In a remote part of the Canadian wilderness there is ball of fire that has been burning since the mid-1970’s, and hardly anyone knows that it exists. This blow torch of energy, which is fueled by more than a million cubic feet of natural gas per day, was originally man made… But now it’s been forgotten.

I learned about this burning mystery a couple months ago at the Saddledome, home to the appropriately named Calgary Flames. Between puck drops and dome foam – which is beer said to have drug-like effects, due to insanely long beer tap tubes that run throughout the entire stadium to a central keg room – I was told this story.

Supposedly, just recently, a flaring well was rediscovered after decades of being unnoticed to the outside world. Whether the flame has been burning continuously, or has been reignited by static electricity, it’s clear that there is an unbelievable amount of natural gas supplying this one individual hole in the ground.

How this well got there, and why it was forgotten, was explained to me as we watched the hockey game.

Muskeg in Canada

Most people can’t comprehend the vast amounts of rural land that exist within the borders of Canada. In addition to it being the second largest country in the world, it’s also one of the least densely populated. For perspective, Russia has nearly twice the population density of Canada even though it’s landmass is nearly two times bigger. China is just a tiny bit smaller than Canada, but it’s population density is 3,250% more.

Of Canada’s 3.5 million square miles of land, about 12% is peatlands, better known as “muskeg.” This geographical feature can be thought of as an arctic swamp, with the ground surface varying in stability depending on the weather. In the winter, large trucks and heavy equipment can be driven across some areas of frozen muskeg. In the summer, these same areas will swallow a truck whole and even trap wildlife like moose.

Far beneath the surface of Canadian muskeg regions lie enormous amounts of natural resources – mostly oil and gas. The problem is that it’s near impossible to get these resources out of the ground. In addition to heavy equipment being eaten up by the muskeg surface, transporting the oil and gas to its final destination is uneconomical. But that doesn’t mean it hasn’t been attempted.

If you look at aerial photos of the vast Canadian wilderness, you’ll notice that there are thousands of miles of cutlines criss-crossing all over the place. These manmade cutlines, which seem to have no beginning, end, or consistent pattern, appear to be mysterious crop circles from above. In actuality, these lines have been used for old roads, pipelines, logging, and oil and gas seismic surveys.

These seismic surveys are done by using small explosives, or trucks with vibrating plates, that send sound waves into the earth’s surface. These sound waves then reflect back off of different subterranean rock surfaces and are recorded by a geophone. Multidimensional images are then created, similar to how an ultrasound can show a baby in a mother’s stomach. Based on the images produced, oil and gas companies can then decide if they should move forward with drilling exploratory wells.

And that, more or less, is how that random remote ball of fire ended up out in the middle of the Canadian muskeg.

That could be the end of the story… But if you’re anything like me, all of this just raises more questions. How much of Canada hasn’t been explored? Why isn’t Canada capturing more of these resources? And, of course: What opportunities are currently available for investors?

Let’s dig in…

Rich Canada, Poor Canada

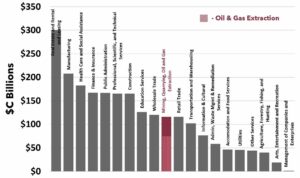

I don’t want to focus too much on what has gone wrong in Canada. This chart sums it up nicely:

Maybe this should be a lesson to never elect someone who is the son of a communist dictator.

Fortunately for Canada, despite past missteps, they are not a resource poor island nation. Instead, they are absurdly wealthy. When it comes to resources, Canada is ranked as the fourth wealthiest country in the world, and ranks second per capita.

Whether it’s timber, potash, gold, uranium, or oil and gas, Canada’s resources rank near the top globally and add up to tens of trillions of dollars of value.

However, if you look at what makes up Canada’s current GDP, you’ll see a different story. Industries like social assistance and public administration have grown much larger than the extraction of natural resources. This trend correlates right in line with the stagnation of Canada’s economic growth.

Source: CAPP

While this may be an infuriating development for Canadians (who are not on the government’s dole), this is a massive opportunity for investors.

Toonie for a Loonie

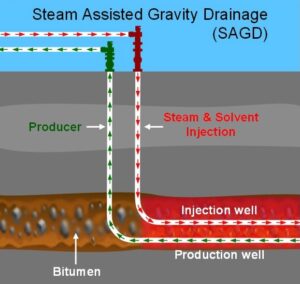

About a decade ago, in Northern Alberta, a small oil and gas company built a $450 million SAGD facility. Steam Assisted Gravity Drainage (SAGD) is a technique where you pump steam into the ground to heat up bitumen. This heated bitumen, which starts to act more like a liquid, eventually seeps through the ground to a lower well which is then pumped to the surface.

Source: CNRL

On paper, this $450 million project was projected to produce billions of dollars of heavy oil. But, the company went bankrupt before production was optimized and the facility got lost in a long legal process.

Fast forward to today and that same SAGD facility was acquired through an auction for a couple million dollars. And if this acquirer can get this facility up and running, they’ll be looking at billions of dollars in returns over the coming decades. We’re talking about an investment that will generate a 50,000% return, or much higher if oil goes anywhere above where it is today. (And yes, you can invest in this company.)

The situation that is being set up in the entire oil and gas industry, and especially in Canada, is nothing short of a once-in-a-lifetime opportunity. No one is paying attention.

