I don’t particularly like making predictions. Not because it’s not fun (it’s a blast!), but because you look really stupid when your predictions are wrong.

Of course, when you make a prediction, especially about something that is very substantial, you can look like a hero. That’s even more true if you have money on the line – real money.

That’s more or less the world of investing – making bets on how you think the future will unfold.

That’s also the world of investment newsletters and high flying hedge fund managers who thrive on making predictions that come to fruition.

Some of these individuals are very good at this game of making forecasts that seem to always come true. The trick is to make arguments that are just vague enough, with no specific timelines. That way, nothing can really be proven incorrect. But the argument itself seems entirely logical and even likely to unfold in the future.

Making accurate forecasts about financial markets is much more of an art than a science. There is a way to formulate a future prediction, and communicate that message so that the audience believes and understands the principle… But, may be left with many questions about what to do with the message itself.

Fedspeak Principles

This reminds me of Ray Dalio’s book Principles. He explains structures that you can make your brain work around, but nothing really actionable. Maybe that’s why Bridgewater has under-performed the market as of lately? (jk, Ray, you’re the GOAT of raising money.)

Another example is when I wrote about “fedspeak” in June of 2016, nearly a decade ago: “The other day, Yellen made the same speech that she has always given; and that is, we have no idea what she said. Like Bernanke, and especially Greenspan, she has the ability to talk at length about nothing.”

What I’m getting at is that many predictions, especially if filled with big words and complex theories, can be headline worthy but hardly actionable.

If you’ve read this far, I applaud you. The irony is not lost on me, nor should it be lost by you, that I am writing in such a manner which is identical to what I am complaining about.

And that’s the beauty of investing, writing, and life. You can be presented with all of the information in the world, explained in a variety of poetic analogies… Then after all of that, you can still screw it all up.

The Canary is Dead

The canary in the coal mine is typically attributed to John Scott Haldane. He discovered that small, warm-blooded animals succumb to carbon monoxide poisoning faster than humans. Meanwhile, the Austrians were likely using those small yellow birds as early as the late 1600’s when going under ground.

The rationale is quite simple – if the bird in the tiny cage dies, it’s time to get out of the mine. Usually killed by carbon monoxide, the death of a canary was just a preview of what was to come for miners if they didn’t soon get fresh air.

It’s tempting to use this saying – canary in a coal mine – often in the investing world. But there are really only a few times when you can look at something and say with certainty, “we’re in big trouble.”

These times almost always relate to macro observations that apply to the broader economy. On their own, equities, real estate, and politics will not cause enormous problems within an economy.

Of course it’s fun to talk about how the eventual collapse of tech valuations may spread into other parts of the market. Or how a country’s president may crater an economy. And when it comes to real estate, people have been talking about crazy prices for thousands of years.

But none of those things are as important as the cost of credit.

Two Trend Changes

What’s currently unfolding in the US bond market in nothing short of historic.

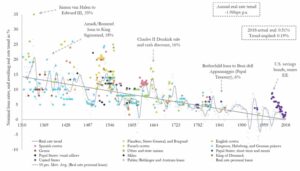

Without knowing anything about financial charting, bonds, or what’s going on in today’s economy, anyone can spot what is going on in the chart below:

It’s crystal clear that the pattern has changed. The previous downward direction, constrained by two trend lines, has broken the top trend line.

Without looking at the reasons (yet) of what has caused this change, it’s tempting to want to forecast what comes next. Ignoring what this chart actually represents, even a child would likely guess that this line is headed in an upward direction for the foreseeable future.

This is especially true if you look at what happened before the last change in treasury yield direction.

Ignoring the blow off top in treasury yields during the early 1980’s, the run up in treasury yields prior and the decline in yields post are nearly identical in time – 35 years for each cycle.

This up-down trend, which is about the entire lifespan of a human being, is difficult for the human brain to put into context. It’s hard to relate your personal situation to trends that can take over a lifetime to play out.

Looking at the historical trend of interest rates over the past several hundred years, the cyclical nature is easy to spot.

Source: Visual Capitalist

Other than the boom-bust credit cycle, which we often see in the mining industry, the historical downward trend in interest rates is notable. It’s easy to see that we’ve bottomed out, leaving us with three options for interest rates:

- Bounce off the bottom and start their ascent higher

- Continue to decline and get well into negative rate territory

- Bounce along a close-to-zero environment

Regardless of which of these three unfold, this is the ‘second change’ in interest rates that is most important.

Beyond Rising Rates

Where interest rates are headed next is much less important than how we get there.

Sure, there are far more arguments for why rates will surge rather than retreat. It really comes down to the reckless spending and blatant disregard for simple budget balancing of nearly every government in the world.

While it’s tempting to point the finger at politicians from every side of the aisle, the reality is that the people are the ones to blame. Politicians know that if they even whisper about austerity measures, they’ll be dragged out of office before the next election.

That’s why the point of financial resolution will only be achieved through crisis.

Unlike historical crises that materialized from financial mismanagement and usually involved armed conflict, the crisis of the future may be one that is hard to feel.

In fact, it’s likely that we’re already in this crisis, and the majority of people being effected can barely feel anything.

The loss of purchasing power of the US dollar has long been a trend that most are familiar with. Artificially manipulating a currency’s supply is a hallmark characteristic of a late stage fiat currency. Throw in some central bank interest rate horseplay, and you have the perfect setup for a silent crisis.

Rates going higher to account for riskier debtors pales in comparison to what those debtors will do to keep the game going.

The New Silent Crisis Trade

Fueled by cheap money, the US tech industry has absolutely boomed over the past couple of decades. This is most obvious as seen by the performance of the NASDAQ, which has mostly been the recipient of investors looking to park their money in fast growing companies.

This trade – trading your fiat currency for shares of tech companies – has been a clear winner. In a low interest rate environment, that sees short-cycled rate gyrations trending lower, speculative non-tangible hyper-scalable assets can perform extremely well.

Conversely, industries such as energy and mining, which are almost the exact opposite, have suffered over the past several years. These companies have had their valuations depressed and the substances they produce are at historically low values relative to tech equities.

This trend will reverse. And it’s already started.

The Gold Canary

As we watch the historic shift in interest rates, we’re also seeing gold skyrocket. It’s a logical series of events, where investors would rather park their capital in a time tested safe haven asset (gold), rather than see their value inflated away into thin air.

But it’s not just gold that is set to benefit from this new era of rising interest rates and grotesque government financial management. Nearly every commodity, unleveraged physical asset, and historically undervalued sector is likely to boom in the coming years.

That’s because investors will panic rotate out of highly valued positions into undervalued safe havens. This rotation, which has barely started, is likely to accelerate in terrifying ways for those who chose to ignore the clear warning signs.

Oil, gas, coal, copper, uranium, nickel, foods, and many more building blocks of the modern world will see tremendous demand in the coming future. Investors will crave tangible assets that they feel can weather an inflationary storm.

Perhaps one of the most interesting situations is what’s unfolding in the gold, silver, and platinum markets. Gold, which has recently broken out to new highs, is typically passed (on a percentage basis) by silver and platinum. Yet, neither of those silver colored metals has caught up yet.

Red = Gold; Blue = Silver; Purple = Platinum

For now, gold is the outlying performer. Is this an anomaly or a clear canary in the coalmine?

Perhaps we should look at Bitcoin for clues…