I was surfing at a beach near my house a while back. I’ve probably surfed there several hundred times, so I had my routine.

Park my car, change into my wetsuit, grab my board, lock the car, hide my key, run with my board to the water and then surf. Pretty simple.

But this time, when I came back to my car I noticed that there was glass all over the ground. Someone threw a hammer at the rear passenger window. The hammer was still there on the seat.

There was nothing wrong with the car, other than a broken window and my stolen camera. My camera (which had pictures from a trip I had taken through Central America, and stupidly I hadn’t backed up) was a devastating loss. It was an expensive DSLR Nikon and the actual photos were really important to me.

So, I called the cops to make a report.

Including the window and the camera, the total loss was several thousand dollars. Really frustrating.

The police report was pretty much useless, except that I could use the report for an insurance claim. But, the deductible for the claim was so high I ended up not doing anything other than paying out of my pocket to get the window fixed and buying myself a new camera.

I was straight up robbed.

Everyone has had something like this happen to them. It sucks.

But what if we knew we were about to get robbed?

I mean, if you saw some shady looking people down a dark alley, you’d probably avoid them right?

If you can see something coming, you avoid it.

If it’s predictable, it’s preventable.

Well, if you have US dollars in a bank, or even under your mattress, you’re about to get robbed.

Not like a gun-to-your-head robbed, but more of a slow robbery that takes several years.

Like a child taking change out of your pocket everyday, that eventually adds up to a huge sum.

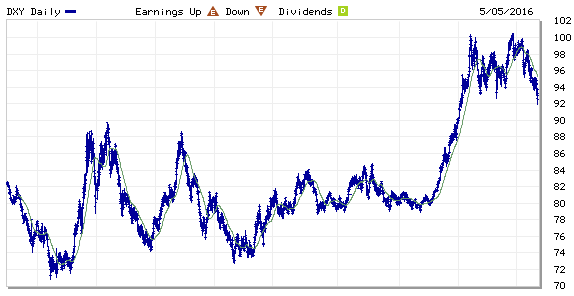

The US Dollar Index is telling us we might start to get robbed. This index, which basically determines the buying power of the dollar may be starting a downward cycle.

You see, for the past couple of years the dollar has gained a lot of strength versus other currencies. So, the amount of money it takes you and I to buy a burger is a lot less than someone buying the burger with another currency. Our purchasing power is strong. So, if we know that the dollar has had strength for a while, and we know that everything comes in cycles, we should be able to prepare for a change in the cycle, or a downturn in the dollar’s buying power.

So, if we know that the dollar has had strength for a while, and we know that everything comes in cycles, we should be able to prepare for a change in the cycle, or a downturn in the dollar’s buying power.

So how do we do that?

Simple. We either buy things that are timeless representations of wealth, like art, real estate or precious metals OR we buy other currencies.

So what currencies should we look at?

We should look at (somewhat) stable currencies that have seen their buying power weaken.

A great example is the Australian Dollar, which has lost a tremendous amount of buying power, in US dollar terms, over the past several years.

But what does this all mean?

But what does this all mean?

If we were to switch our savings from US dollars to Australian dollars, we could save ourselves from being robbed.

Both the US and Australian economies have significant problems, but we’re looking for the economy with less problems and more opportunity to gain strength.

The Australian economy is heavily correlated to commodity prices, which has created a lot of difficulty for Australia lately. However, the recent strength in metals and other commodities would be a bullish sign for the Aussies.

At the same time, the US stock market has been on the second longest bull run in modern history and there are numerous other ominous indicators that we, in the US, may be in for some pain.

But, if we simply switch our savings from one currency to another, we can see a preservation in our wealth just by allowing time and cycles to do their work.

…If we really want to see some gains… we’d look at Australian mining companies, where we could profit on both the currency arbitrage and the strength of a well run business.

We can also replicate the exact situation that I laid above to the currencies that have seen MAJOR changes, like the Chilean Peso, Colombian Peso, South African Rand and Mexican Peso.

MACRO TRENDS

Transportation Revolution

A recent Bloomberg article titled, “Billions Are Being Invested in a Robot That Americans Don’t Want” talks about how people don’t want driverless cars.

The article definitely has the data to support their argument, but how powerful is an argument when the people being surveyed have no idea what they’re talking about?

I’ll just lay out some great quotes from history instead of attacking this article…

“This `telephone’ has too many shortcomings to be seriously considered as a practical form of communication. The device is inherently of no value to us.”

– Western Union internal memo, 1878

“The horse is here to stay, but the automobile is only a novelty—a fad.”

– Advice from a president of the Michigan Savings Bank to Henry Ford’s lawyer Horace Rackham. Rackham ignored the advice and invested $5000 in Ford stock, selling it later for $12.5 million.

“There is no reason for any individual to have a computer in their home.”

– Kenneth Olsen, president and founder of Digital Equipment Corp., 1977.

“Heavier-than-air flying machines are impossible.”

– Lord Kelvin

Cannabis Amendment

Oklahoma just passed legislation to allow the use of cannabidiol for seizure patients, multiple sclerosis and paraplegia of all ages. While this isn’t the biggest news in the marijuana world, the fact that middle American states and societies are embracing the use of cannabis products is another sign of the larger movement.