We had just finished a casual dinner at a restaurant called “Greenbowl” that was located somewhere in Shenzhen. I couldn’t find the place again if my life depended on it, but it was a great meal in a clean and hip space.

When it came time to pay our bill, we couldn’t. I mean we literally could not pay our bill. They didn’t accept credit card and they wouldn’t take cash. No Chinese RMB, no US dollars, and no Hong Kong dollars… all of that paper was useless.

This restaurant would only take payment through WeChat, which is a do-everything app that nearly everyone uses in China.

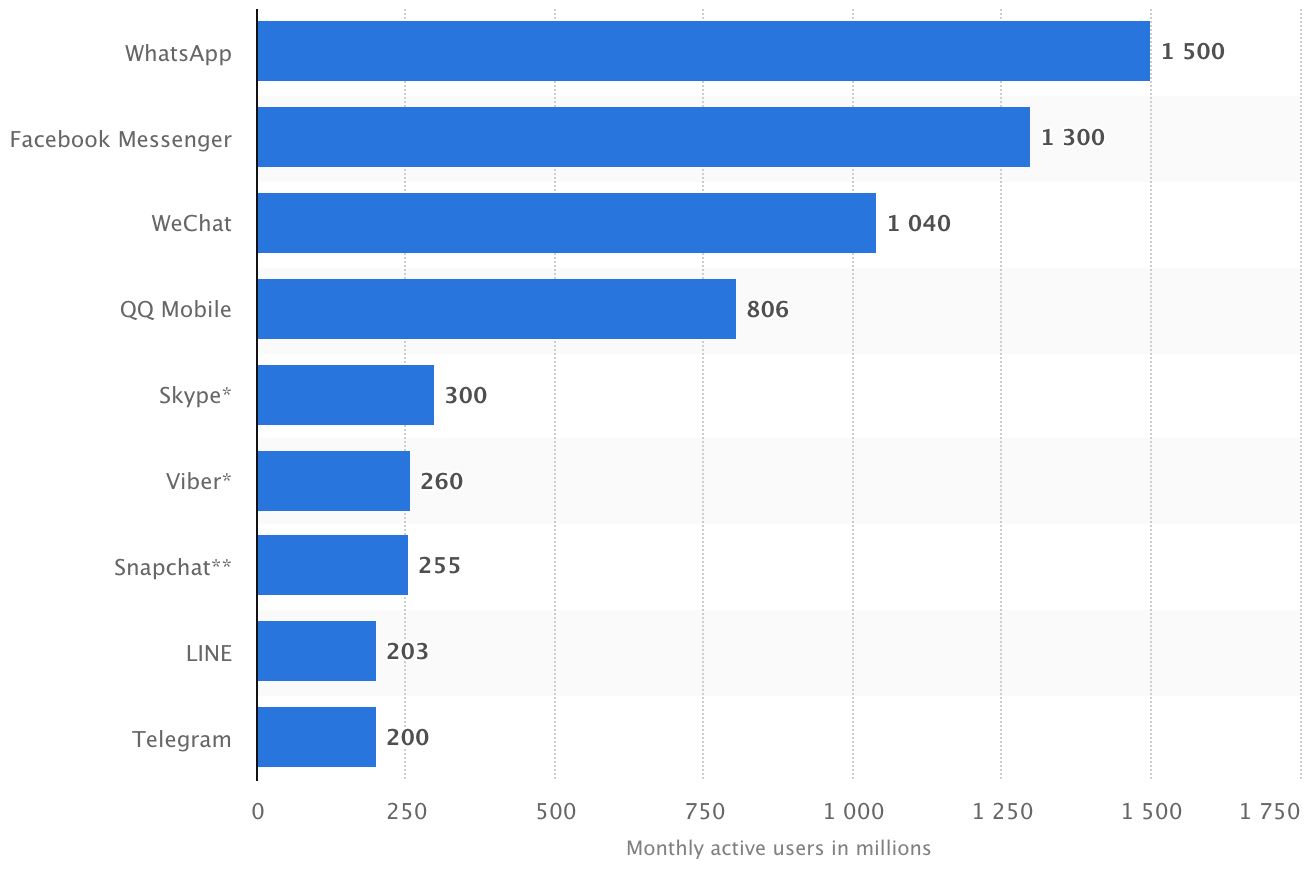

Currently, there are over 1 billion people who use WeChat and over 90% of those users are Chinese, which makes WeChat the third most used messenger app in the world.

However, unlike the other apps on that chart, WeChat is the only ‘must have’ app when you are in China… as we found that out at the restaurant.

We eventually figured out how to pay for our meal, which involved a complex 3-way currency exchange with a couple of other restaurant guests who took our cash and paid with their WeChat Pay account.

Even though we found out a way to pay for our meal without WeChat, the bigger picture was clear: Mobile payments are not only here… but they are the only way to pay in many cases.

For consumers this may sound strange… you can only pay for things with your phone? It’s a very uncomfortable feeling for many people, as the power and anonymity of paying with hard cash has long been a satisfying feeling.

(Of course, governments are backing this move to digital payments, which are totally track-able, which means they can get their tax revenue.)

Regardless of what some people are comfortable with, the digital and mobile payment trend is clear. So, you can fight it, or embrace it.

If you choose to embrace it… then you should have a look over at China and the rest of Asia where mobile payments are about to absolutely explode. And a big reason for that is the infrastructure that China is investing to provide connectivity for consumers and sellers.

This massive network of cell phone towers will allow anyone with a phone to start buying things with a simple scan of a QR code.

Now think about people who are actually selling things… they’ll be able to make financial transactions in a blink of an eye. No cash register, no credit card machines, no vault with cash… it’ll all be based on tiny electronic devices, called “cell phones.”

The speed and volume of digital financial transactions is set to skyrocket, especially for micro purchases (think a bottle of water or a pack of gum).

As an investor, there are two huge opportunities here. Obviously investing in the platforms that facilitate these transactions will benefit the most. There are dozens of companies throughout Asia that are raking in the money right now. (One of them spoke at our private dinner in Hong Kong last week.)

The other major opportunity is to provide things to sell to these new consumers. Remember, you don’t have to sell anything physical… and you don’t have to physically be there…