Don’t Spend More Than You Make. The Only Budget Rule You Need to Know, Unless You Are The State of Illinois.

Don’t spend more than you make.

Simple as that.

You can apply that rule to any budget. Whether it’s a family or a business, the rule is the same: Don’t spend more than you make.

That is, unless you are a government entity that has the ability to bend the rules…

Meet The State of Illinois.

A place where you can spend more than you make, and then put the burden on public employees and taxpayers.

Illinois has been making the news over the past several weeks because… well… they are in big financial trouble.

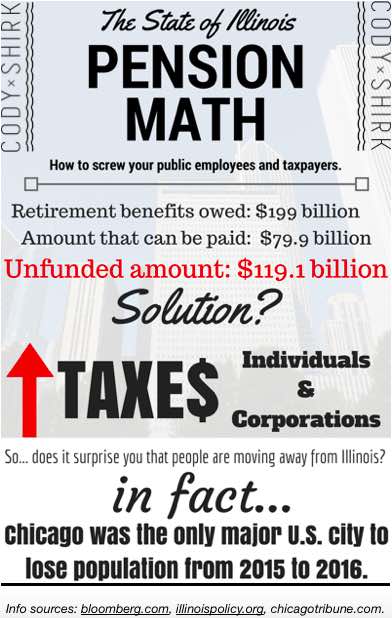

With a growing pile of debt and no way to pay it, a revolutionary solution has [finally?] been determined: raise taxes.

Now, if you’re living in some other US city, or maybe you’re not even in the US at all, this may not mean much to you.

But, let me show you something that you might want to know…

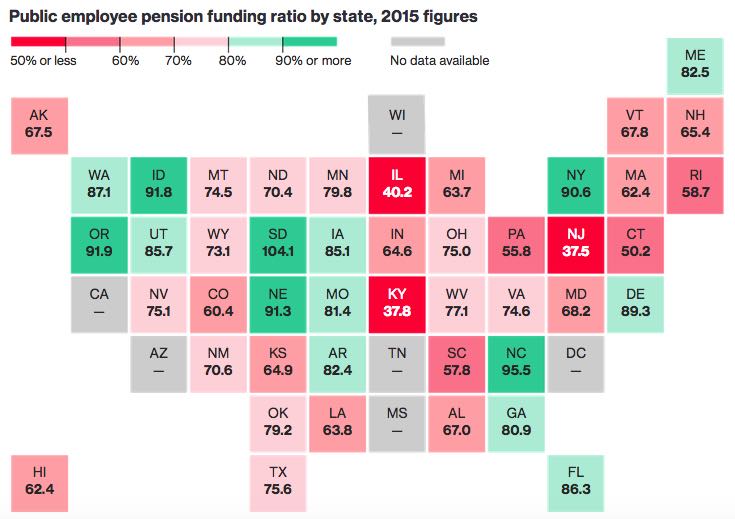

First, take a look at the rest of the US. Here is the public employee pension funding ratio by state:

Source: Bloomberg

There is literally only one state in the entire US (South Dakota) that is properly capitalized to pay for future pension funding obligations.

The worst off? Illinois.

Imagine that… a state not having a budget for two years. They have been spending way more than they have been making. They are breaking the most simple budgeting rule out there:

Don’t spend more than you make.

And that’s just the tip of the iceberg…

Illinois is on the hook for more than $100 billion in unfunded pension liabilities.

Lots of people are going to pay for this. It’s probably going to be a combination of retirees not getting their promised pensions and taxpayers footing the bill for the shortfall.

But, not all taxpayers are putting up with the State of Illinois’ mismanagement…

They’re leaving.

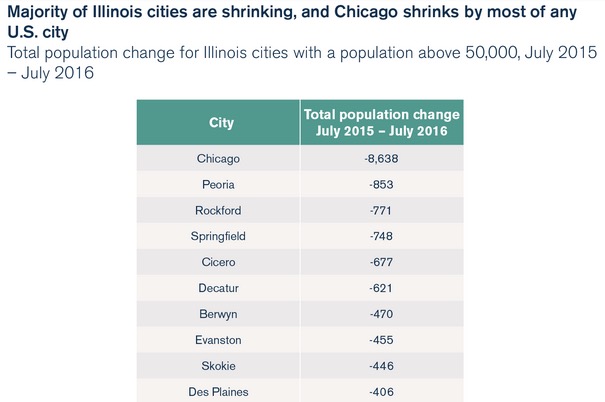

“Chicago [was the] only major U.S. city to lose population from 2015 to 2016.”

And it’s not just Chicago. It’s the entire state of Illinois.

Source: Illinois Policy

And why are they leaving?

“According to a Paul Simon Public Policy Institute poll released in October 2016, 47 percent of Illinoisans surveyed said they want to leave the state. And taxes were the most commonly cited reason people gave for their desire to move.”

The actual tax payer base is getting smaller, while the total state tax burden is getting larger.

How does this get resolved?

So what?

This is just another story of a government mismanaging money… nothing new here.

Here is the point:

Take control of your wealth now. Don’t assume that your retirement plan is being handled by someone else. Because that someone else might be like The State of Illinois.