“The stock market always goes up in the long run, so if I am investing for the long term, why does it matter when I buy stocks?”

I’ve heard this rationale several times in the past week. People continue to buy stocks in all markets, even though we are seeing record highs everywhere.

These people justify their investments because they have ‘no other choice,’ and if they wait long enough, their investment will eventually turn positive.

But we all have a choice. And that choice can be that we DO NOT invest when the market is overvalued.

If today’s S&P 500 fell back to the lows of 2002 and 2009 (around the 800 mark), then the index would fall more than 60%.

If you have $100,000 and you lose 60%, you end up with $40,000. If you want to get back to $100,000, then you’d have to make 150% gains on your $40,000.

However, if you were to limit your exposure to the risk (as in don’t buy things that are near or at the top of the market), then you would never have think about 150% gains. Simply protecting your downside risk could be considered a win.

Now, all that said, the above strategy is if you are a passive investor. If you only check your stocks once a month, then follow the above…

But… if you take a more active role in managing your money – which I assume you do because you’re reading thing – then read on…

If we look at the time it takes markets to build value versus lose value, we’ll notice that the time frames do not correlate.

Markets go down much faster than they go up.

Of course I’m not pointing anything out revolutionary… we all know this.

But, why don’t we capitalize on this?

When the market is losing money, an investor can make money – they just need to know how to make the right trade.

The easiest way to do this is to short stocks. In today’s environment we don’t have to look much further than a company’s balance sheet to identify the most indebted companies. When the markets (and economy) turn, these companies are in for some big time trouble, as many will not be able to repay those debts.

Today’s market darlings trading with P/E values over 100 will quickly face reality.

But, I want to show you an even easier (and riskier) trade that could make you big bucks and it has to do with Donald Trump and Hillary Clinton.

Whatever you and I think about either of them doesn’t matter.

What matters is what the world thinks about them… and it’s not good.

Regardless of the election results, there is a chance that there will be immediate market volatility. So, instead of us sinking money into a long term investment, we can go buy short term options.

The best way to do this is to buy call AND put options on the stock SPY, which is an ETF of the S&P 500.

The trick is to buy options that will expire very quickly, as these options are very cheap. However, this is a very risky trade, because there is a good chance that the option will expire worthless.

But considering that this election is one of the most hotly debated and it coincides with historical market highs, this is a bet that is hard to pass up.

Using this great option calculation tool, we can predict how much money we can make on a trade.

You’re going to want to buy as close to the election date as possible (November 7th), and make sure that the option expiration date is after November 8th. When you buy an option contract with such a short window, you can buy the contract for 5 cents or less per share.

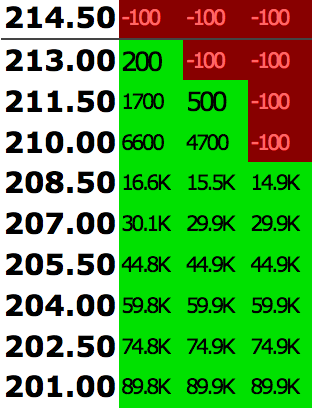

As a quick example, say that SPY is at $214.

If we buy a put option that expires in three days, but allows us the right to sell SPY at $210, then that contract will only cost us 1 cent per share.

If we buy 100 of these contracts, then that will cost $100. (There are 100 shares in each contract).

Here is what the chart would look like:

As we can see, if SPY trades above $208.50, then we lose our entire $100. But, if SPY closes at $208.50 or below, our profits could be enormous.

We can do the opposite strategy with a call option to hedge our put option bet.

This year’s election offers us one of those high-risk-high-reward trades.

Consider this trade as buying a lottery ticket, as you are probably going to lose your money. However, this is a lottery ticket where the odds are much more in your favor.

And if you make some money, you can thank Hillary or Trump.As market volatility increases over the next year, we will have many more similar trades on our radar. Just wait until the high-flying companies start to suffer… that’s when those options can get real interesting. I’ll have MUCH more coming.