Gold, silver, platinum, copper, nickel, and the rare’s. That’s close to the order that they are, and will be, going parabolic.

The reasons are numerous and obvious for those who are happily sitting on their hands, watching their portfolio’s rise in value by 2% per day.

We all know this won’t last forever. At some point the euphoria will end. Other things will become too cheap, and the rotation will be quick and dramatic.

But we’re not there yet. The mania that longtime metals investors are witnessing is likely to go on for longer than you think. Remember, the normies are just now hearing about gold reaching $4,000 per ounce, even though you’ve already seen your gold value rise by more than 50% YTD.

For silver, it’s been a gain of 60% YTD. And for my favorite, which I have been shouting about for the past several years, platinum is up over 80% YTD.

So, now what?

The Painful Sell

I recently saw a poll online that asked investors about what was the hardest to sell: A stock that is going up or a stock that is going down. Overwhelmingly, the poll showed that over 80% of investors found it harder to sell an investment that was ascending in value.

It’s a strange human nature trait to always want more than you’ll ever have. That probably comes from our caveman instinct to stockpile resources because you never know what will happen tomorrow.

When it comes to investing, striving for ever higher gains usually results in a rollercoaster ride of net worth. Ask me how I know… I’ve ridden the up-down value ride more than I’d care to admit.

Just like many hard lessons in life, it’s been a very valuable experience. I’ve learned that you never lose money selling for a profit. That’s not to say that you shouldn’t let your winners run. Just that you’re far more likely to lose money in life if you don’t leave a little meat on the bone for others.

That’s what I did this week. I started to trim my metals positions despite anticipating a possibly violent run up in the coming months. Which likely applies to nearly ever mineral that you can pull out of the ground.

But there is something else you can pull out of the ground that is surprisingly cheap.

The Painful Buy

Being a good investor – someone who can consistently make money over a long period of time, and call it their full time job – is extremely difficult. That’s why so few people do it… they can’t. It’s intellectually and emotionally exhausting.

The even harder challenge of being a full time investor is the feeling of being alone and laughed at. Almost every great trade or investment looks crazy before it works.

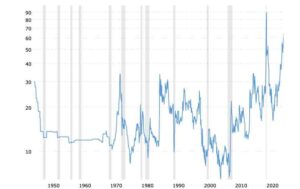

With that said, let me present this chart to you:

Source: MacroTrends

When I see data like this, I salivate. I love extremes and outliers. It’s what makes the world interesting and investing lucrative.

Let me first say that the largest spike in the chart doesn’t count. That was the pandemic spike, where gold mooned and oil went negative. It was an anomaly that is somewhat irrelevant to the longer term trend (but if you had actually sold all of your gold to buy as much oil as possible, you would have done quite well).

What you’re looking at is the gold to oil ratio. Excluding the pandemic spike I just mentioned, this ratio has never been this extreme. Not even close.

It’s possible and even probable that this ratio will get even more extreme, which means even greater opportunity.

Sell your precious metals for oil?!

Maybe not all at once. Just make sure you get off the rollercoaster at some point.