One of the most ridiculous rules in the investing world is the accredited investor requirement.

If you aren’t familiar, most private investments require you, as the investor, to be accredited. In the US, this means that you must make over $200,000 in each of the two most recent years and/or your net worth is $1 million or more (excluding your primary residence).

There are a variety of other requirements, depending on how you are specifically investing. But in general, an accredited investor needs to worry about the $200,000 income or the $1,000,000 net worth.

In theory, the accredited investor requirement makes sense. Essentially, the government is watching out for the individual by preventing ‘less sophisticated investors’ from getting involved in potentially risky private deals.

A ‘less sophisticated investor’ is basically defined as someone who doesn’t make a lot of money. This, of course, is a ridiculous way to quantify the intelligence of an investor.

There are MANY highly educated and experienced individual investors who are very savvy when it comes to allocating their personal money, even though they many not technically qualify through income or net worth.

Likewise, there are MANY individuals who make a lot of money who have no idea how to invest, but are technically accredited investors. (For example, Drew Brees is the latest sports star to get bamboozled, when he got scammed into investing in diamonds and jewelry.)

Interestingly, if you have ever made an investment into a private company, the process to prove you are an accredited investor in generally very simple. All you have to do is check a box indicating that you meet the income or net worth requirement.

Seriously. That’s the process for many investments. You just check a box on a piece of paper. There is no background check, no external document submission, and nothing is reported after you check the box. Furthermore, when you become an accredited investor, it’s not like you receive some plaque or trophy and you don’t get put on a special list.

Again, the accredited investor requirement makes sense in theory. Protecting the small, and presumably unsophisticated, individual investor is a good thing.

But, in reality, when someone self-certifies as an accredited investor, they are really taking the risk off of the investment issuer. Or in other words, who ever is taking the investment money must be able to say, “Well, we only accept accredited investors who know and understand the risks.”

A better requirement might be to have investors take a test to ensure they understand certain risks in the investing world. This would allow individuals to be approved as ‘sophisticated’ based on their knowledge, instead of how they accumulated their wealth. (Many countries actually do this.)

I could harp on this topic all day long, as it’s an antiquated barrier to entry for many very qualified investors. But, the whole reason why I am even bringing this topic up is because of the recent Congressional hearing with Facebook CEO, Mark Zuckerberg.

In short, Facebook, which I am not a fan of, could be in serious trouble for sharing information about its users.

If Facebook is prosecuted and convicted to the extent of United States laws, the company could be liable for trillions – yes, trillions – of dollars in fines.

Obviously, this would completely bankrupt the company and collapse the entire Facebook empire… But, that’s not going to happen.

Facebook may see some fines and more regulation, but they will not see the full potential penalty for one key reason: Policy and law makers do not understand what they are supposed to be regulating.

The Congressional hearing with Mark Zuckerberg has been a complete embarrassment. Instead of learning about what’s behind the curtain at Facebook, the public has instead discovered the ignorance of our politicians.

For example, Orrin Hatch, who has over 40 personal staff members to brief him about a variety of issues, asked this question to Zuckerberg:

“Well, if so, how do you sustain a business model in which users don’t pay for your service?”

“Senator, we run ads,” replied Zuckerberg.

“I see. That’s great,” Hatch said, nodding approvingly.

Really, Senator Hatch!? I know you were born in 1934, but don’t you think you’d ask a question that was a little more researched?

Then Senator Schatz tried his hand at asking questions about WhatsApp:

“If I’m emailing within WhatsApp, does that ever inform your advertisers?”

I won’t even show you the rest of this conversation, as WhatsApp is a messenger, so sending an email within WhatsApp is not even possible.

