After clearing customs at the Denpasar airport, my wife and I hopped into the first taxi we could find. Our goal was to get out of the Indonesian city as fast as possible, so we could leave the other tourists behind.

The traffic was horrible and the taxi didn’t have any air conditioning which created a category 5 hurricane between my back and the vinyl seat…

As we made our way through the crowded streets in the sauna-taxi, we started to hear, “All the peoples look over here! All the peoples look over here! ALL THE PEOPLES LOOK OVER HERE!”

This guy standing on a tiny wooden box keep yelling until… well… until all the people on the street were looking at him.

Believe it or not, this strategy worked incredibly well. He was able to capture a surprisingly large audience, even though he was only one man with a wooden crate and a little monkey.

Now, to his credit, he was standing on prime real estate – the corner of tourist row in Kuta, Bali. All kinds of tourists gathered around him to see what he was yelling about.

Meanwhile, my wife and I are sitting in the sauna-taxi watching this whole spectacle unfold. So, as we’re inching along in traffic, we realize what is going on.

Basically, the guy’s monkey goes around to tourists and takes money our of their pockets. Literally. The monkey climbs up people’s legs and pulls money out of their pockets.

Now, most of the tourists think this is hilarious and they let the monkey take their money. I guess they think that it’s worth the show.

But, some people don’t think it’s funny. In fact, some people are terrified. Because this little monkey is aggressive and lightening fast.

The monkey is basically pick-pocketing people faster than they can run away. From the sauna-taxi, it’s absolutely hilarious!

Eventually, the crowd disperses. Some people are starting to back away as they don’t want to lose any money, while others are sprinting down the street away from the monkey-thief like their life depends on.

Looking back on this story, there are basically three components.

- Some guy who is yelling a compelling message… “All the peoples look over here!”

- Some instrument that can both entertain people and take money… The monkey.

- People with money… Tourists.

Does this sound at all familiar…??? Let’s see…

So yesterday, Facebook dropped nearly 20%. The company lost $120 billion in one day, which makes it the largest loss for a company in recorded financial history.

Facebook is not some tiny small cap junior minor stock that swings wildly from day to day. If you have a retirement account or some type of ‘safe’ stock portfolio, I’d be willing to bet that Facebook is in there somewhere (probably in some ETF).

My point is that Facebook should be a company where people can confidently put their money to work… or at least that’s what people thought.

Real quick, let’s take a refresher course in stock valuation by looking at the price to earnings ratio, better known as the ‘P/E’. The P/E ratio is exactly what it sounds like. It’s what the price of a company is trading at, compared to its earnings.

Investors are willing to pay a higher price for a company if they believe the future value (earnings) will go up. A high growth stock will have a higher P/E, because investors are paying a premium to buy the stock because they think the company will make more money in the future.

Historically, the average S&P 500 P/E ratio has been about 15. Can you guess what the P/E ratio is for Facebook? It’s 29. And that’s after the 20% correction.

But, Facebook is CHEAP compared to some other big companies…

- Google P/E = 53

- Amazon P/E = 227

- Netflix P/E = 243

- Tesla P/E = N/A, as in “not applicable”… because Tesla is losing about $7,000 every minute – that’s over $10 million every day.

Let’s look at this another way, with pictures.

I do best with pictures. They tell a much better story. Besides, when it comes to valuing stocks, there are all kinds of different measurements. There is the price-to-earnings ratio, the price-to-book ratio, the price-to-sales ratio, free-cash-flow, etc.

