“It is not the strongest species that survive, nor the most intelligent, but the ones most responsive to change.” -Darwin

During the mid 1970’s, the Eastman Kodak Company dominated the film and camera industry. With 90% of film sales and 85% of camera sales in the U.S., they were the undisputed giant.

Kodak also invented the first digital camera in the mid-1970’s, but soon decided to shelf the project, as they feared the new technology would be a threat to their film sales.

They didn’t want to cannibalize themselves.

We now know that this was a fatal move for Kodak, as the company has struggled to stay alive ever since.

Even though Kodak is the most obvious example, there have been countless other stories where businesses have failed to pivot their product. Whether it’s due to stubbornness, lack of perspective, or just a legitimate mistake, it’s always incredible to see industry giants fall to new trends and technologies.

Just like nature, you must adapt, or you will die.

But, it’s not that easy for major companies to simply change their business model in a day to position themselves for what’s coming next. In addition to a large work force that they must re-train, there is also a large amount of actual infrastructure that has to be modified.

Imagine a production line for gasoline engines suddenly changing to produce electric motors. That would be nearly impossible to do in a short amount of time. But, if a company has a plan to change over a long time period, then they can make the transition smoothly.

However, there is a huge problem. How does a business know where to transition to?

Businesses must be constantly forecasting and predicting where their industry is going… and then make actual steps towards where they think they should go.

Sometimes these companies get it right. They predict where their industry is going and then they build out systems and infrastructure to get there.

And sometimes companies get it wrong. They end up building systems and infrastructure that become totally useless.

When this happens, companies end up with “stranded assets.”

Stranded assets are exactly what they sound like. They are assets that become stranded.

The technical definition is “An asset that is worth less on the market than it is on a balance sheet due to the fact that it has become obsolete in advance of complete depreciation.” The term stranded asset is usually used for accounting to write down assets on a company’s balance sheet.

But, just because a company may have stranded assets on its books doesn’t mean that the asset is actually worthless. It’s just worthless to them.

Here are three future stranded assets that you can start to plan for now.

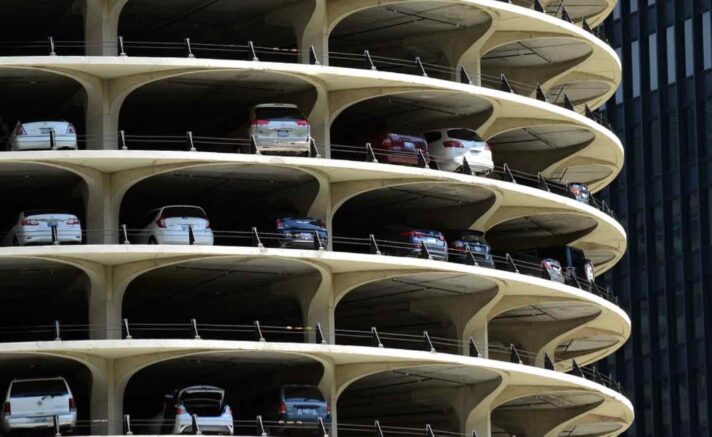

Parking Structures

Personal car ownership will disappear in the future. I won’t dive into this hot debate (you can read about it here), but let’s just assume that this is true for a moment.

Think about all of the parking structures in major downtown cities. Right now they make complete sense. There must be a place to put the vehicles that people use to travel to a city.

We’re all familiar with the nightmare of parking in a downtown area. Some cities have great parking infrastructure… and some cities have almost zero.

As transportation becomes more efficient (especially for everyday commuters) parking will not be as necessary as it is now.

This will theoretically leave massive parking infrastructure assets stranded.

At the same time, there is a worldwide trend of people moving from the countryside to major city centers. This will require more housing and workspace for those who are transitioning to a city lifestyle.

The obvious solution here is to repurpose those parking structures into buildings that can be used for living and working.

Perhaps there will be an opportunity to purchase these parking assets at a discount, as parking companies begin to offload their stranded assets?

Banks

To be clear, I’m not talking about the business model of a bank. I’m talking about the physical locations of a bank branch.

As we shift towards digital currencies and transactions, there is almost no need to physically visit a bank location.

Just a short time ago, it was necessary to visit a bank to get cash, deposit checks, sign documents, and do all kinds of financial transactions.

Now, in 2018, you can do almost everything on your phone from wire money to deposit checks to sign documents.

This shift away from visiting banks will leave a lot of stranded assets. And if you know how a bank is built, they are often unique and difficult to repurpose (heavy duty construction features, vaults, and strategic locations make them hard to simply remodel over the weekend).

But, that doesn’t mean that there isn’t a way to repurpose these stranded assets. Whether it’s providing cold storage for crypto assets or making a custom restaurant, there will be an opportunity to pick up bank real estate for a discounted rate.

(There is a very cool restaurant in San Francisco that has done this. One of their private dining rooms is actually inside of a bank vault. They were able to purchase the bank from a credit union that was going out of business for a fraction of what comparable restaurant locations were selling for.)

Gas Stations

This is another obvious real estate location that will likely be phased out in the near future.

