Billionaires Are Indicating A Recession Has Already Started

The last two times this happened with billionaires, we’ve had a recession. Will this time be different?

Take a look at this table:  I took this from Wikipedia, which combined the information from “The World’s Billionaires” list published by Forbes.

I took this from Wikipedia, which combined the information from “The World’s Billionaires” list published by Forbes.

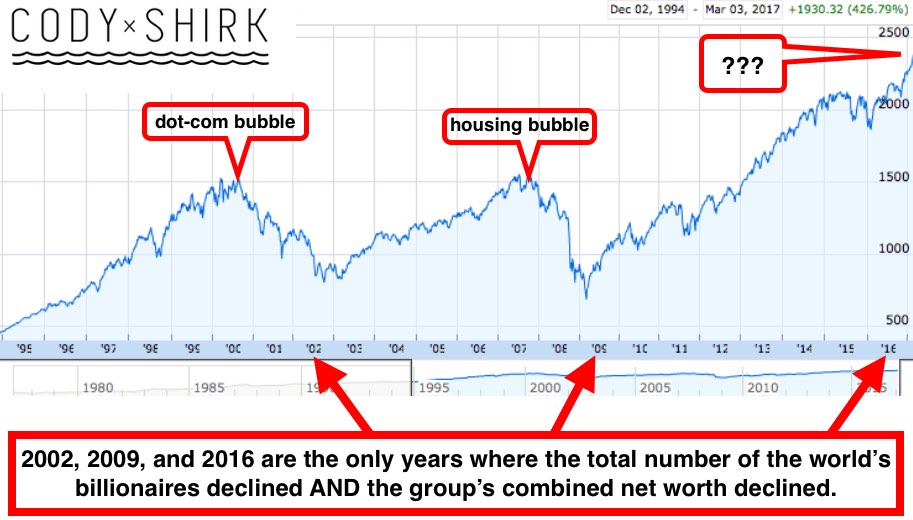

On this list, we can see that there are only several times where the total number of billionaires AND their total combined net worth declined.

There are three periods of decline, starting from the year 2000.

The first begins in 2002, after the dot-com bubble.

The second begins in 2009, after the housing bubble (or Great Financial Crisis).

The third begins in 2016, which doesn’t really correlate to anything… yet.

So why did the total number of billionaires in the world AND their total net worth decline in 2016?

I can come up with three reasonable answers, with the third answer being the most probable.

Answer #1:

The small decline in 2015 negatively impacted most billionaires wealth.

This answer is somewhat acceptable. We can look at the market’s performance in 2015 and see a generally flat performance with two periods of decline. This could (in theory) have an impact on billionaires for the year 2016.

But, if we look back to the periods of 2000, 2001, 2007, 2008, and 2011 we can see similar results (or worse) to 2015. And these periods result in no decline of billionaires wealth. How can that be?

Answer #2:

The growing middle class throughout the world has dispersed more wealth, which has taken away wealth from billionaires.

There is a significant amount of data that can prove the growing middle class throughout the world. The Wall Street Journal says, “number of [US] upper middle class households has more than doubled since 1979.”

The statistics are even more impressive for Asia, especially in the past several years. Asia is also host to the largest number of new billionaires.

Answer #3:

This is what nobody wants to hear.

Perhaps the decline in the number and total wealth of the world’s billionaires is a warning sign.

Hopefully you’re asking: “If the world’s richest people have lost money, then why is the stock market at all-time highs?”

As a Bloomberg article says, “You can thank the little guy for Dow 20,000.”

The little guys are the ‘mom and pop’ investors who have been piling into ETFs (and other equities) recently.

So passive investors are charging into the market, while active investors are exiting.

Hmmm… isn’t there a saying about dumb money and smart money?

Anyway, this doesn’t necessarily give an exact answer as to why billionaires are losing money.

So, why is this?

If we take a look at the world’s billionaires, we can see that their wealth is generally correlated to specific companies. Their wealth is not always correlated to market indices (S&P 500, Dow, FTSE, etc.).

(There are exceptions, with some billionaire’s wealth fluctuating with the way that the market values their company.)

So, if a company is making a lot of money, the CEO (or founder, owner, whoever) is making a lot of money. If a company is losing money, then we’d see the opposite.

Is that why billionaires are losing money?

And here is where things get interesting…

Even though we are seeing new daily highs in the stock market, specific companies are trading for higher multiples. The CAPE (cyclically adjusted price-to-earnings ratio) is currently at levels not seen since the dot-com bubble.

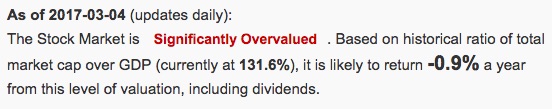

We can also look at how investors are valuing the market compared to GDP. This ratio – total market cap to GDP – is an excellent way to determine how expensive the market is.

The highest level ever was during the year 2000 tech bubble at 148%. In 2009, the market was at 57%. Today, the ratio of total market capitalization to GDP is at 132%.

Source: GuruFocus

There are numerous other indicators that I could cherry-pick to illustrate how overvalued the market is right now. But, perhaps the most interesting indicator is the loss of wealth within the billionaire club.

So does that mean we’re headed for a market crash and we’re all going to lose money?

Heck no.

Well, we might be headed for a crash, but that doesn’t mean we can’t make money as investors. We just have to look in areas that are not overvalued. We have to explore opportunities that are uncrowded.

That’s why I recommended buying real estate in one of the ‘world’s most dangerous cities.’ Real estate is selling well below the cost of construction and rental yields are high. I (and several readers) have taken advantage of this opportunity and things have only gotten better with prices already appreciating.

I’ve got more coming about Cali, Colombia very soon.

That’s also why I recommended buying uranium at the beginning of the year. Everyone hates uranium, as the stock price has been in free-fall for the past six years. But, we were able to get a quick 25% gain in just over a month. It’s down a bit since then, but we’re still up 10% with no plans of selling for a while.

These were both undervalued and uncrowded investments with tremendous upside potential.

It’s easy to follow the crowd into overvalued markets. Just do what everyone else is doing.

Personally, I look for the opposite. I know there’s more value when there’s less competition.

Let’s hope that the billionaire’s list is wrong about where the market is headed. But, if it’s right, we can be ready.