]

The “Little Investor” Mistake That You Can Avoid

Investing is very difficult. The problem is that you don’t realize this until you’ve lost a lot of money!

Usually, when someone starts investing, they open up a brokerage account and start buying stocks. It’s one of the easiest ways to get started in the investment world and at the beginning it looks like an easy way to grow your money.

That’s because we’re bombarded with financial news all day long about certain stocks going up and investors making tons of money.

The assumption is that all you have to do is start buying flavor-of-the-month stocks and wait a little while. Then, one day, you’ll be richer.

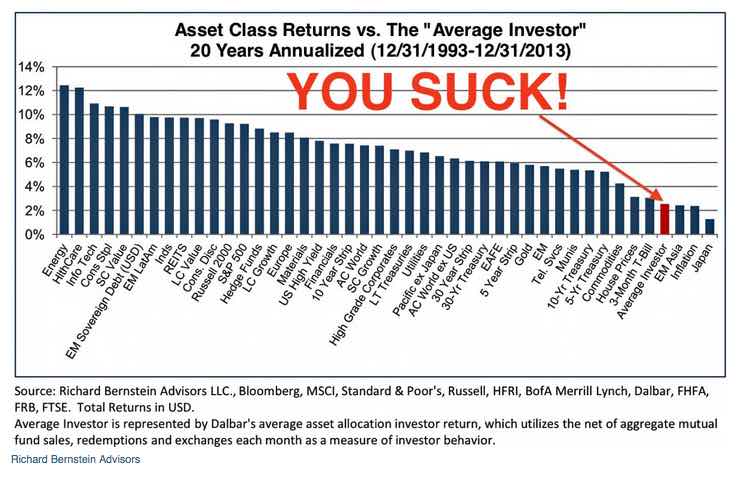

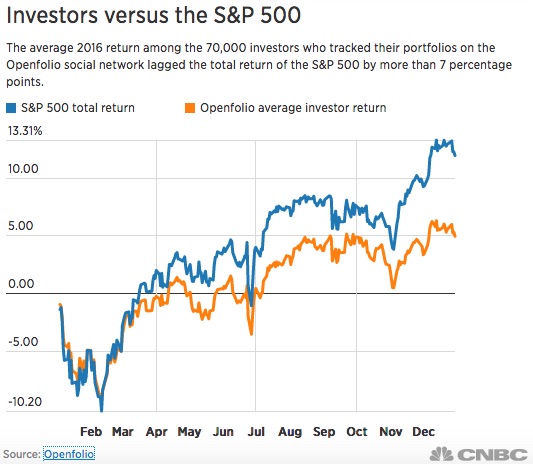

Obviously, this is not the case at all. Most small investors end up losing their money or getting very small returns on their invested capital. That’s because they’re always chasing the news and seem to be one step behind the big gains.

Source: BI

If you stake a step back, it’s actually crazy to think that a normal person sitting in their home is going to beat the stock market. There are investment firms all over the world that spend millions of dollars on research teams, high tech infrastructure, and are privy to information that only insiders are aware of.

How is the ‘little investor’ going to compete with that?

Well, usually they can’t. Little investors end up chasing their tale and don’t get the returns that they think they can.

Another assumption from little investors is that you have to buy stocks.

Source: CNBC

I’m always blown away when someone says that their investments are diversified. They’ll say something like, “I own 40 different companies in my retirement account, so I have spread my risk out among many different investments.”

What about investments outside of the stock market? What about residential real estate, fine wine, precious metals, collectibles, private equity, agriculture, or art? There are MANY other assets you can invest in outside of the stock market.

Being truly diversified means owning more than some shares in Apple and Berkshire Hathaway.

So, if you know that you are at an immediate disadvantage in the stock market… and you know that there are other assets to invest in…

Why not stack the odds in your favor? Why not invest in things where you have an advantage?

The “Little Investor” mistake includes:

- Investing in areas where you don’t have an advantage over others.

- Investing in assets that require a huge minimum in order to have an influence. (You will have no/limited say in a public company unless you are buying a significant ownership in a company. This literally means you need to be investing hundreds of millions, if not billions, like many hedge funds and activist investors do.)

- Spending an absorbent amount of time researching and studying investments that end up not returning yield that correlates to the time spent finding the investment. In other words, you can spend the same amount of time or less pursuing investments that provide bigger returns, which means you are getting a better yield on your time spent.

Ironically, even investors who are experienced or have significant funds to invest, still use strategies that don’t allow them the most advantages.

If you fall into that category (experienced investor and/or want to invest $10k+ per year) then, you should consider joining the Explorer Partnership. We look for investment opportunities that are not widely available to the public and where the advantage is on our side.

