I just found out about some shocking information in the shipping industry. The bad news is that this information could significantly hurt our economy. The good news is that I found a couple different ways to invest in this upcoming trend.

Before I dive into this topic, I want to note that I’ve found some of my best investments by complete coincidence. Whether it’s been real estate, an interesting stock, or a private company, I’ve often stumbled upon lucrative situations by complete happenstance.

This shouldn’t come as a complete surprise. Finding hidden investment opportunities is the foundational strategy of my Explorer Report. Meeting new people and traveling to strange places often lead to the most unexpected results.

Last week in Costa Rica was no different. Among the many interesting investors and entrepreneurs who joined us at the Explorer Summit was an expert in shipping. In fact, he is one of the largest exporters in the United States.

What he shared with our group took me by total surprise…

Does Market History Rhyme?

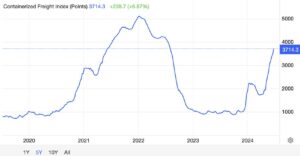

He started out by explaining the recent run-up in the Containerized Freight Index (CFI). In the past year it’s up over 300%!

This index, which tracks the cost of shipping containers on major trade lanes, is currently in hockey-stick-chart territory. And, as I write this, there are no signs of slowing.

Just look at the index over the past year:

Source: Trading Economics

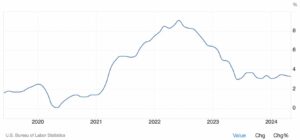

Zooming out, to look at the five year chart, we can see that this upward trend is eerily similar.

The difference, this time around, is that the upward index trend is much more aggressive. Prices to ship containers are increasing at a much faster rate with no indication of a plateau.

Source: Trading Economics

As a savvy investor, you’re probably already thinking of the trickle down effects of this index increase.

“if it’s more expensive to ship things… then things will get more expensive… and if things get more expensive… then…”

Of course, there are a near infinite amount of butterfly effects that could take place as a result of shipping costs increasing. There are also many other data points to take into consideration.

However, despite the many possible outcomes that will be served up in the near future, none are as obvious and impactful as inflation.

Hello Inflation, My Old Friend

When the CFI started to increase in August of 2020, inflation began heating up about seven months later in March of 2021.

Interestingly, when the CFI peaked and then started to decline in January of 2022, inflation began cooling about seven months later in July of 2022.

Source: Trading Economics

The correlation between the CFI and inflation is stunning. And there are other indicators that are tracking this same path, including the US dollar index, the NASDAQ, and even gold and Bitcoin.

All of these charts indicate that we will see inflation start to increase starting sometime during the fall of 2024. (That is, if the Fed doesn’t intervene before then, and/or there isn’t any significant global event.)

I’m not going to start beating the inflation-is-coming-back-and-rates-will-go-higher dead horse. I’ve been saying that for a while now.

Instead, I’m going to take you down a different route…

A side note, before jumping into investment opportunities: Why does inflation increase when shipping costs increase?

The last time we saw freight costs increase was during the pandemic. Items that saw the most inflation were mostly imported goods into the US, typically from China. If you think about a container full of lower cost goods, and then compare the shipping cost of that container, you end up seeing that the price of those goods costs more to be placed on US shelves/warehouses. This increased cost ultimately gets passed onto the consumer. To highlight this issue, you can see what has happened to “dollar stores” across the US. Family Dollar is shutting down nearly 1,000 stores, Dollar Tree is closing 600 of its stores, and 99 Cents Only is completely going out of business.

A Ship List

The last time the Containerized Freight Index spiked, so did shipping company’s profits. Of course, those profits, just like inflation, will be delayed. That means there is plenty of time to position yourself now for what’s likely to come.

There are two disclaimers that I must mention. First, I am not an expert in investing in this industry and have only realized the current unique situation after my conversations in Costa Rica. Second, the transportation and logistics industry is extremely cyclical, so whatever investment play that can be made right now is likely not a long hold. So, take those two disclaimers as your warning…

I’ve identified several ways to invest in this situation, to play on the rising profit margins of the shipping companies who are benefiting from increased freight costs.

ZIM Integrated Shipping Services Ltd. ($ZIM)

ZIM is an Israeli based company that came as a recommendation from conversations in Costa Rica. I’ve only briefly dug into this company, so am only mentioning it here because of the conversation I had.

Although the company IPO’d in early 2021, it has an operating history that goes back over 75 years. During its short time as a public company, it returned shareholders over 700% in a little over a year.

Since that eye-popping return, the company’s share price has fallen in true cyclical market fashion.

However, the company now seems to be recovering and has even started to reissue their dividend. Will $ZIM go on another tear? Maybe.

SonicShares Global Shipping ETF ($BOAT)

This ETF, which holds nearly 50 different shipping companies, is probably the best way to make an easy entry into this investment situation.

It’s important to note that $BOAT was launched in August of 2021, which was in the middle of the last surge of the CFI. I’m sure the ETF issuer was trying to capitalize on this trend. Overall, this just means that there isn’t much of a track record for this fund.

That said, $BOAT currently offers a 10% dividend and is certainly positioned to benefit from rising freight costs.

Breakwave Dry Bulk Shipping ETF ($BDRY)

This is an ETF that you need to be very careful with. Instead of holding multiple companies, $BDRY invests in Freight Futures. This can result in huge short term gains, but in the long run an investor will get burned from the cyclical nature of the industry and from the ETF’s expenses (which are a steep 3.5%).

Still, $BDRY is a great option for those who see the dramatic rise in the CFI and want to benefit in the short to mid-term.

Cheap Ship

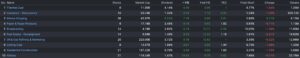

I’ve already made the compelling case for why the shipping industry looks interesting compared to the rising CFI. Now, let’s take a look at the industry’s current valuation…

Source: FinViz

As you can see, not only is the Marine Shipping industry one of the cheapest in the world, but it’s also throwing off yield.

Within this industry there are many multi-billion dollar shipping companies trading for unbelievably low valuations.

Source: FinViz

Wrap This Ship Up

There are many different ways to capitalize from the dramatic rise in the CFI. Additionally, other than inflation and the shipping industry, there are many other areas of the economy that will likely be impacted.

What’s your best idea to play this trend?