I’m sitting in New Jersey right now, looking at the skyline of Manhattan.

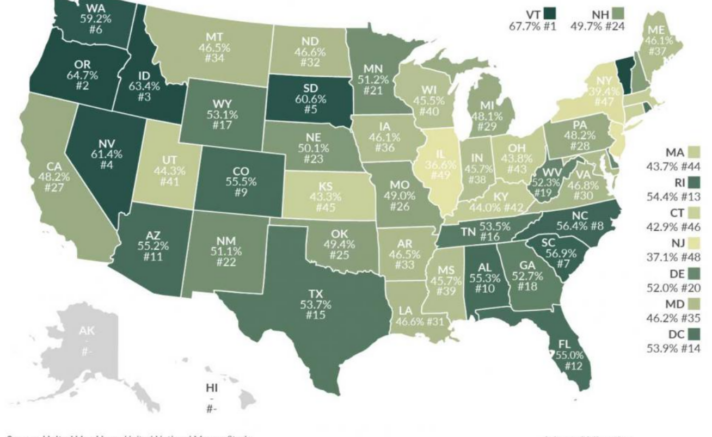

Here in New Jersey, income tax for top earners is nearly 9%, while over in New York they’ll be paying just a fraction less. Both of these states require their residents to pay income tax in addition to their federal tax obligations. That means many tax payers are looking at shelling out nearly 50% of their income to the government.

Whatever your feelings towards taxes are, there is one simple rule to building wealth: How much money you make is not as important as how much you actually get to keep. And by minimizing your tax obligations, you are able to keep more money, which can be used to further build your wealth.

If you’re like me, you probably hate thinking about taxes. Not only are they extremely confusing, but they’re also boring.

On top of that, most people feel like taxes are just a fact of life that they can’t change. While it is true that we all must pay taxes in some way – whether it’s deducted from our income, applied to our consumption, or levied on our investments – there are many ways to legally lower your tax burden.

Traditional strategies include donating more money to charities, appealing your property taxes, or simply reviewing your available deductions. (Seriously, that’s what Consumer Reports is recommending you do… fight your property taxes and donate more money.)

