I just found a zero percent interest real estate loan. My dad forwarded me an email, and I stared at it scratching my head, “Is this a real? How are they able to do this?”

Then I paused and thought to myself, “Ah, it’s just the marketing and sales team working together – very creative!”

Marketing thought about how to stand out from the noise, and sales came up with a creative way pay for a home. Actually, it was probably some creative finance executive who figured this out, but you get the point.

Here’s what they’re doing: They are selling (highly priced) homes to buyers who can put down 40% of the total purchase price – in cash. Then, once the home has its roof built, they require another 10% down. Finally, they finance the remaining 50% of the purchase price over a certain amount of years at 0% interest.

The builder is likely covering most of their costs with the initial 50% they get in cash, with the rest of the 50% becoming pure profit into the future. Title to the home will be transferred to the buyer once the loan has been paid. The builder gets great, predictable income into the future with (hopefully) excellent collateral that increases in value over time.

Obviously, this is not a new thing. Builders offering interesting purchase options is usually why the builder is so good. They’re builders in their business too. However, in today’s world, their marketing really stands out!

Zero percent real estate loan? How can that be with rates now going over 7%?!

Home Affordability = Worst, Ever

The real estate loan industry in the United States is a racket. The 30 year home loan was engineered for one simple purpose: to entrap borrowers in a financial contract that rewards lenders in an absurdly favorable way.

Now, I’m not saying there is some secret cabal of bankers that met in secrecy to figure out how to screw over home buyers… I’m just saying that the home loan industry has evolved to make a story like that believable.

The actual story of how the 30 year home loan came to be originates from government intervention after the Great Depression. Another great government intervention that has ended up artificially screwing up the housing market.

Anyway… Here are some surprising statistics that indicate the direction of home ownership:

- First time home buyers in 2022 was 36 years old versus 33 just a year prior (Source)

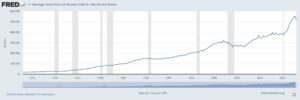

- Average age of homebuyers in 2023 is 47 compared to 31 in 1981 (Source)

- In 1960, 68 out of 100 Americans could afford a home; in 2023, 43 out of 100 can afford one (Source)

As demonstrated by the chart below, housing affordability in 2023 is literally the worst in recorded US history. And this is based on trailing data from a couple months ago. As I write, mortgage rates have spiked again to 7.22% – a level that will only exacerbate home affordability.

Source: Longtermtrends

As borrowing rates continue to creep higher, more and more buyers are going to be priced out of the market. Which means…

The Future of Real Estate

I hope I’m wrong – I really do. I’m sitting on a lot of equity in my home. But I can’t imagine a scenario where real estate prices go up from here (except for Weimar style hyper-inflation).

There is a common narrative going around right now that current home owners who are locked into a sub-3% 30-year loan, won’t sell. They’ll stay put until rates come back down, which means there’s less inventory on the market. Less inventory, of course, means more demand, which would keep prices high.

Source: FRED

All of this assumes that current home owners, who may be locked in at a low rate, will always be able to make their payment. This narrative also assumes that people won’t have to move for job changes, family reasons, or unforeseen hardships.

Whatever may happen with the real estate market in the next couple of years, one thing is clear: access to cheap debt is over. But when one door of opportunity closes, another one opens…

The Future of Debt

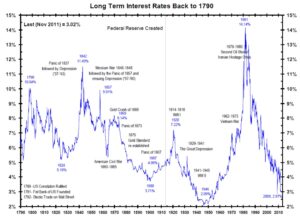

Although borrowing rates of 7% (and likely higher to come!) seem very high, we’re actually still under the average rate since 1971. It’s hard to imagine now, but the 1980’s saw rates in the mid-teens – more than double today’s real estate loan interest rates.

If we zoom out even further in time, we can see that anything under 4% is actually the anomaly.

Source: Ritholtz

In the past, sub 4% interest rates really only existed during WWII – a time period that had a unique set of challenges. Looking forward in time, and taking the above chart into consideration, it’s hard to see how we can return to the artificially low rates that we’ve become so accustomed to over the past decade.

However, higher rates also means more opportunity. That’s because the past decade has been nearly impossible for individual investors to compete with banks or any other type of lender. Instead, investors have focused on capital appreciation via leverage, rather than yield from savings.

Investors have been swinging for the fences instead of going for base hits.

Now, it’s time to think of base hits. Situations where an investor can receive a reasonable return on capital, while at the same time collateralizing any risk with high value assets. Exactly like the zero percent real estate loan that I shared at the beginning.

The builder gets their costs (risk) covered with the 50% down, with the extra 50% being pure profit (and collateralized by a great asset).

The coming years will be exciting times for creative investors who can structure unique deals. Perhaps that’s how we’ll get our Rural Cult off the ground.