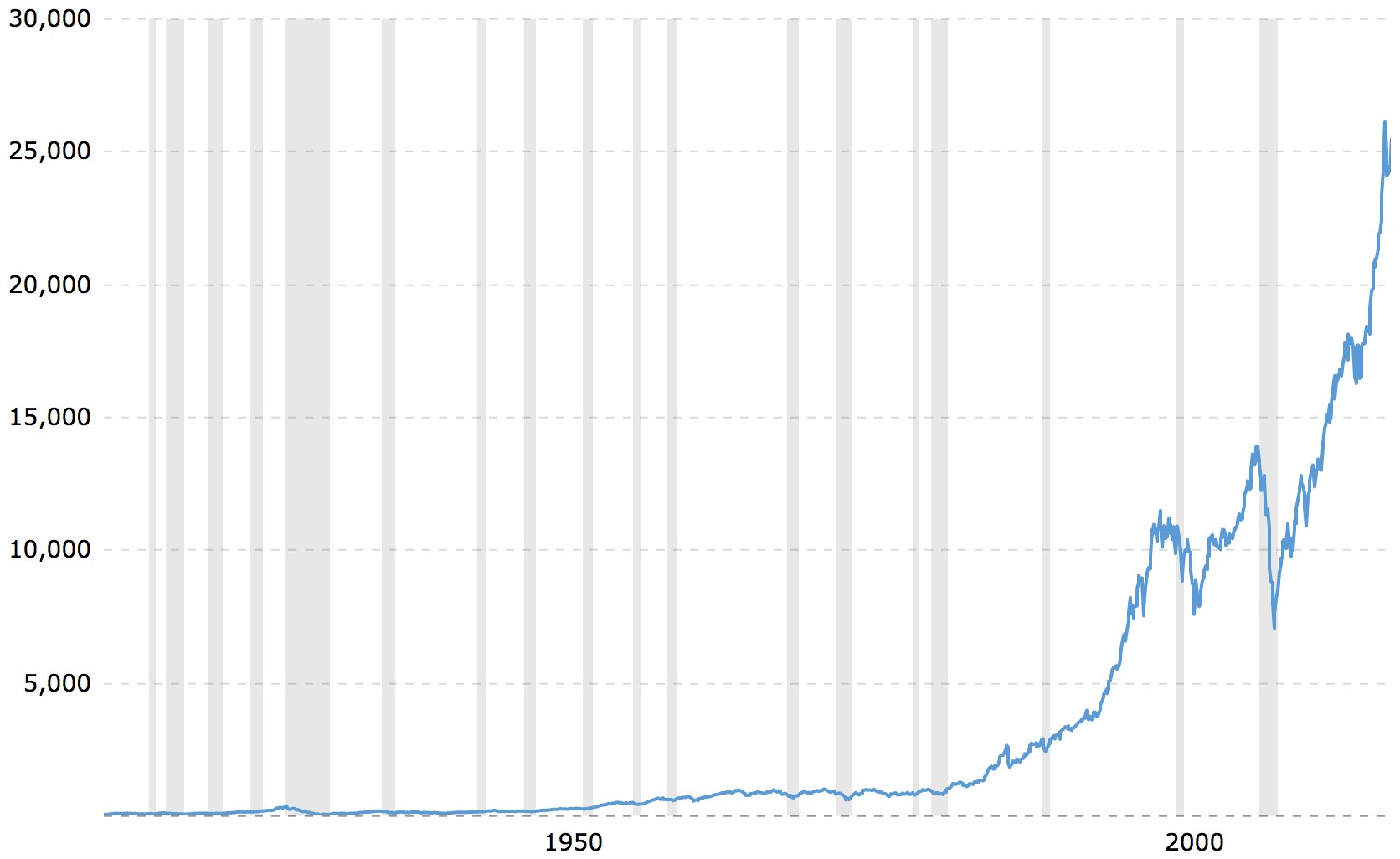

Now, I’m not going to show you the 100 year historical chart of the US stock market. The truth is that we’ve had way too many technological advancements to compare today’s trends with what was going on 100 years ago.

Plus, more people have access to the stock market today, which means that there are more investors with more money competing to invest in companies.

If I showed you the 100 year historical chart, it’d be an apples to oranges comparison. It wouldn’t really put today’s market into context. So I won’t show it.

Actually, screw it, here it is:

I’ll just leave that chart there without any comment.

Let’s look at more pictures!

Starting with Facebook’s historical chart:

Not bad. Seems like steady growth. Maybe a 20% pull back is healthy.

