It’s time for a mid-year check in, especially since I made a variety of predictions at the beginning of the year.

Did I whiff them all? Or did I luck out with some good calls?

As I mentioned in my ‘prediction post,’ I only ever write about investment opportunities and themes that I am personally pursuing. Why waste time on searching for situations that I wouldn’t want to exploit myself?

Like I said this past December, “This strategy makes me much more cautious about what I discuss, as I’m on the hook for anything I get wrong.”

‘Tis the life of a fund manager, I suppose?

Although it’s a bit too early to define how 2025 will ultimately unfold, I think it’s fair to say that the global economy has experienced a healthy does of emotional whipsaw so far.

But with these ups and downs there has been incredible opportunities. That is, if you had the cajones to pursue them!

Don’t worry if you missed out so far, there are still many more interesting situations that haven’t developed yet.

Let’s dive into what I predicted in December of 2024, and how they’re doing now…

Bitcoin

December 2024 prediction: “Bitcoin continues to surprise.”

Welp, this was an easy one. I’ve been writing about Bitcoin since, well, I started writing about investing. Like many early adopters, I have my own ‘lost it all story.‘

Anyway, it’s clear that Bitcoin is here to stay. The real question is how much should you be owning right now (relative to your worth, of course).

I don’t have that answer. That’s because I’ve found that my number was far too low than what I should have had. Ironically, I’ve also found that my number was far too high for most people to stomach.

Personal situation aside, Bitcoin has certainly continued to surprise. That’s mostly because the only thing that has been more surprising than the current ATH of Bitcoin (around $118k, as I write this), is the global addiction fiat currency.

Healthcare

December 2024 prediction: “Healthcare bottoms.”

Last month I had my third child and was reminded about how broken the US healthcare system is. (Baby is all good, thanks for asking.)

I don’t fault medical professionals directly; they’re mostly incredible people. It’s the system that they operate in that is incredibly bureaucratic, confusing, and in need of a top-to-bottom overhaul.

This has, perhaps not too surprisingly, driven the valuation of many healthcare companies to incredibly low valuations. In fact, the entire healthcare sector is on track to have the third consecutive year of under performing the S&P500… by ~20% EACH YEAR!

No wonder the Wall Street Journal is now calling some health insurers uninvestable:

Source: WSJ

‘Something uninvestable?!’ This is like music to a contrarian investor’s ears. You often hear the most outrageous things about industries – both at their height or bottom – right before they reverse course.

Two such examples are UnitedHealth and Centene, both of which I’m taking a serious look at. Centene is especially interesting, as it’s currently holding the same amount of cash on its books as the entire company’s market cap. That’s not to mention they still have growing revenue and a P/E under 5.

But hey, who knows. Maybe the healthcare sector is entirely broken and these companies will never come back. Maybe the fall of US health insurance companies is part of the Fourth Turning?

Maybe.

U.S. Dollar

December 2024 prediction: “The U.S. dollar weakens.”

The USD’s record decline for the first half of 2025 seems to have surprised everyone. This is despite the fact that the sitting US President literally stated, multiple times, that he wanted to weaken the USD.

Most people get up in arms with the thought of a weaker dollar. It’s as if the strength of the currency directly correlates to the strength of the nation.

In reality, a weaker currency actually makes the US a more competitive trading partner on the world stage. Also, the current decline in the dollar’s strength is relative to other currencies. People forget that ALL of the currencies are screwed relative to hard assets (and Bitcoin).

As tempted as I am to go on a tangent about the USD and unfolding global currency wars, I’ll refrain.

It’s entirely possible that the DXY will reverse course this year, or slow down in its weakening trend. But remember that this trend is really a distraction from the larger purchasing power trend, which has a course set in stone.

Energy

December 2024 prediction: “Energy becomes a safe haven.”

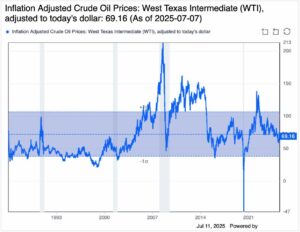

Priced in inflation adjusted USD terms, oil seems to be trading almost perfectly. That is, if you believe that the lifeblood of all of our economies shouldn’t have any sort of premium priced in.

For the most part, I have not gotten this prediction correct. But I still believe that through the later half of 2025 and into 2026, some investors will begin to move their speculative wins into more secure areas.

Energy is still the cheapest sector within US markets with a forward P/E of 12, and has the highest yield of 4.5%. Interesting.

A.I.

December 2024 prediction: “An A.I. play bursts.”

It’s a good thing I didn’t short any A.I. companies. Not that I use shorts anyway. Just board shorts.

Now, in the middle of 2025, I’m not sure where I stand with this prediction. Maybe A.I. euphoria will continue for a while?

I mean, it’s perfectly normal that Nvidia’s market cap is currently 3.7% of GLOBAL GDP, right?

Emerging Markets

December 2024 prediction: “Certain emerging markets shine.”

Of the four countries that I specifically mentioned, here is how they have performed YTD:

- Greece ($GREK): +57%

- Brazil ($EWZ): +21%

- UK ($EWU): +18%

- Canada ($EWC): +14%

Yes, I know the UK and Canada are not emerging markets. They are DEmerging markets.

Anywho, there’s likely a lot more upside in many different countries around the world to come. That’s especially true if the dollar continues to weaken and investors realize the value proposition in commodities.

U.S. Markets

December 2024 prediction: “U.S. valuations begin to normalize.”

I was wrong. Very, very wrong here.

U.S. markets are now insanely overvalued. Literally more than they have ever been. Total market cap to GDP ratio is now at 209%.

And we’re likely going MUCH higher.

Soon, we’ll begin to hear many more rationalizations for why currently high (and higher) valuations make sense. For example, the market cap to GDP ratio is out of date because many U.S. companies are generating revenue outside of the country, which means that their contribution to the total market cap is accounted for without accounting for the foreign economy’s GDP they are selling into. Or something like that…

New Predictions for the Mid-Year

I have more predictions than I have time to write. Three kids is no joke.

But, there are two ideas that I think about a lot right now:

- Mining companies are digging up metals that seem to be increasing in price everyday. At the same time, those companies energy costs (especially diesel) are remaining surprisingly low. Considering that mining company’s energy costs are up to 40% of their operating expenses, there may be some incredible earnings coming out over the next couple of quarters.

- Small and mid cap tech companies in emerging markets are very interesting right now. Two examples are Nu Bank ($NU) and dLocal ($DLO). Their valuations are very reasonable, they have tremendous demographic tailwinds, and their TAM is barely penetrated.

Lastly, did anyone catch my call from what I wrote in June? The silver metals are ripping, and hardly anyone is talking about them.