“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.”

– Sun Tzu

When I started writing today’s article, I wanted to talk about risk. I wanted to show you how devastating a huge loss is to your wealth.

I wrote it all out… and then I deleted it all. I thought to myself, “Talking about is risk is boring. I don’t want to focus on the negative stuff, I want to focus on the positive stuff. I want to talk about all of the exciting ways we can build wealth.”

So, I deleted it all and started to write something new. But after I read this head line, “FTSE 100 hits record high as pound falls further,” I decided that the best way to preserve and build our wealth is to talk about risk.

The FTSE (informally called the “Footsie” and basically like the S&P 500 for the UK) tracks the top 100 companies by market capitalization.

Today, October 11th, marks the highest intra-day level this index has ever been, with the previous peak being the last trading day of the year 2000 – the dot-com bubble.

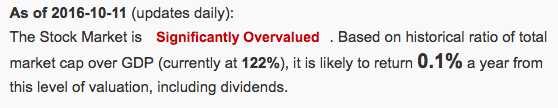

This type of news where indexes, real estate, and many types of assets are reaching record highs seems to be common these days. This should be a screaming sign of risk for you.

We don’t have to look much further than the historical S&P 500 index to see what type of risk we are exposed to right now. I say we, because even if you don’t personally have any exposure to the stock markets, a significant fall will play a huge impact in the economy we live in.  From January 2000 to July 2002, this index saw a fall of about 45% in about two years.

From January 2000 to July 2002, this index saw a fall of about 45% in about two years.

From July 2007 to January 2009, this index saw a fall of about 48% in about two years.

If today’s S&P 500 fell back to the lows of 2002 and 2009 (around the 800 mark), then the index would fall more than 60%.

Of course it’s difficult to say where or when the index will decline, but the fact that a 60% fall is possible should really be understood. What does a 60% fall in someone’s wealth mean?

If you have $100,000 and you lose 60%, you end up with $40,000. If you want to get back to $100,000, then you’d have to make 150% gains on your $40,000.

However, if you were to limit your exposure to the risk (as in don’t buy things that are near or at the top of the market), then you would never have think about 150% gains. Simply protecting your downside risk could be considered a win.

Finally I’ll leave you with this:

Also… I have a fun book to share with you later this week that I guarantee none of you have ever seen.