If you don’t fall into that category – or you’re trying to get there – then consider starting out with a smaller scale investment. Believe it or not, art is perfect… let me show you what I mean…

Investing In Art

Do you think of the pipe-puffing monopoly man when it comes to investing in art?

Well, for the most part, you wouldn’t be far off. The reality is that famous artwork can sell for millions of dollars. Just the insurance alone for some pieces can cost hundreds of thousands of dollars a year.

But… there is another way to invest in art. A way that doesn’t involve millions of dollars.

And the reason why I know this works is because I did it a lot while I was in college. In fact, I still do it today.

Also, this works anywhere in the world. It doesn’t really matter where you are.

First, familiarize yourself with Craigslist (or whatever equivalent is in your country). Most people assimilate Craigslist with scam artists and antique hoarders… but I’ve found some of my best investments, from an appreciation standpoint, on that site.

Second, go to the “for sale” section and type in “signed original,” “original painting,” “original signed artwork,” or any combination of those types of words. Really, what you are looking for is one-off pieces of art that are being sold by private parties.

Third, filter through all of the crap. Even though there are LOTS of original art pieces on Craigslist, most of it is worth very little and will be worth even less in the future. You want to look for art that is:

- Made by a household name. Think Monet, Picasso, Dali, etc. DO NOT buy a piece of artwork by an unknown artist that you *think* will appreciate in value. The chances of you finding an artist before they become wildly famous is slim to none. Buy only established names. Also, realize that the most valuable art usually comes from someone who is dead. It’s true.

- Made by a household name. I repeat this because it is so important! If you have never heard of the artist, then that means the pool of future buyers becomes much smaller.

- Is verifiably original. This is sometimes almost impossible to determine, but try to look for pieces that at least have some sort of certificate of authenticity or have a reasonable paper trail that would indicate that multiple sources believe the piece to be original.

- Is well below half the price of the appraised value. For example, if the appraised value of a painting is $20,000, I would NOT spend any more than $5,000.

- Transportable. DO NOT buy anything that is too heavy to lift, too big to fit in your car, or too delicate to transport. If you have problems moving it, then you will have huge problems selling it.

Fourth, go start negotiating. This is great practice in general, but you will not believe what you can buy some pieces of artwork for. Many sellers either have no idea what they own, or they just don’t care – they just want it gone. Before you negotiate with anyone, do some research on the art you are trying to buy. If you don’t think you can get a 10x return, then don’t buy it.

Fifth, immediately repost your purchase… but make a much better ad. And use eBay instead of Craigslist. The great thing about Craigslist, for a buyer, is that the seller isn’t really making their art available to the world… only people searching in their area will find the listing. Conversely, eBay attracts buyers from everywhere, so when you resell the art, you’ll have a much larger audience.

Think this doesn’t work? Let me show you something that is available right now…

Here is a Craigslist posting in Los Angeles for an original Peter Max watercoloring for $450. If you did a bit of negotiating, I bet you could get the piece for even cheaper.

Here is another original Peter Max piece. It’s a similar size, medium, and even vintage. This one is for sale for $3,295.

Now, I’m not going to say that this is an exact comparison… but it’s pretty close and I’m sure you get the point.

Another thing you might be wondering is, “How the heck do you find an original Picasso/Monet/Dali/etc.” Well, you can look for signed lithographs. The artwork itself isn’t original, but most lithographs have limited numbers of prints and the actual signatures are in fact real. You can find these on Craigslist all the time… and if you find the right seller (desperate) and you are a good negotiator, you can get them for less than $100.

Here are just some of the ads I found after searching for about 15 minutes that I thought were interesting…

Wyland original oil painting for $11,000.

Salvador Dali signed lithograph for $1,250.

Salvador Dali signed lithograph for $375.

Marc Chagall signed lithograph for $2,000.

Jimi Hendrix signed record for $8,500.

Remember, these are all from private parties and the price listed is NOT what you should pay. Negotiate!

Bloomberg just did an article where they compared the values of several different famous paintings versus the DOW. In general, the paintings performed just as well, if not better, than the actual stock market.

Obviously this will all take a bit of work. And this is not a fool proof way to multiply your money.

But… if you’re looking for a way to diversify your wealth, then owning art is a great option.

…And if you’re looking for a way to start out in the investing world, art is something you should consider to ease your way in. There is very little startup cost, you have direct control of your potential returns, and you can select art that you actually like (which means you are the expert and have the advantage over others!).

One last thing: Remember what happens when the economy takes a dive. People start selling stuff for fire sale prices, and art is often the first thing people feel comfortable parting with. Do yourself a favor now and put aside a couple hundred bucks for the next financial decline. Then, when the time is right, pick up a nice piece of art for pennies on the dollar. You’ll thank me later.