¿Dónde está Wally? Où est Charlie? Wo ist Walter?

Or, if you’re in the US it’s, “Where’s Waldo?”

If you don’t know what I’m talking about, do yourself a favor and go buy one of the Where’s Waldo books. It’ll keep you, your kids, or anyone else in your house occupied for much longer than you’d ever think.

Where’s Waldo is basically a puzzle book where the reader has to try and locate a guy, with a red and white stripped shirt on, out of a crowd of people. Every time you turn the page, there is another hand drawn scene with hundreds of characters and Waldo hidden somewhere amongst the crowd.

Some people can find him very fast, while it takes others much longer.

Many scientists have tried to figure out the best strategy to locate Waldo, such as scanning each picture with your eyes horizontally versus vertically or looking for specific colors and shapes.

However, regardless of the different strategies utilized, some people are just better at finding Waldo than others. (This guy took it to another level and made an algorithm to find Waldo.)

Is it that some people are just more observant? Do they see different colors better? Or is it that they look for specific shapes?

Really, we don’t have the answer. It’s one of those weird human skills that some people have that just can’t be explained.

There are many other examples of this, where some humans have a sixth sense for identifying certain things.

But, this sixth sense isn’t really one thing, but rather an ability to combine a variety of your existing senses to notice something that others don’t.

As an example, women are usually much better than men at reading people. Men tend to see a person superficially and not think much more of them. Meanwhile, women notice little things that clue them into deeper observations.

