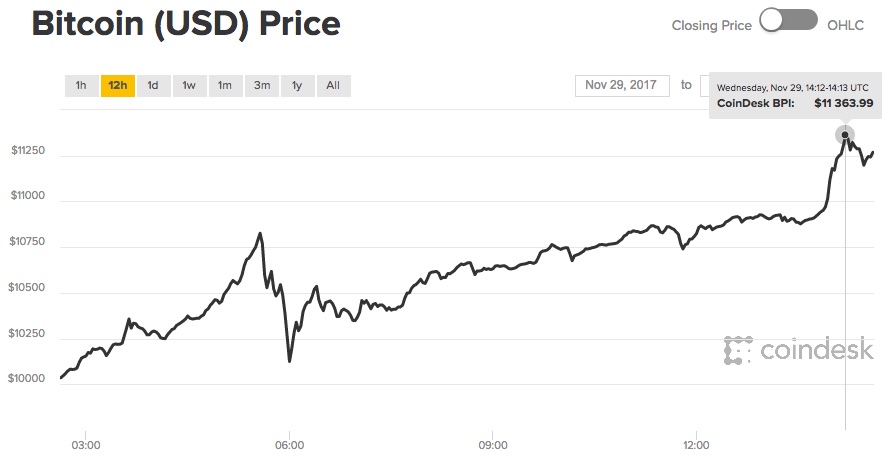

When I sat down to write this, late last night, Bitcoin was just over $10,000. After sleeping for about eight hours, I woke up to see that Bitcoin is now just over $11,000.

That’s a 10% increase in 8 hours. Annualized, that’s a 10,950% return.

Whether you’re a Bitcoin believer, Bitcoin hater, or you don’t even know about Bitcoin… you must at least acknowledge that the digital currency is a big deal.

But, will it stay that way?

No.

At least, that’s what history tells us.

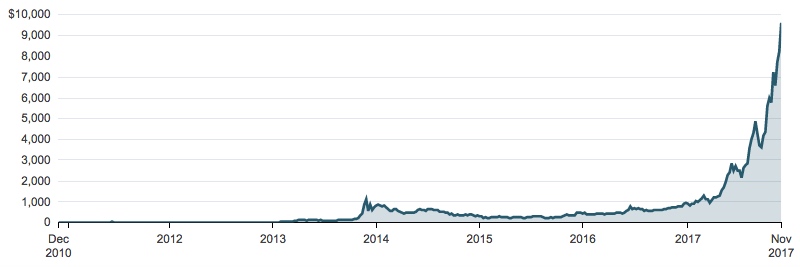

If you were to show the following chart to anyone, they would tell you what’s next…

Meteoric rises – in anything – are typically greeted with an equally violent crash. And this isn’t just in the investing world.

It happens in nature too.

Think about what happens during the spring. Flowers bloom, grass grows, and creatures are born. Then, during the fall, leaves turn brown and the cycle of life comes to an end. The next year, this process repeats.

Now think of a wave in the ocean. Wind blows across the surface of the water, creating ripples. These ripples start to stack up on each other and create a wave of energy that travels across the ocean. Soon, that wave of energy comes close to the shore line. As the ocean floor becomes more shallow, the wave increases in height until it reaches a peak and then crashes down.

It’s all cyclical.

What stage of the cycle is Bitcoin in?

Does Bitcoin even have a cycle?

That’s the big question… both for Bitcoin skeptics and believers.

However, we can try to compare Bitcoin to previous bubbles…

The problem is that people want to compare Bitcoin with other assets. Whether it’s real estate or the stock market… it’s tempting to compare Bitcoin’s value to these traditional investments.

However, is Bitcoin an asset? Or is it just a medium of exchange? Or is it some different kind of store of wealth?

Those are the questions that everyone is asking.

Many Bitcoin believers think that the crypto currency is all of those things. It’s a store of wealth, a medium of exchange, and a currency that can’t be manipulated by outside entities. It’s perfect.

And that’s why the Bitcoin exchange ‘Coinbase’ opened up over 100,000 new accounts over the Thanksgiving weekend, which makes them larger (in terms of clients) than the mega-brokerage Charles Schwab.

That’s incredible.

Now, I am not calling a ‘Bitcoin bubble’ here.

In fact, right now it feels like there is a bubble in calling the ‘Bitcoin bubble!’

But… for argument’s sake, let’s assume that Bitcoin is becoming overheated…

In any bubble there is a start and an end. The ‘end’ doesn’t necessarily mean that it’s over… just that there is a significant correction.

This was evident during the 2000 dot com bubble. The bubble was fueled by the idea that the internet would change the world. Dot com companies were so valuable, investors were willing to pay astronomical prices for ‘future’ returns.

We all know what happened. The dot com bubble popped and many companies disappeared. But, the internet did – and still is – changing the world. It’s just that the rapid appreciation of valuations that these dot com companies had were not sustainable.

This happened again in 2008 with the US housing market.

The housing bubble resulted in the US stock market dropping by over 50%, finally bottoming on March 9th of 2009.

Interestingly, Bitcoin was officially released in January of 2009, just two months before the market bottom.

Has Bitcoin’s rise been a result of the bull market we’re in?

The start of our current bull market and the release of Bitcoin are within two months of each other.

To add fuel to the fire, current Bitcoin ‘investors’ are now taking out loans on their houses in order to buy Bitcoin.

Throughout history, we can see that nearly every financial bubble has popped because of the expansion of credit which ends up not being supported by the underlying asset. (Speculation in 1929, dot com companies in 2000, real estate in 2008, etc.)

And while the actual amount of money that is flowing into Bitcoin is relatively small in the bigger picture, perhaps Bitcoin’s rise is just another symptom of an overheated market.

Or… maybe Bitcoin really is the ‘thing’ that changes our financial system.

Maybe it really is ‘different this time.’