Everyone knows that Munger said, “Smart men go broke three ways: ladies, liquor, and leverage.” But the truth is that he just added ladies and liquor to make it funny. The real risk is leverage.

Considering that 2025 has been the year of lower alcohol consumption and less sex (correlation there?), you’d think leverage would follow a similar trend. You’d be wrong.

Although social debauchery during this period of late-stage-Roman-vibes is amongst us, the majority of irresponsible behavior has mostly shifted to financial markets. The period of sexual promiscuity and substance abuse did have a good run for the past couple of decades, to be fair.

Perhaps today’s addiction to leverage and gambling can be blamed on governments and central banks setting bad examples? If the entities responsibly for monetary policy are being reckless, why shouldn’t the market participants act in the same way?

Or maybe it’s a different problem altogether: Those seeking economic advancement know of no other route, other than taking on increased risk to make exponential gains.

A recent WSJ article titled, “The Economy That’s Great for Parents, Lousy for Their Grown-Up Kids” encompassed the situation quite well. It’s near impossible for younger generations to view, let alone achieve, the economic success of their boomer parents…

Unless you gamble and use leverage.

YOLO, Send It

This was the subtopic of a speech I gave at a family office gathering in Dallas recently. The access and variety of new audacious financial products is dizzying.

The menu of items being offered to satiate current ‘send it’ demands include:

- The introduction of 5x leveraged ETF’s, some of which are being launched by the appropriately named company Leverage Shares.

- The rapid growth of prediction markets, a la Polymarket, Kalshi, and various other platforms. My favorite recent bets, I mean predictions, relate to the number of seconds Trump will shake hands with Zelensky, Xi, and other world leaders.

- The offerings across multiple different crypto platforms, which now offer 50x leverage and above. Recently this has led to many billions of dollars being liquidated during relatively low periods of market volatility.

At the risk of stating an obvious prediction, I’ll say it anyway: Whatever catalyzes the next financial pullback will almost certainly be traced back to betting, often times with leverage.

But it’s not just betting in the obvious sense. Many of today’s investments, although not considered explicit bets, are in fact horribly positioned to achieve what their values suggest.

Of the top ten largest publicly traded companies in the world – all currently worth more than $1 trillion, each – none of them have a P/E less than 27. Several of these companies have a P/E over 50, and one has a P/E of nearly 300.

Without explosive earnings growth for many of these companies it would take decades, or even hundreds of years, for earnings to match their price.

This is not to say that companies can’t grow into their valuations – price to earnings should not be the only metric to measure a company’s potential future value. But this is to question whether the world’s largest companies can grow into their valuations, which require decades of explosive earnings growth to justify their current valuation.

How can the world’s largest companies maintain aggressive growth for years to come? EACH of those top ten valued companies are currently larger than the GDP of nearly 180 countries.

An investment in a highly valued mega-cap company is no different than a leveraged bet on a low odds gamble.

But AI is going to eat the world, right? Right!?

It’s All Better Than the Dollar?

One recent investment narrative has been the ‘debasement trade.’ This strategy seemed to go mainstream for the past couple months, as gold and silver were ripping higher. But for anyone who knows about Jekyll Island, that trade has been in play for the past century.

However, the debasement trade isn’t just about precious metals. It’s about the entire stock market, cryptocurrencies, and anything else you can think of that might outpace the purchasing power of the dollar. (And the euro, yen, peso, etc.)

Did the recent surge in pandemic-era spurred inflation create a scenario where individuals are willing to bet on the future value of anything other than fiat money?

And in placing these bets did risk assets get over-weighted allocation when compared to traditional safe haven assets?

I believe the answer is ‘yes’ to all of that.

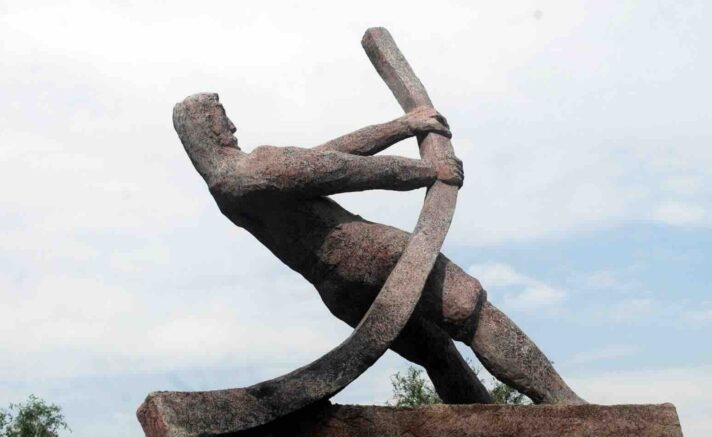

Leverage or Poverty

Is it possible that analyzing company valuations and productivity metrics is missing the forest for the trees?

We’re concerned about a couple of trees that have bark beetles instead of watching an arsonist igniting the entire forest.

15 year car loans, 50 year home mortgages, and the end of quantitative tightening should give us some clues. The can is only getting kicked harder and it’s likely that leverage will only increase.

Until it can’t.