Right now it may be hard to see, but the reality is that most economies are shifting towards electric powered vehicles. This will make the thousands (probably A LOT more than that) of gas station locations around the world completely useless.

Gas stations are often located at busy intersections where they receive a lot of traffic. This means that their location is usually very desirable. Of course you could convert the gas station into some sort of electrical vehicle charging station. But, I think there is even a better opportunity…

Do you know where gas stations hold all of their fuel? Underground.

This is a potentially HUGE environmental hazard. I believe that there will be a very niche, but very profitable business opportunity for those who want to remove those tanks and ensure that the actual land is cleaned up.

There are already a lot of companies out there that do this… but there will be room for more.

The Oil and Gas Journal says, “The average tank upgrade has cost about $100,000, and EPA estimates that the average cleanup has cost $125,000 recently.”

Now, that’s just three simple examples of assets that will become stranded.

As an investor, that means that these are opportunities to capitalize on.

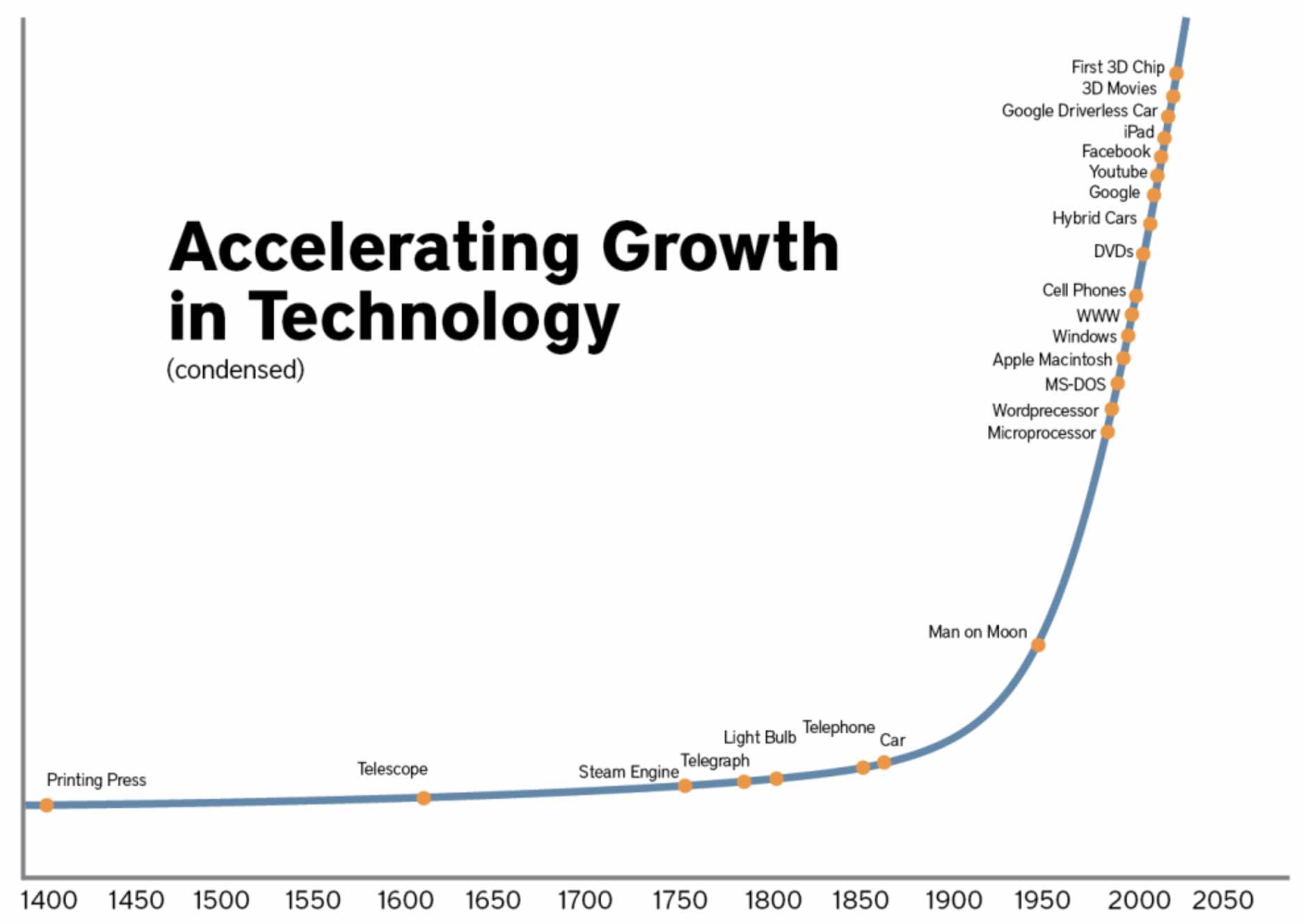

And, as time goes on, we will see HUNDREDS of more opportunities like this. That’s because our technological advances are expanding faster and faster.

The faster we advance as a society, the faster assets will become stranded… which means more and more opportunity.

Maybe you can think of something that will become stranded soon… and more importantly can be repurposed… ???