In four days, we’ll be kicking off our Explorer Partnership trip to China at an exclusive member’s only club in Hong Kong.

We have E/P members and guests flying in from nearly 20 different countries to explore the “Greater Bay Area”.

If you’re thinking about San Francisco when you hear the name “Greater Bay Area” that’s OK, you’re not alone.

But, we’ll be visiting the Greater Bay Area of China, which is located around the Pearl River Delta. We’ll be exploring Hong Kong, Macau, and Shenzhen. We’ll also be meeting the founders and CEOs of several seed stage companies, and a couple of Asian ‘unicorn’ companies.

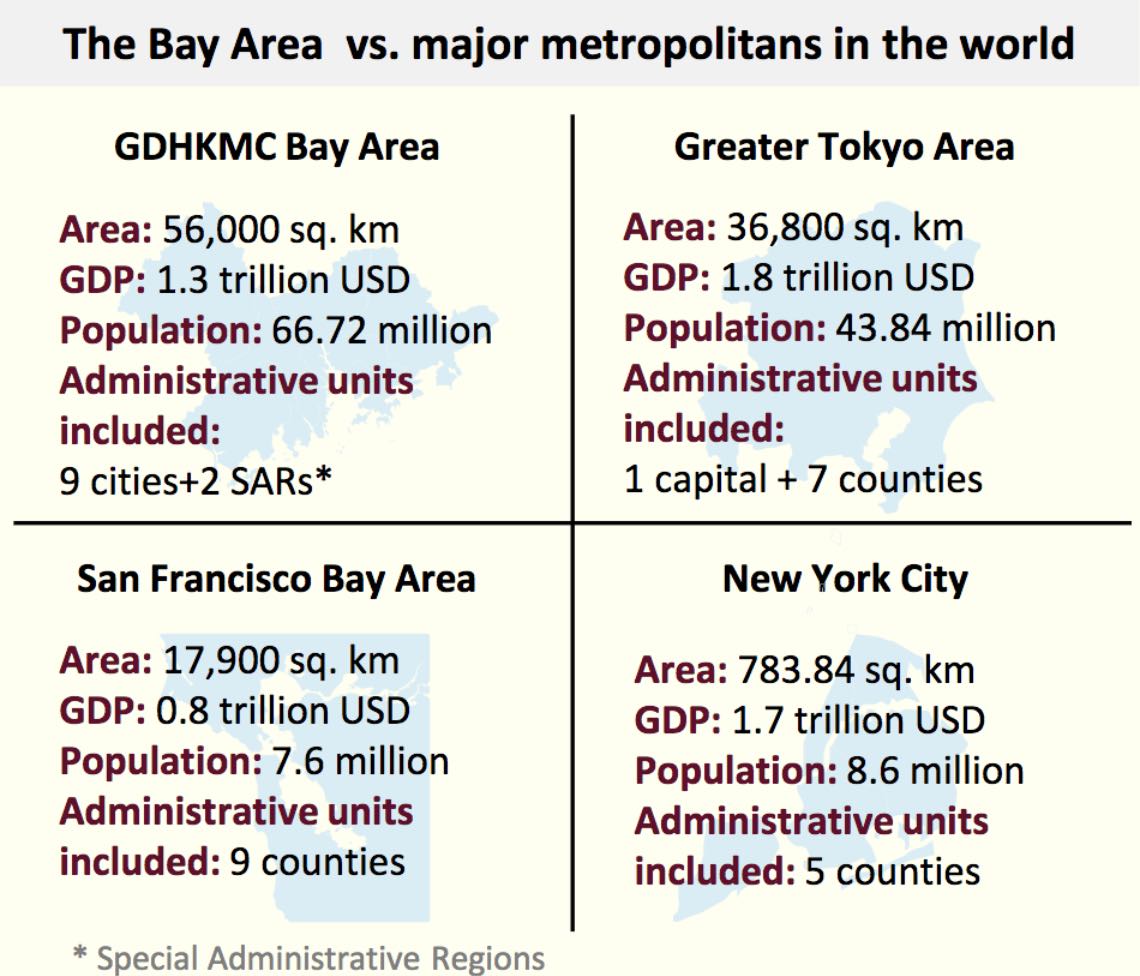

The Greater Bay Area of China is about twice the size of the Bay Area of San Francisco, when it comes to actual land area. But, if we compare population sizes, they are completely different.

San Francisco’s Bay Area is home to about 8 million people. In contrast, China’s Greater Bay Area is home to about 70 million people.

The size and importance of this region is massively underestimated by the rest of the world.