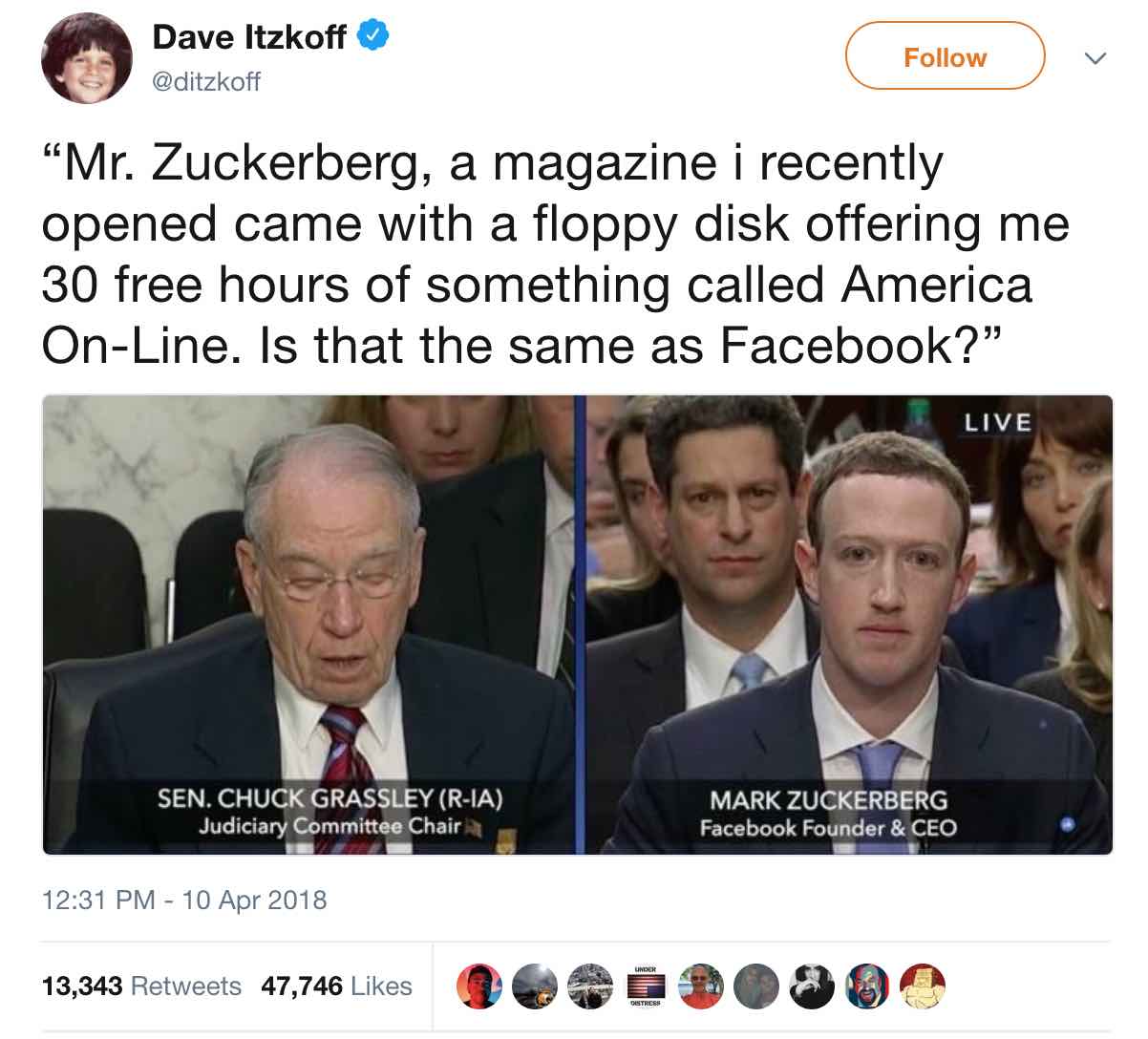

For those watching this dog and pony show who actually understand what is going on, there was some fun to be had:

It didn’t stop there.

YouTube, Twitter, and the entire internet is full of memes and parodies of politicians attempting to ask Zuckerberg questions.

Each one of these politicians in the hearing has a personal staff that number in the dozens, yet they are unable to understand the topic in which they are interrogating Zuckerberg over.

Perhaps it’s time for these politicians to become accredited? Accredited interrogators.

I hope you see the irony here. These regulators, who are responsible for the laws by which citizens must adhere to, don’t even understand what they are regulating.

I could continue to nit-pick this topic apart, but there is a bigger theme going on here which is both terrifying and exciting at the same time.

The terrifying part is that we (in all countries) are being made to play by the rules of regulating bodies that are completely out of touch with reality.

The exciting part is that we (in all countries) are beginning to have access to information, technology, and resources that are going to completely change the world.

Crypto-currencies, transportation, food, and communication are just some of the areas that are going to see a tremendous amount of change.

With these changes, we will see a huge struggle within the regulating bodies that simply do not know what to do. We’re currently seeing this unfold with Facebook. We’re seeing the same thing with crypto-currencies and how governments around the world try to play catch-up.

As an investor, it’s time for you to start thinking for yourself about where you should be placing your wealth and what opportunities lie ahead of us.

Because if you rely on the regulators who can’t even understand Facebook, let alone create realistic accredited investor guidelines, you’re going to be left in a world that has passed you by.