What are the most important things that you use throughout the day?

Your cell phone? Your computer? TV? Internet?

What about food? Water? Your car?

I think we’d all put emphasis on the first group of things. We all place a tremendous amount of value on technology and resources that have integrated into our lives. Cell phones are like an appendage for most people now.

But, really, food and water are the most important things to us. Energy, transportation, health and the bare necessities are what we need to actually live.

Fortunately, for many people in the world, we take that stuff for granted. We assume that we’ll get a meal with clean water and there’ll be light during the nighttime. We assume that there will be cars and buses and trains to transport us around.

Perhaps we have lost sight of this? We sure don’t value that stuff as important.

I mean, we literally don’t put as much monetary value on those necessities.

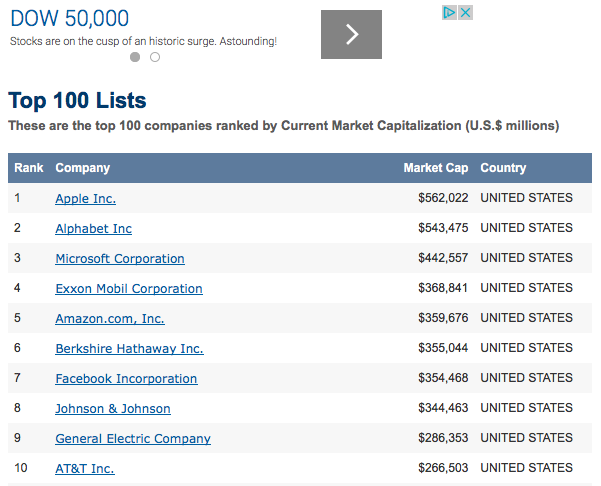

Case in point… look at the current market leaders measured by market capitalization:

And… this list is not accurate… Amazon just overtook Exxon Mobil. AND SO DID FACEBOOK.

(I used this list for a reason… I’ll mention it below.)

So the top five companies by market cap in the US are tech companies. Apple, Google, Microsoft, Amazon and Facebook are ruling the market, in that order.

Now, I certainly understand the value of each of those companies.

But how is it possible that the top five most valuable companies are all tech related?!

What about food, transportation, energy and all the other things that we consume in our lives?

Look up at that list again. Look at the advertising banner that is above the list.

“DOW 50,000 Stocks are on the cusp of an historic surge. Astounding!”

Ummm… I feel like this is screaming “WATCH OUT!”

Now, I’m not predicting that any of those tech companies are going to crash, or even that the DOW won’t reach 50,000.

But, what do you think?

Do you think that the top five most valuable companies in the US should be tech companies?

Right now, in today’s environment, we should all be taking a step back to have a moment of rational thinking. We should be ready to sidestep, just like a matador, away from a major collision.

It’s not time to run for our lives… but we should be starting to look for the exits. Preparing for what looks like a very questionable situation.

Last week when I was talking about the VIX I said, “I’ll be honest; it’s a straight up bet. A very educated bet. But you’ll probably lose your money. Maybe a couple hundred bucks.”

I was talking about options on VXX, which tracks the volatility index.

Well, I was mostly right about losing the money. If you had exited the trade early, you could’ve doubled your money.

But I’m not a day trader and I don’t suggest you start either – that kind of trade is very risky.

You see, the contract expired worthless. The VIX did not rise like I thought it might. In fact, it went lower. Despite all of the weird news events and the top five most valuable companies now being all tech, the VIX didn’t budge.

This further adds to my concerns of what is going on.

Tomorrow, I have a short guide about getting yield that I’ll share with you.

Also, have you looked at silver and gold yet? There is still a chance we could see a little correction, which would be a great buying opportunity. But there is also the chance that the current prices could be left in the dust.