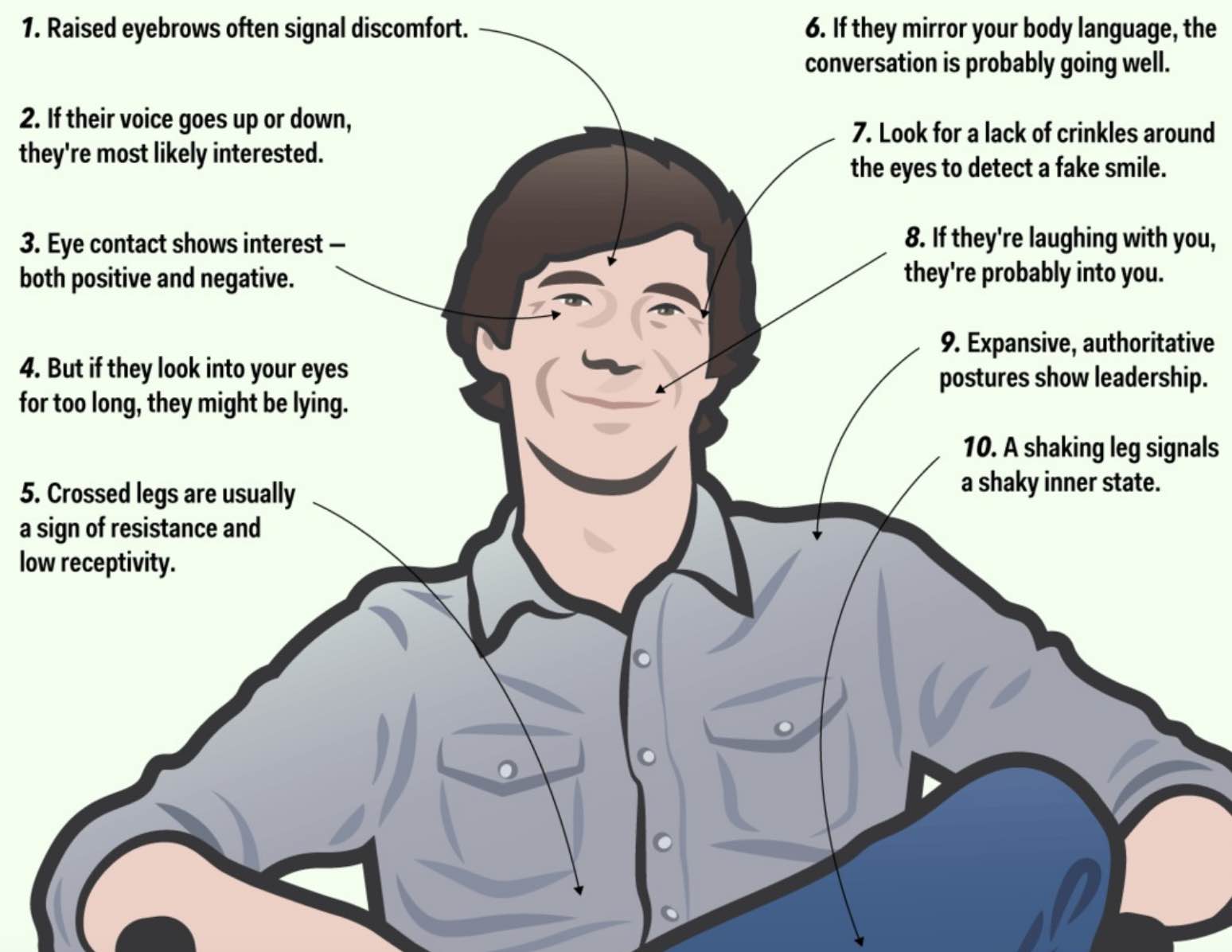

Like how someone touches their own face when they are nervous, or the way someone blinks their eyes, or if someone has stress sweat. By noticing these little things, you can start to form a more detailed picture and make observations that aren’t apparent on the surface.

This exact skill is very pertinent in investing. You’ll find that many successful investors – especially in the startup world – say that they have a ‘gut feeling’ about what is a good or bad investment.

This probably has to do with a lot of different things. One could be that the investor is just very observant and is able to get a deeper understanding of the people they’re investing in. Another could be that the investor has learned from experience by taking small subconscious notes about what does and doesn’t work.

This skill of having a ‘gut feeling’ is impossible to just acquire. You’ve either got to be lucky enough to naturally have it, or you’ve got to learn from experience (i.e. lots of failures).

I’d be willing to say that there is no one on this planet who can be a perfect startup investor. Meaning, there is no one out there that can pick every single company out before they turn into multi-billion dollar unicorns.

Yes, there are great investors out there that have invested in a variety of massively successful companies, but these same investors also have a huge pile of investment failures.

So, how do you find the right startups to invest in?

There’s really two main choices.

1. You go out on your own and just start hustling. You find fascinating people with potentially profitable businesses and then you give them your money to execute on their idea. Through this process you end up losing most of your money, but you learn an incredible amount of lessons. If you have any money left over, then you capitalize on what you’ve learned, and most importantly, you start to develop a strong network of fellow investors who are connected to brilliant entrepreneurs. And once you develop this network you double down. (This is what I have personally done and now try to foster this network through investments done with the Explorer Partnership.)

2. You find someone that you can draft off of. Just like a bicyclist will ride behind another bicyclist, you try to find someone who has experience and can lead the way. The most common way to do this is to invest in a venture capital fund or become a member of an investing syndicate. This way you can not only learn from experience people, but you can put your money to work along side others who have done a lot of the heavy lifting for you. (Again, what we’ve made here.)

It’s important to point out that you should be taking notes and learning lessons in a consistent way. Meaning, if you are always chasing the next hot market while deploying a different strategy each time, you’ll be losing your money left and right.

Even though the idea of investing in startups is sexy – especially in the bubblicious market that we are in – the reality is that the majority of startups fail and take down all of their investors money with them.

Investing in startups that actually return a profit is hard. Really, really hard. You have to combine a variety of skills while at the same time trying to time the broader market to ensure you have the best exit potential.

After you’ve put some time in to find the best startups – which means you’re going to make a lot of mistakes and/or learn from the people who have done it before – maybe you’ll be just like that person who can always find Waldo.