The Pendulum Swingeth

Just a decade ago, there was a narrative that was widely accepted around the world: Fossil fuels are terrible for the environment and the entire world is going to do everything possible to never use them again. By 2026, everyone will be driving an electric car, renewable energy sources will power our lives, and we’ll never use carbon producing energy sources ever again.

Governments around the world, especially in western nations, pushed their citizens hard with this agenda. Huge subsidies for green energy projects and electric vehicles; vilification of gas stoves and traditional oil companies; and worst of all, massive under investment in exploration and infrastructure projects within the traditional fossil fuel sector.

What’s coming next, in my opinion, is a dramatic swing back to reality.

But this swing is just starting, and there is plenty of opportunity to position yourself now. The broader energy market is still the least valued sector in the entire stock market, and when you look at the actual market cap, it’s even more compelling.

As of the beginning of 2026, the total market cap of the entire US energy sector makes up 2.3% of the S&P500. This is lower than the average of 6% over the past decade, and drastically lower than the ~30% during the 1980’s.

Said simply, energy is ignored and hated. This is despite oil and gas demand increasing every year while investment into (and within) the industry is declining every year. This will all set up for a spectacular reversal.

BNPL – Buy Now, Profit Later

The list of interesting energy companies could fill pages. But if you want to stop reading and get your hot stock pick, just buy ExxonMobil. They are one of the best run companies in the world and are basically another arm of the US government – they’re too big to fail.

However, if you look a little deeper, especially in certain markets outside of the US, you’ll find some oil companies trading for unbelievably low multiples. Many of these companies, which are priced as if they were dead, are profitable and sitting on incredible amounts of reserves. This is especially true for Canadian oil and gas companies which often have proven reserves of 50 years or more.

That’s why I recently visited Alberta and Saskatchewan, driving hundreds of miles a day, in -30F degree weather, dodging moose. After visiting dozens of different oil and gas facilities and speaking with multiple different operators, I have a new understanding of one of the best value investment opportunities available today.

An Alberta crossing guard.

Before I mention any specific company, I want to make something clear: This is not a get rich quick trade and this may take several years to play out. But when you contrast this situation’s downside risk with today’s market valuations and volatility, this stands out as the most compelling opportunity available in early 2026.

In addition to physically touring and viewing the facilities of many Canadian oil and gas companies, I also reviewed the books of dozens of different companies. While not a completely exhaustive list, here are some of the companies that I’ve taken a hard look at:

- Enbridge Inc.

- Canadian Natural Resources Ltd.

- Suncor Energy Inc.

- TC Energy Corp.

- Imperial Oil Ltd.

- Cenovus Energy Inc.

- Pembina Pipeline Corp.

- Tourmaline Oil Corp.

- Whitecap Resources Inc.

- Keyera Corp.

- Plains All American

- Arc Resources Ltd.

- Ovintiv Inc.

- South Bow Corp.

- Peyto Exploration and Development Corp.

- Tamarack Valley Energy

- Gibson Energy Inc.

- Athabasca Oil Corp.

- Baytex Energy Corp.

- Enerflex Ltd.

- Freehold Royalties

- Paramount Resources Ltd.

- Vermillion Energy Inc.

- Birchcliff Energy Ltd.

- Advantage Energy Ltd.

- Precision Drilling Corp.

- Greenfire Resources

- Surge Energy Inc.

- Saturn Oil and Gas Inc.

- Obsidian Energy Ltd.

- Inplay Oil Corp.

- Falcon Oil and Gas Ltd.

- Petrus Resources Ltd.

- Hemispehere Energy Co.

- Gran Tierra Energy

- Yangarra Resources Ltd.

- Arrow Explorations Corp.

- Lycos Energy Inc.

Amongst this list of names are some companies I expect to grow at least 10x within the next 5 years. There are also some companies that may go bankrupt, or be acquired for a discount, within the next 12 months.

For me, and for EEF, I am already allocating a large portion towards a select number of positions within this list. And I expect my holdings within this sector to eventually make up a majority of total AUM.

Distracted Sheep

About a month after I returned from Canada, I was fortunate enough to attend the Goldman Sachs energy conference in Aventura. This conference is a who’s who of the broader energy world and included everyone from Chevron’s CFO to the US Energy Secretary, Chris Wright.

Being in a room with these kinds of people makes you second guess your assumptions about energy in general. Why would I, as a non-energy expert, have any better forecast or investing ideas than these giants of the energy industry? This feeling was especially true when it came to the attendance for certain presentations.

For example, when Chris Wright took the stage to speak, there were several hundred people in attendance with standing room only (and a full detail of US Secret Service). Considering the US had captured Maduro just a couple days prior, the audience was especially interested to hear what the Energy Secretary had to say about the future of US (and Venezuelan) energy.

Meanwhile, in the same exact room at a different time, a fireside chat was held with some of Canada’s top oil and gas companies. The same room that had been jam packed was now almost completely empty, except for myself and some sorry junior analyst interns taking notes.

Considering that this event wasn’t even filmed, I wonder who these Canadian oil executives were even talking to? Just me?

If you were to ignore the valuations, charts, resource reserves, balance sheets, and every other metric of Canadian oil and gas companies, this picture alone would be interesting. But when you combine all of these together, this opportunity becomes almost impossible to ignore.