Want To Make Some Money? Get Involved In One Of These 4 Big Markets

Facebook, Apple, Amazon, Netflix, Google, Tesla, and Microsoft.

Artificial intelligence, virtual reality, driverless cars, robotics, and gene augmentation.

If you’re not invested in one of those companies or you’re not working in one of those industries, then you’re missing the bus… Right?

That’s what it seems like.

Everyday there is some new technological breakthrough or some new multi-billion dollar idea.

That’s very exciting for the consumer.

But, what about the everyday entrepreneur? What about the average person who is trying to start a business out of their garage?

How the heck are you going to set up a lab to edit human genes? How are you going to engineer a car to drive itself?

Unless you have some serious financial backing, you’re going to have a very tough time competing with those big companies.

What happened to the simple businesses that anyone can start?

They’re out there. You just have to ignore all the noise you hear in the news everyday.

Here are four markets that you should look at today that have massive upside potential, but don’t require massive investment.

1. China’s Middle Class

China is difficult to understand. I’ll be the first to admit that.

I’ve been numerous times and I always leave with more questions than answers.

The last time I was there, a couple of months ago, I took this picture: Yes, that is a line of people waiting to go into a Chanel store.

Yes, that is a line of people waiting to go into a Chanel store.

I’ve been to plenty of malls throughout the US and the rest of the world, as I’m sure you have too. Do you ever see lines of people waiting to go into high-end stores?

But, this Chanel store wasn’t alone. Gucci, Louis Vuitton, Burberry, and numerous other high-end retailers had lines out their door as well.

It’s the rise of the Chinese middle class that is fueling this shopping binge… and it’s just starting.

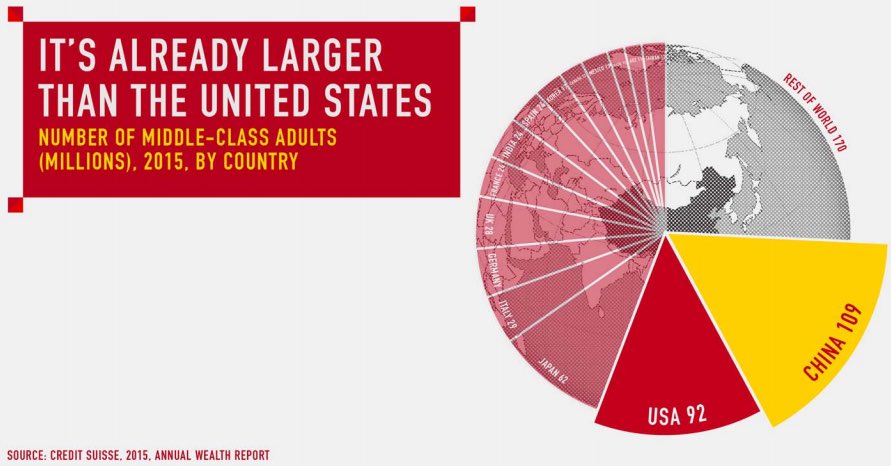

The middle class in China already outnumbers the middle class in the United States. But, unlike the US, this demographic is still growing.

Source: BI

Instead of importing products from China to the US…

Import products from the US to China.

While this may seem counter-intuitive, the facts speak for themselves.

There are more buyers in China than the US.

So… go sell things to China! Especially high-end products.

(We will be going VERY in-depth on this next year. E/P members, stand by.)

2. Home Services – Plumbing, Electrical, HVAC

Sounds boring, right?

Well, that’s exactly why you should pay attention to these services.

Unclogging pipes, rewiring houses, and fixing air conditioning units aren’t really the most exciting things to talk about.

But, these simple tasks are not going to be replaced by robots anytime soon.

So who is going to be working in these jobs?

Great question.

It’s not like teens are going to college to get their degree in plumbing.

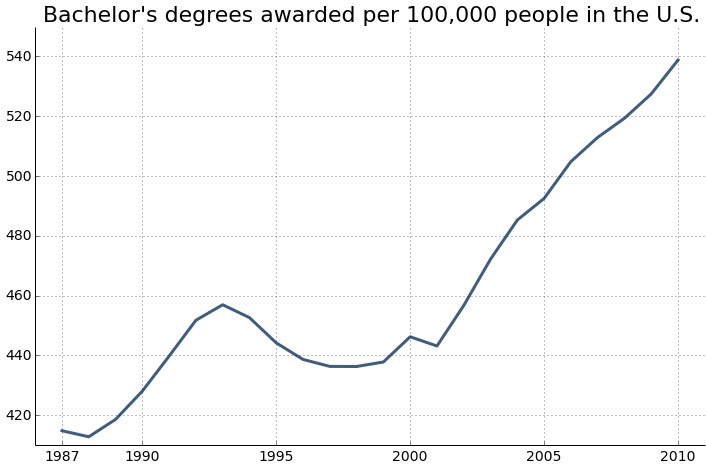

Source: RO

The days of going to trade schools are long gone. We have an increasing number of college graduates who know how to write 20 page essays, but can’t replace a fuse if their life depended on it.

