punt? Maybe. But time is on our side with this one. With weakening consumer demand, increasing interest rates, and no clear path for Leafly to significantly change their business model, I don’t see a sharp reversal in their stock price anytime soon.

But when it comes to value investing, and specifically cannabis value investing, I have never seen anything even close to the opportunity that Leafly presents.

Some Personal Thoughts:

The more I dug into the data for this article, the more I convinced myself that Leafly is extremely undervalued. That doesn’t mean you should go out and buy shares of the company, but I do see a huge opportunity to do a turn around, or at least a stabilization of the assets.

Here are some random strategies that I would pursue:

- PE firm buys Leafly, takes it private, reorganizes the company, and generates cash from organic traffic. This could literally be a money printing machine with very little overhead and a team of less than a dozen.

- Weedmaps or a similar company acquires Leafly, streamlines backend dev/server/tech requirements, creates synergies with organic traffic, and cuts all non-performing business lines. This would be the most likely scenario, if debt was still cheap. If Weedmaps and Leafly joined forces, they’d have a near monopoly for online cannabis dispensary search traffic.

- Leafly hires new leadership who takes drastic measures to completely change the company and significantly cut overhead, like Twitter recently did. To be fair, it does appear that Leafly is making big changes, but not fast enough, IMO.

- A private investor start buying up shares and does a hostile take over. This would be very strategic and would be an amazing move if anyone could pull this off. I think this is unlikely because there isn’t enough trading volume.