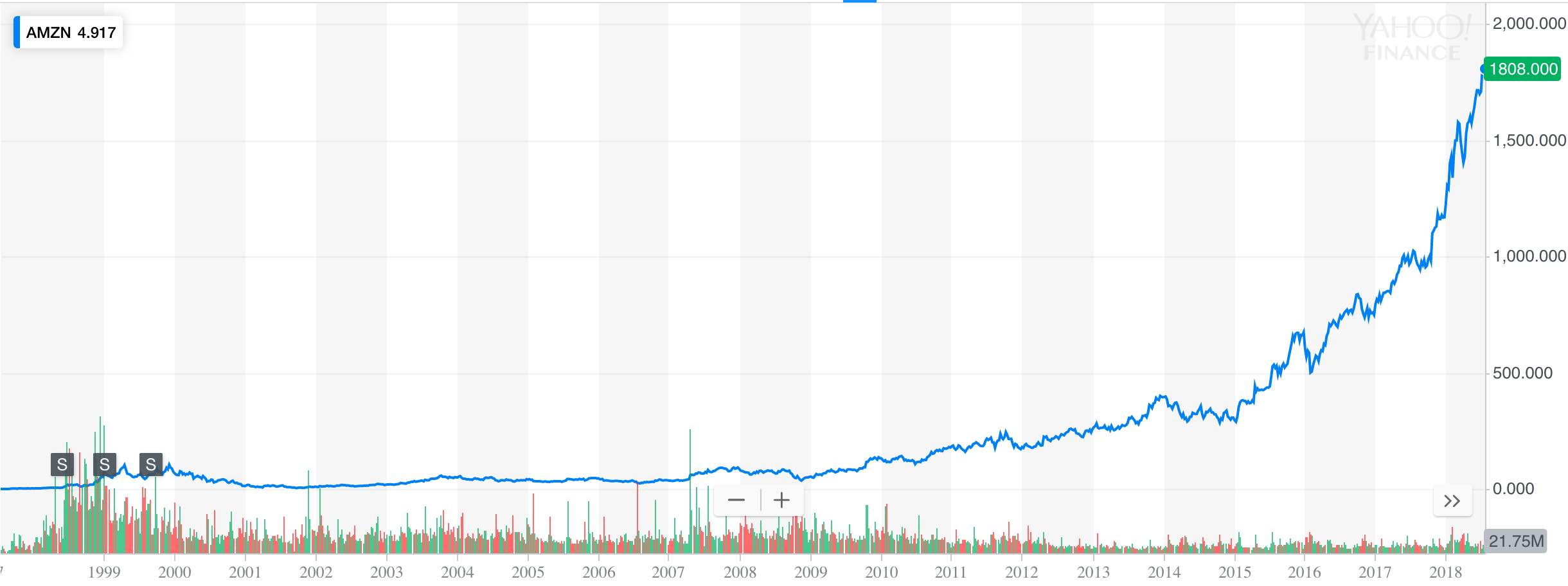

Here’s Amazon:

Hmmmm… that’s impressive.

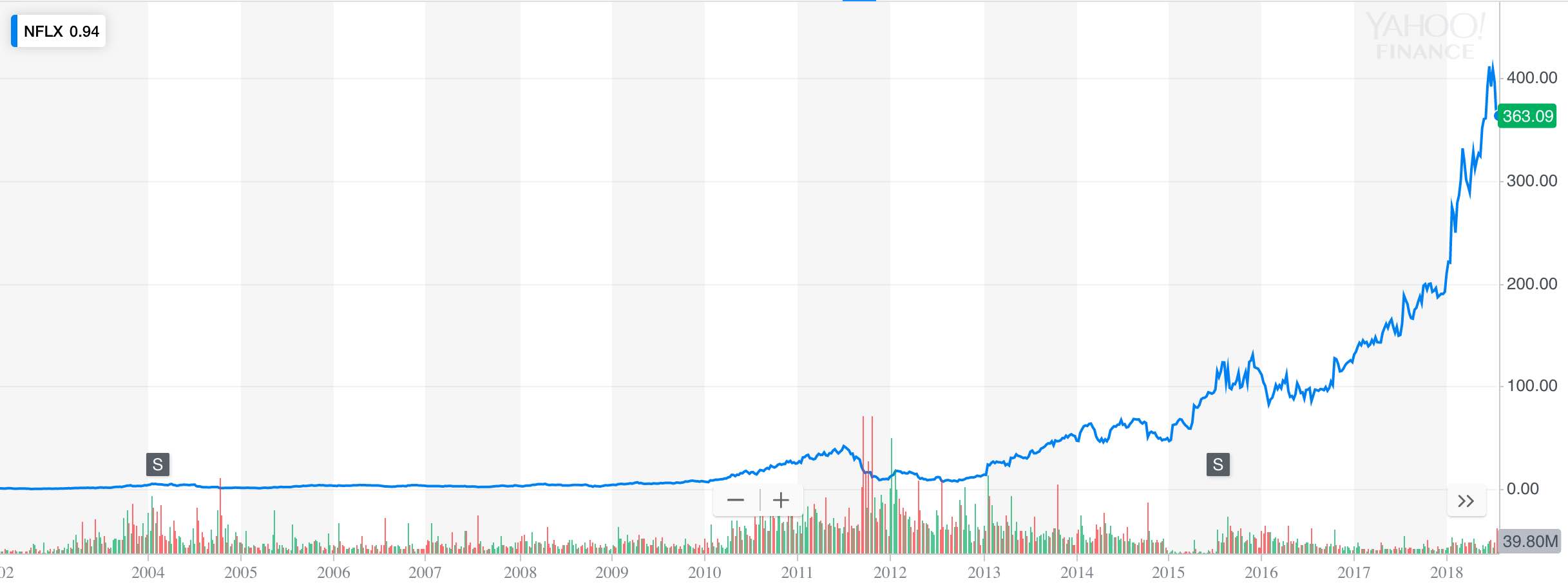

And Netflix:

Wow! That’s incredible!

Now, I’m not about to tell you that all these companies are going to crash down to zero.

These are all major companies that provide tremendous value to their customers. The chances of these mega corporations disappearing is basically zero.

(Well, except for Facebook… ask some teenagers if they use Facebook and you’ll find out if the next generation of consumers is using the social platform. Hint: They’re not.)

But, do you think that a company like Netflix should be valued at over 16 times the average P/E ratio? The valuation that Netflix currently has means that investors believe the company could grow 16 times its size and then be an ‘average’ valued company.

Netflix currently has about 100 million subscribers. So, if they multiplied their customer base by 16, that would be 1,600,000,000 subscribers. That’s over five times the size of the population of the United States.

Maybe Netflix will both increase their subscribers and also stop spending money… and get more profitable, which will justify its valuation. Or maybe the entire country of China will subscribe to the primarily English speaking service.

Or… maybe valuations have gotten out of control.

Maybe investors are listening to a guy on top of a box, while a monkey is running around stealing money out of their pockets.

Maybe it’s time to keep the money you already have and invest it somewhere else.