Imagine buying over 100 tons of US nickels.

To put that into perspective, not even the world’s largest forklifts can lift that much weight. In fact, they can’t even lift half of that weight.

So, why would someone go through the trouble of buying 100 tons of nickels? That is equivalent to 20 million individual coins! Just the logistics of physically handling this type of investment is a lot of work.

However, from a value investment perspective, this is one of the safest plays out there. That’s why billionaire Kyle Bass did exactly that several years ago – he bought $1 million worth of nickels.

To understand why holding nickels is a very good investment, you first have to know the background of currencies themselves.

In order to make an exchange between two parties (a buyer and a seller) the actual medium of exchange has to represent something of value. But, ‘value’ is subjective, right?

Some people value rare artwork, while others might value a special breed of tulip. Throughout history, there have been many examples of different ‘value holders’ depending on the culture. Sea shells, beads, tapestries, seeds, spices, and all sorts of ‘value holders’ have been used as mediums of exchange in the past.

However, worldwide there has been one consistent medium of exchange that has lasted thousands of years: metals. Normally we think of gold and silver, but there are many other metals, such as copper, platinum, nickel, aluminum, and zinc.

The reason why people throughout the world value these metals is because they are easy to understand. They are physical pieces of value that cannot be replicated without significant work.

That’s one of the reasons why many people believe Bitcoin has value. Although Bitcoin is not physical in the sense that you can hold it in your hand, it is very difficult to ‘make’ more (that is, unless you put your Bitcoin into cold storage, or print out a paper wallet). The finite nature of Bitcoin gives it value because someone can’t replicate it easily… they have to put in work. They have to ‘mine’ for more… just like you’d mine for more gold or silver.

Governments have long understood that the only way that they can issue a currency is if their citizens have faith in the medium of exchange. Most governments throughout the world first minted currency that was made of gold, silver, or copper.

Today, things have changed. Because of the inflationary nature of government currencies, the actual value of the metals in most coinage becomes worth more than what the currency represents.

Put in other words, when governments increase the supply of money (i.e. they ‘print’ more money) the value of each individual unit decreases in value. It’s just like a shareholder of a company when their shares get diluted from the issuance of additional company stock.

For anyone who holds physical money, they will eventually see all of their buying power inflate away… unless, they are holding money that has valuable metal in it… that’s where nickels come into play.

First, let’s look at how the US used to make it’s coinage. Prior to 1965, most US coins had a large amount of silver in them. At the time, the purchasing power of the actual coins were worth more than the silver content of the coin. But, once the value of the silver was more valuable than the actual coin itself, US mints changed the metal formula in those coins – they took out the silver.

For example, if you own a 1943 nickel, it’s melt-value today is worth nearly $1. That means if you literally melted the coin and extracted the silver, it’d be worth about $1 even though the nickel’s face value is worth 1/20th of that.

That’s nearly a 2,000% increase in value for that 1943 nickel! And the nickel is not alone:

These coins are know to collectors as ‘junk silver.’ Many collectors and investors hold junk silver because of their silver content. You might be able to occasionally find one of these coins in circulation, but most have been picked out by those collectors and investors.

You can buy junk silver from most coin dealers, but you’ll be paying market price for whatever the price of silver is on that day.

Back to nickels…

Today, nickels are made of 75% copper and 25% nickel. No more silver, as it’s worth too much.

But, have you seen what’s happening to the price of copper and nickel? They’re going up. And if the trend continues, their prices could continue to rise for a while.

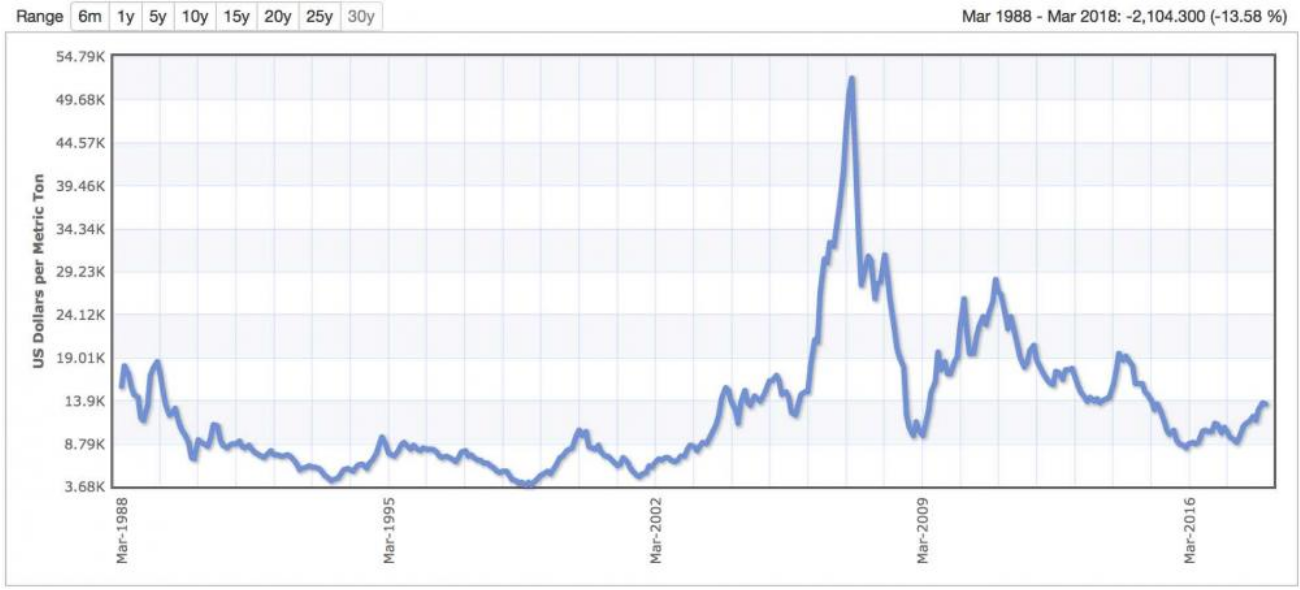

Here is nickel’s (the metal) 30 years price chart:

As you can see, the price of nickel is relatively low right now. Will it’s price spike? No one can say for sure.

But, even with the current price of nickel being low, the actual melt value of a physical US nickel is worth 90% of its face value.

So what will happen when the price of nickel (the metal) goes up? The melt value of a nickel coin will go up, which means that the value of the nickel coin will be worth more than five cents.

Now, I want you to imagine this scenario: Inflation hits the US dollar AND the price of nickel goes up (along with other commodities).

If you are holding physical nickel coins in that scenario, then you may end up with an asset that has gone up significantly in value.

Now let’s think of the opposite scenario: The US dollar maintains its value (or even sees deflation) AND the price of nickel goes down.

Then you’re stuck with a bunch of nickels that are still worth five cents… which is exactly what you paid for them in the first place.

The worst case scenario would be if the US dollar sees inflation AND the price of nickel declines. However, historically, the US dollar has had an inverse correlation to the price of commodities. So, this scenario is pretty unlikely.

Sounds like a great investment: little downside risk with great upside potential.