The demand for these services will continue to increase as the population grows, but the labor pool to fill these jobs will decrease. This will inevitably result in higher prices for these once simple tasks.

(If you are looking to start a business in one these service related industries, please contact me, as I am currently looking to invest in a simple, well run, small company.)

3. Baby Boomer Services

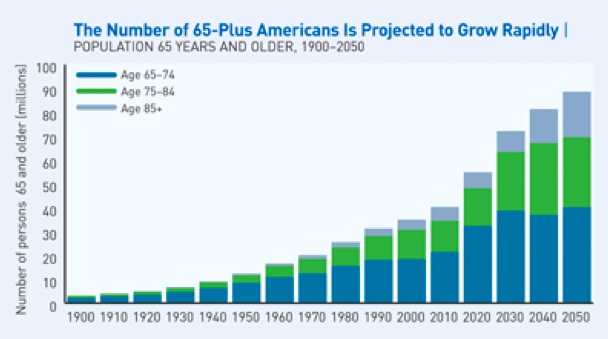

This is a pure numbers game.

Pick a service and don’t make it over-complicated. The shear volume of potential clients will ensure that you’ll be successful if you can just stick to your business plan.

Source: USCB

And don’t over complicate it. There are already some big players in this space, but there are plenty of services that are being ignored.

Instead of building a senior care facility… provide the food services, building maintenance, or transportation that the facility contracts out.

4. Cannabis

This is probably the lowest hanging fruit I can think of for a variety of reasons.

First, cannabis is federally illegal in the United States and most of the world. That means that the major players that are federally regulated (think banks, pension funds, and institutional investors) can’t touch the market.

Second, there is still a negative stigma around cannabis that will take a while to dissipate. This means that early adopters will have first-mover’s advantage.

Third, most people currently in the cannabis industry are focused on actually growing the plant, which leaves all of the auxiliary services relatively uncrowded.

If you are skeptical about the future of cannabis, consider this:

Cannabis is legal for adult recreational use in 8 US states representing over 20% of the US population. According to Arcview Market Research, the leading cannabis industry market research group, the legal cannabis business in the US and Canada generated almost $6.7B in sales in 2016, up 34% from 2015. Arcview estimates the industry will grow to $22.6B by 2021.

And that’s just the recreational market.

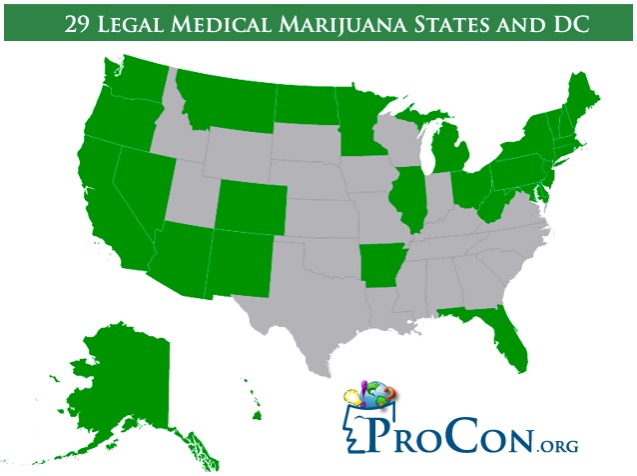

Medical cannabis is currently legal in 29 US states.

Source: ProCon

The cat is too far out of the bag.

While cannabis is still federally illegal, I cannot see a scenario where states would have to reverse legislation.

Especially when a state, like Colorado, generates over $1 billion a year in tax revenue.

Just think what California – the sixth largest economy in the world – will receive next year when cannabis becomes legal for recreational use.

Remember, there is always an opportunity around every corner.

If you think you’ve missed out on the mountain of money that has been made in the tech industry lately, don’t worry.

While everyone has been focused on high-flying tech, these industries have been slowly plugging along with little attention. Get after it!