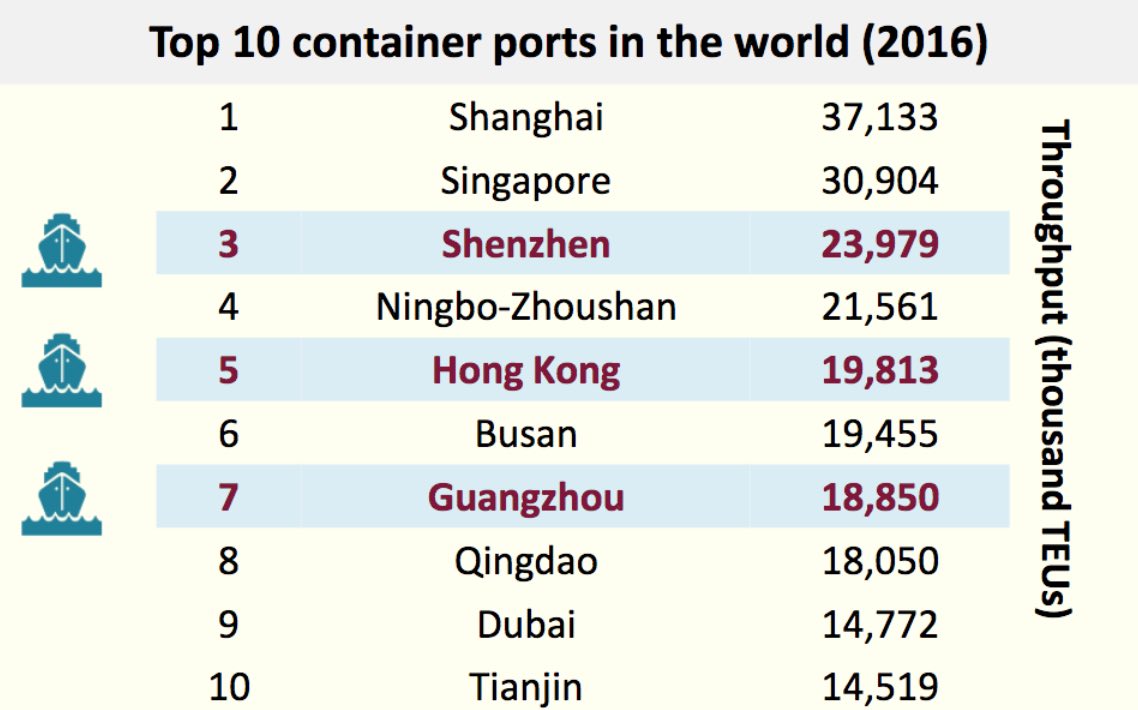

Three of the world’s biggest container ports are in the Great Bay Area of China.

Not only is this area of China a behemoth when it comes to economic output, but the future potential is even more impressive. If we compare the populations of similar sized regions in other countries, the Greater Bay Area is by far the biggest.

Now, consider that China’s middle class is exploding, while the middle class of other regions like New York is shrinking, then you can start to see how this becomes interesting. If the per capita growth were to even slightly increase in the Greater Bay Area, then the amount of wealth being created would completely blow San Francisco and New York out of the water.

We could speculate all day about what could happen. But, at the end of the day, this becomes a numbers game. This region of China (and this area of the world) is positioned for an incredible amount of success.

Meanwhile, back in the United States, I read this article in Bloomberg:

“Tech investors are pinning their hopes on Jeff Bezos after disappointing earnings sank shares of megacap peers Facebook Inc. and Netflix Inc.”

I had to laugh out loud when I read that. Imagine being an investor who decides not to invest in Facebook or Netflix and then believes that their only other option is to invest in Amazon.

As I mentioned a couple days ago, here is a reminder of what the P/E valuation for those companies are (plus, Tesla for good measure):

- Facebook P/E = 29 (after their big loss)

- Google P/E = 53

- Amazon P/E = 227

- Netflix P/E = 243

- Tesla P/E = N/A, as in “not applicable”… because Tesla is losing about $7,000 every minute – that’s over $10 million every day.

If you’re an investor who thinks that your only option is to invest in a company that is trading at a P/E valuation of 227, then you’d better take a step back.

Look, Amazon is an incredible company. I, probably just like you, use them almost everyday. Amazon will probably go on to be extremely successful.

But, ask yourself this: If Amazon is currently being valued at 227x its earnings, how much more upside is there?

As a reminder, the P/E ratio is the ‘price to earnings’ ratio. So, if a company were trading at the historical P/E of 15, that would mean investors are paying $15 for $1 of current earnings.

For Amazon, investors are paying $227 for $1 of earnings.

The P/E ratio is not the only thing an investor should consider. In fact, there are numerous valuations and metrics an investor should look at. Investors are paying this high valuation because they believe the future earnings will be much higher.

Will future earnings be much higher? Will investors continue to pay a high premium to own Amazon? Will valuations go up forever? Maybe.

Well, while this crazy game of musical chairs is going on, we’ll be in an area of the world where technology is exploding and very few investors are looking. We’ll be visiting private companies that aren’t even available to the public yet and meeting the founders of these companies face-to-face.

The best part is that we’ll get the opportunity to invest in companies that aren’t being bid up to astronomical valuations. And these companies will have massive upside growth potential, just like the Greater Bay Area.