Bitcoin Investing – Do You Even Know What That Means?

In the past month, at least 20% of the emails I have gotten have been about Bitcoin investing.

Should I buy it? Should I sell it? Should I buy this cryptocurrency? Should I buy that cryptocurrency?

Truthfully, I didn’t really want to write anything about Bitcoin.

It’s not that I don’t like Bitcoin. Actually, I think it’s great. I bought a bunch when it was well under $10. I lost a lot of it, but I still have some today.

(This is how I lost a lot of my Bitcoin.)

So why didn’t I want to write about it?

Because EVERYONE is talking about Bitcoin right now.

So… now I am finally caving in. I’m going to talk about Bitcoin.

But, first I did a Google search to see where I could start. You know… just to get the creative juices flowing..

Search for ‘investing’ and Google’s suggestions are interesting too.

Search for ‘investing’ and Google’s suggestions are interesting too.

If you know my investing style, then you know I am immediately repulsed by this.

I generally look for uncrowded investments that are not making the news headlines everyday.

I want to invest in things before they make the headlines… not after.

At this point, you’re probably thinking that I’m going to say that Bitcoin is headed for a crash.

But the truth is that I have no idea what it’s going to do.

However… there are two main reasons why Bitcoin looks very risky right now.

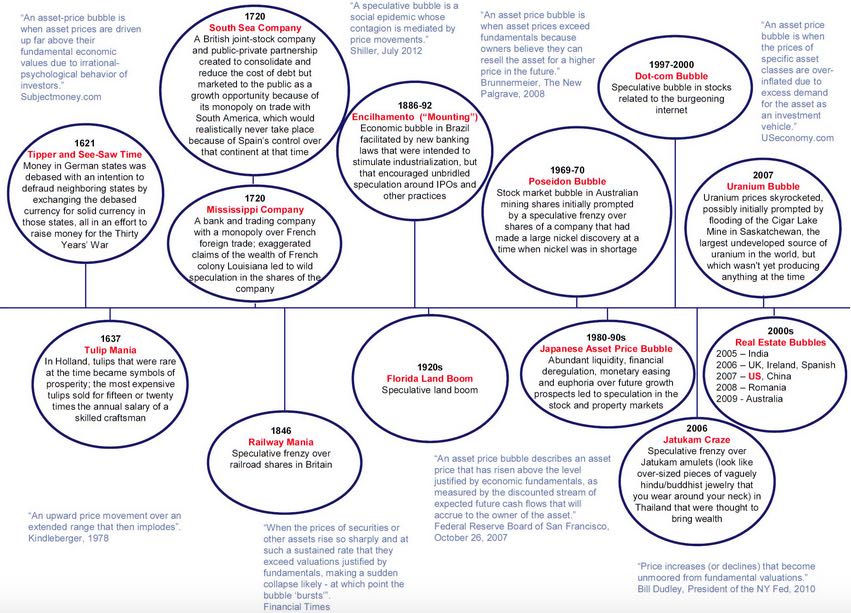

#1 If you look at the quick and massive rise of Bitcoin, you can compare the unsustainable momentum to almost any bubble in the past.

Whether it’s Tulipmania, the 1920’s stock market, the 2007 housing bubble, or Beanie Babies…

When you see a massive increase in price over a short amount of time, that is usually indicative of a bubble.

Source: ZH

Famous bubbles throughout history.

#2 People who are buying Bitcoin have no idea what the purpose of Bitcoin is. They have no idea that it is supposed to be a decentralized currency, used for transactions.

The majority of Bitcoin buyers are buying with the intent of selling at a higher price. This is pure speculation. This is EXACTLY how financial bubbles are formed.

They are not using Bitcoin for transactions, they are buying and holding. This reduces liquidity, which in turn drives up price even further (Bitcoin holders will only sell/trade/spend when the price is higher than what they bought it for).

This is EXACTLY what happened with every past economic bubble. People buy with the expectation that they can sell to the greater fool. What happens when the greater fool disappears? Just like a game of musical chairs, you are the one that gets stuck without a place to sit.

All that said, Bitcoin could continue climbing to astronomical levels.

That’s usually what happens in a bubble… prices go higher than you can ever imagine.

That also means that the resulting correction is that much more violent.

A serious price correction would be healthy for Bitcoin. That could ensure that it reaches the $10,000, or dare I say $1,000,000 mark, at a much more sustainable rate.

So what should you do?

If you want to get involved in Bitcoin, you need to first fully understand how the cryptocurrency works.

The very first thing you should read is the Bitcoin White Paper.

You should also read the book The Creature From Jekyll Island by G. Edward Griffin. This book gives you an incredible history lesson about money, the Federal Reserve, and our economy. (It will make you really understand how amazing Bitcoin is.)

After you’ve done that (or if you’ve already done that), I’d still be very cautious.

Yes, I believe that Bitcoin (really the blockchain) will be the future of currencies and transactions. But, for the present time, there are plenty of ways you can lose a lot of money.

***Our trip to Kiev, Ukraine in late September still has a couple available spots. We will be meeting with a company that is issuing a cryptocurrency backed by real estate and agriculture. This could mean that you could invest into real assets using a cryptocurrency – pretty cool!