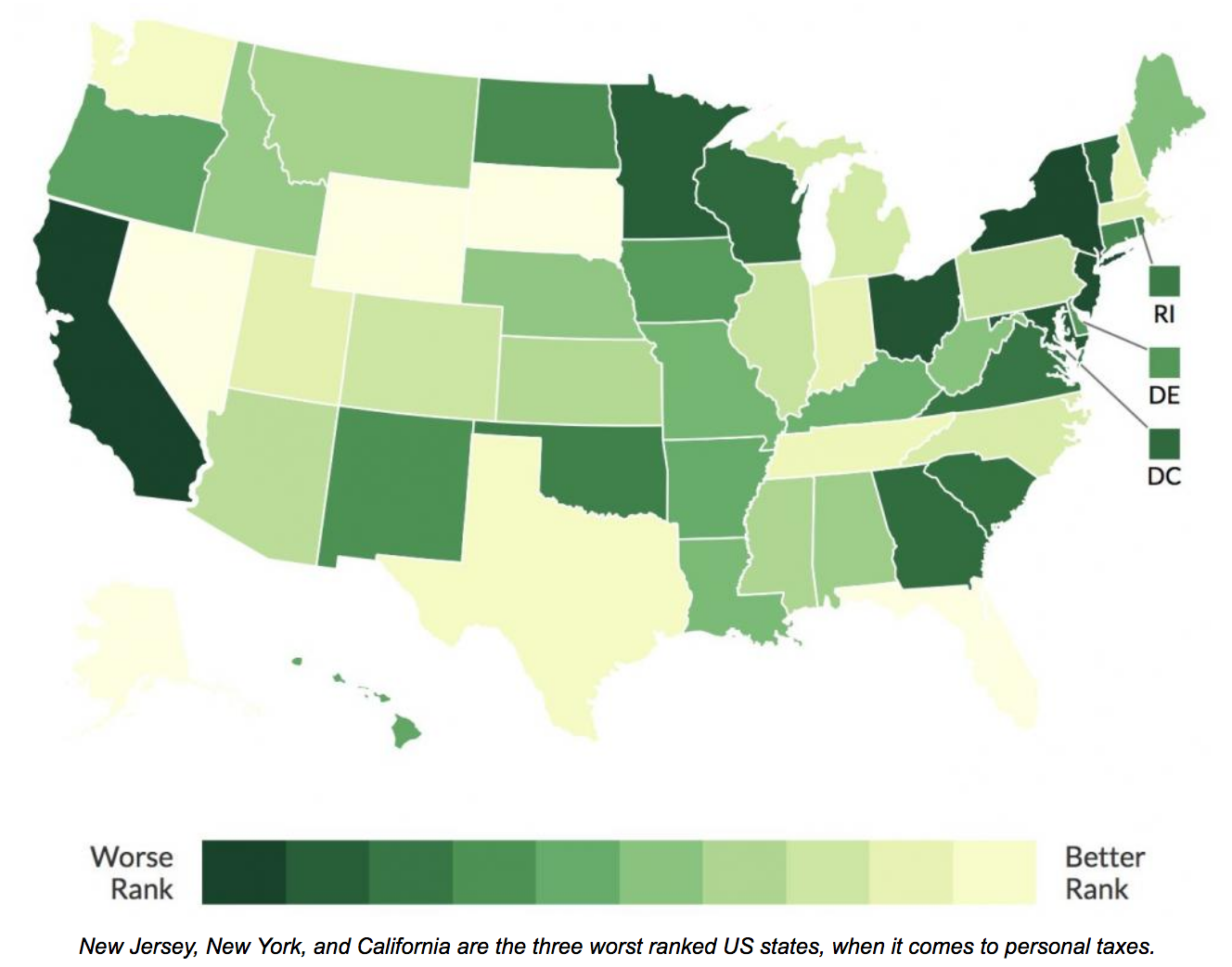

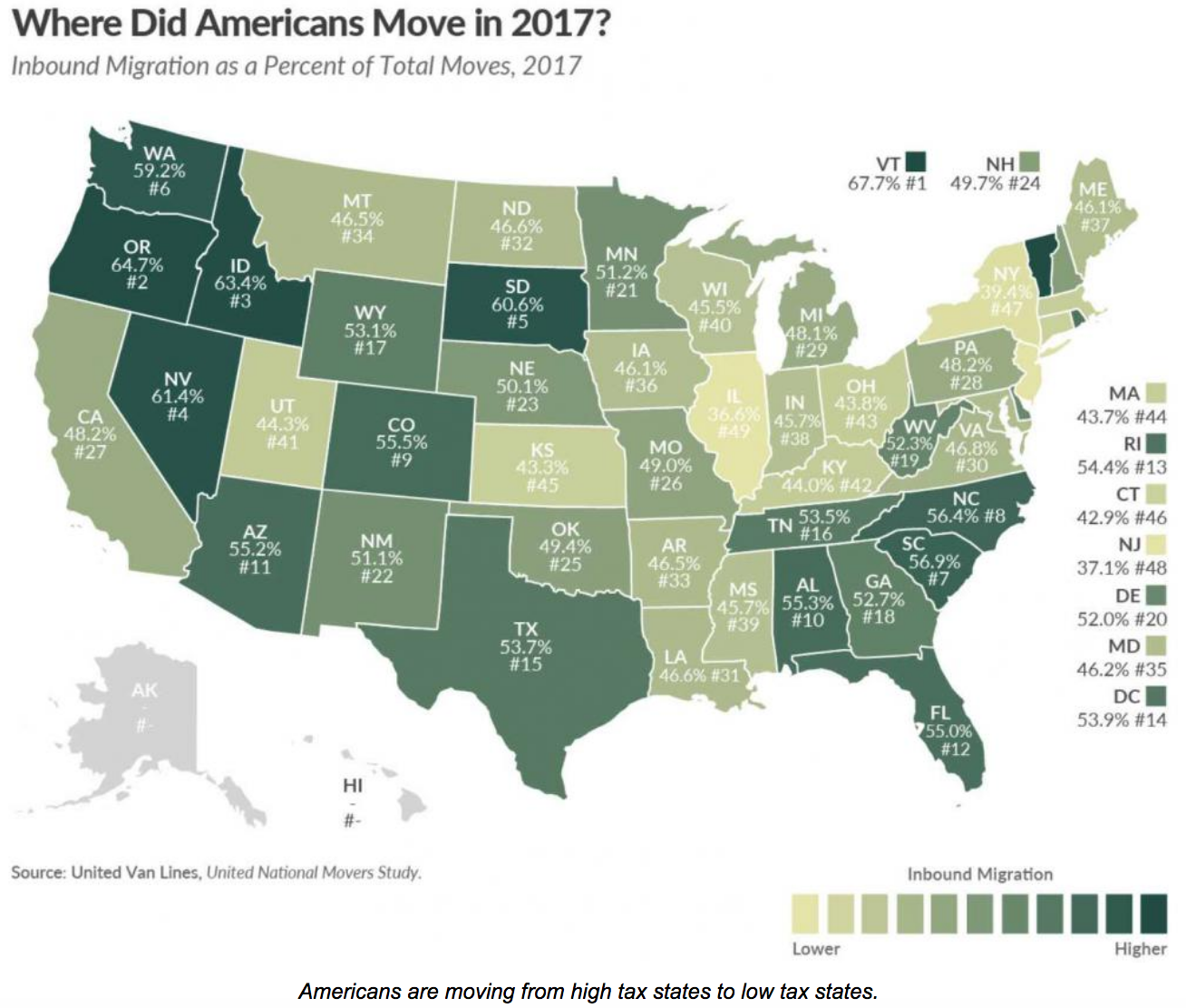

But, if you really want to make a difference, then you need to look at other places. That’s what millions of Americans are doing. In fact, “800,000 people are about to flee New York and California because of taxes, say economists.”

Conversely, states with no income taxes are seeing a huge increase in immigration. Texas and Florida, which are both zero income tax states, are ranked number one and two in the US. Florida receives 900 new residents every day!

For many, the move is easy to make. By simply living in a different state, you can have about a 10% bonus by getting rid of state income taxes.

However, for the majority, moving is not an option. Family ties, employment obligations, and a variety of ‘entanglements’ make it very difficult for most people to move.

And that’s why I was shocked to learn a strategy for saving taxes in Puerto Rico last week. We learned a way that you can incorporate your business in Puerto Rico and pay less than 10% tax in TOTAL… all without having to physically move there.

The opportunity doesn’t work for anyone, but many Explorer Partnership members are going to be able to use this strategy. This will significantly increase the amount of money that they can keep at the end of the year.

If you’re living in a high tax location right now – no matter where you are in the world – take a hard look at what your options are. Change doesn’t happen without massive action.