Here is a little wake up call for your Monday!

What I’m about to share with you may sound a little bit confusing… but I’ll make it real simple.

First, what is a “nonperforming loan?”

Here is the definition, straight from the IMF:

Translation = A nonperforming loan (NPL) is when a loan is not being paid back. It’s not performing!

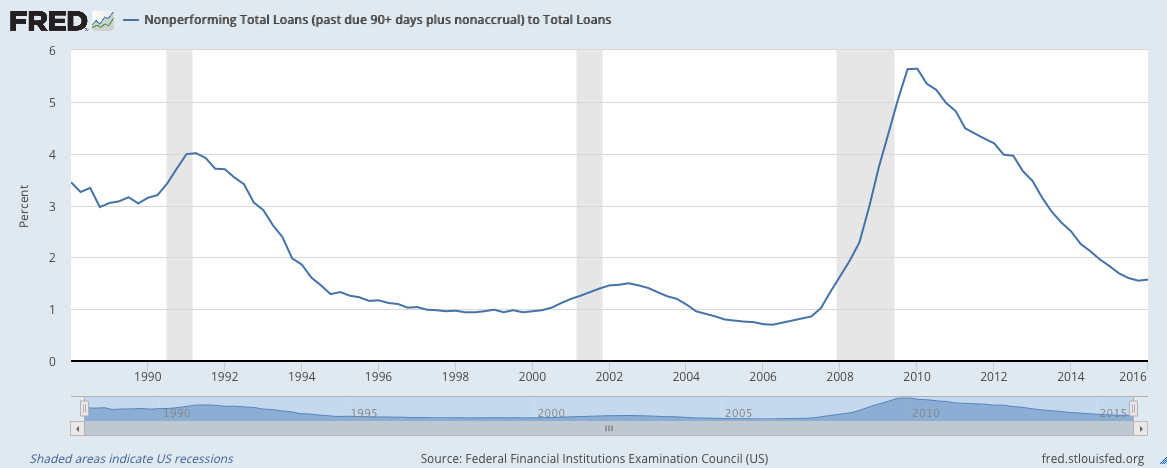

Let’s take a look at the US nonperforming loan rate since 1988: Notice anything? The line is leveling off. Actually it is going up a little bit – meaning more loans are not being paid.

Notice anything? The line is leveling off. Actually it is going up a little bit – meaning more loans are not being paid.

The first quarter of 2016 is the first quarter since 2009 that NPLs have gone up. There has not been one quarter of increasing NPLs.

Maybe it’s just an anomaly… I thought. So I dug a little deeper.

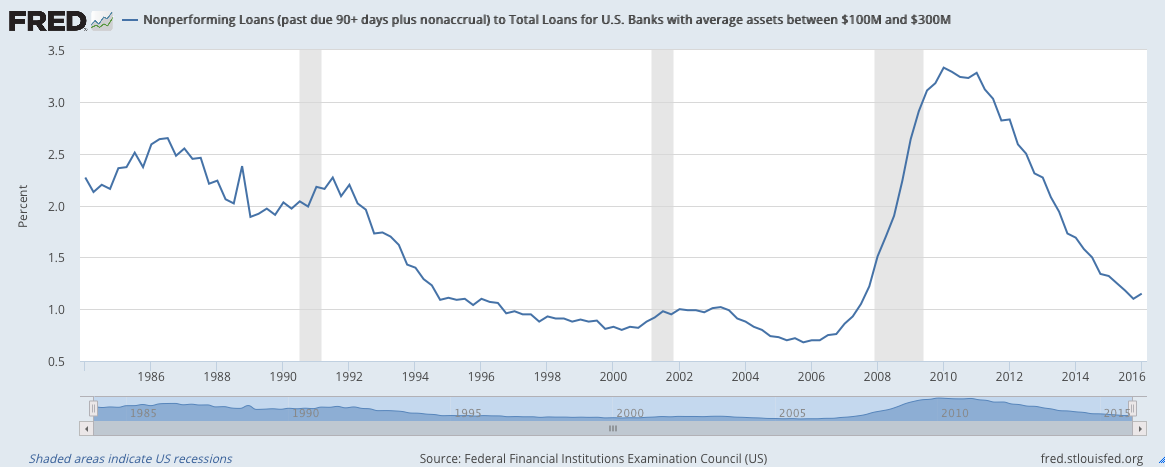

Here is the NPL rate for for U.S. Banks with average assets between $100M and $300M… you know smaller banks: Uh oh… the line is going up a little more.

Uh oh… the line is going up a little more.

Ok, ok, ok… maybe another anomaly. Maybe we’ll see a bit of a turnaround soon. Totally possible.

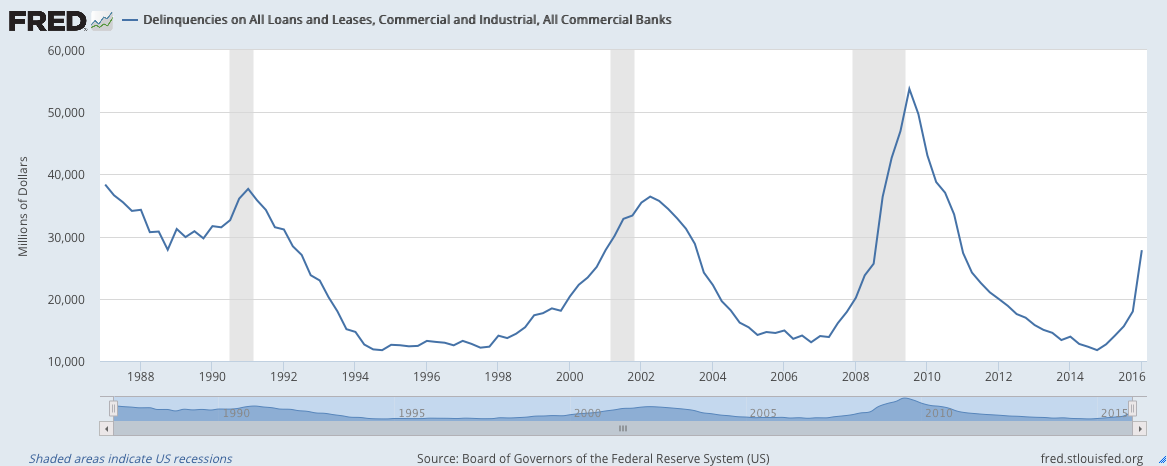

So then, I thought, let’s look at commercial loans:

Oh. That’s not good either…

Oh. That’s not good either…

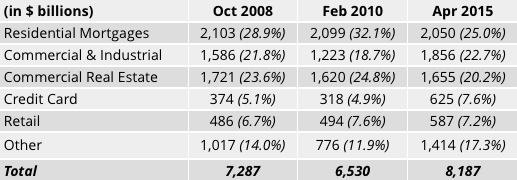

But it’s just commercial loans… they aren’t that big… right?

Here is how they stack up versus other loans: Commercial loans matter. A lot.

Commercial loans matter. A lot.

I’m not beating ‘the economy is going to collapse’ drums here… just wanted to point this out to you. It’s data that a lot of people don’t talk about. In fact… is anyone talking about this???

(There is one more piece of data that I didn’t show you… I’ll talk about it later in the week. It’s probably the biggest reason to be concerned.)

Last week I mentioned about ways to make money in a market when you have no idea what is going to happen.

I’ll send that out tomorrow.

Thanks!