Debating the best investment market in the world is a losing battle.

The answer is simple: The United States is the best place to invest in the world, by a long shot.

I could share dozens of charts with you, so you can see how the U.S. has absolutely obliterated the returns of every other country out there over the past century. But I don’t need to. It’s widely accepted that the U.S. is the best place to put your capital to work.

I could also share endless stories of my personal international investing expeditions over the past two decades (well, I actually do through my website). Many of these stories end in disaster, or frustrating outcomes.

However, that doesn’t mean there aren’t unique opportunities in other parts of the world. In fact, for certain time periods, foreign markets can offer extremely lucrative situations.

These situations can lead to enormous returns that most investors are unaware of. (And that’s why I continue to explore international investing opportunities, with all of the past battle scars worn as lessons learned!)

United States vs. The World

Most international investments are difficult to investigate. In the U.S. there is a plethora of data that any investor can dive into about nearly any investment you can imagine.

Conversely, when it comes to international markets, information can be extremely opaque and sometimes impossible to access… That is, unless you physically investigate the opportunity yourself.

That’s what I’ve been doing for the past 20 years. I’ve completed dozens of real estate, private equity, and business transactions in Asia, Europe, Latin America, Australia, and even Africa.

I have had a lot of success and also a fair amount of failures. The lessons learned are numerous, but can be summarized in two statements:

- For many investors who want to have great returns over the long run, the U.S. is the only market you should invest in.

- For experienced investors who understand market cycles and want outsized returns, international investing must be part of your strategy.

So, if you’re an investor who already has a main source of income (through traditional employment) and doesn’t want to worry about different investing strategies, what I’m about to share is probably not for you.

However, if you are someone who has some investing experience and you’d like to have larger returns to supplement, or ultimately replace how you make a living, then this is exactly what you should be paying attention to.

Extreme Value Distortion

Right now, in early 2025, global markets are in a situation that has never been seen before. What I mean is that the United States is currently valued vastly higher than nearly any other global competitor.

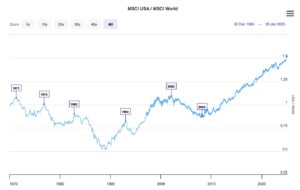

The chart above compares the performance of the MSCI USA index to the MSCI World index. It provides a valuable perspective on the relative strength or weakness of the US stock market in comparison to the global stock market as a whole. Source: LT

Now, as I said before, this is mostly for good reason. The United States is the best place to do business and put your capital to work.

But things have gone too far… Valuations are getting out of control which is presenting some unbelievably unique situations in international markets.

As demonstrated in the above chart, the United States’ markets are currently stronger than the rest of the world. And not just by a little.

But it’s not just the comparison of the U.S. to global stock markets. It’s the actual valuation of U.S. companies themselves.

Using Warren Buffett’s favorite valuation metric, aptly called the “Buffett Indicator,” we’re now at levels that forecast a future negative return.

For clarity, the above chart highlights the value of the U.S. market (blue line) compared to the GDP (green line). Typically, value should track closely to productivity.

The current market value compared to the GDP is at a ratio of over 200%, which projects a negative future return. This is based on decades of market data and trends.

Simultaneous to U.S. markets being significantly overvalued, many other markets around the world are reaching historical low valuations.

Seven Least Expensive Global Markets

In this report, I discuss seven of these undervalued markets.

I’ve specifically picked markets that are accessible to U.S. investors. That means that the valuations for the countries listed below are based on companies within those markets that are freely trading on U.S. exchanges.

There are many other inexpensive countries around the world, but are more difficult to access via their domestic public stock exchanges.

Having invested in many international markets over the past two decades, I have learned how important liquidity is. That is why I have not included many countries and/or companies that may be equally compelling from a valuation standpoint.

With no clear path to liquidity, international investors often get stuck in value traps. Years ago, I coined the term for this situation as a “barbed investment.”

All specific companies, within the countries below, are traded on the New York Stock Exchange (NYSE). I’ve selected companies with the largest market capitalization (which usually also provides the most liquidity) for each of the inexpensive markets below.

Please note that valuations were based on price to earnings ratios (P/E). This ratio is by no means the only way to value a company, as there are many other factors and future events to take into consideration.

However, as you’ll see below, the valuations of many companies around the world are in such stark contrast to companies within the U.S. that it’s hard to ignore.

Will the below markets (and individual companies) see enormous growth within the next several years?

Only time will tell. But as of right now, here are the 7 least expensive markets in the world….

1. Greece

The Greek economy is experiencing a phase of recovery and growth, with forecasts suggesting a GDP increase of around 2.2% for the year. This growth is supported by strong domestic demand, a surge in tourism, and significant investments. Unemployment, though still above the EU average, has fallen below 10%.

The economy has been benefiting from regained investment grade status, which has lowered borrowing costs and attracted foreign investment. This is especially true in the banking sector where significant privatizations have been completed.

President Katerina Sakellaropoulou has mostly ceremonial duties but serves as a unifying figure for the nation. The real direction of economic policy is steered by Prime Minister Kyriakos Mitsotakis, who has been instrumental in pushing forward economic reforms, focusing on digitization, reducing bureaucracy, and enhancing competitiveness.

Looking forward, the direction of the Greek economy appears mostly positive. Continued political stability under Mitsotakis’s leadership should foster further economic growth. However, there are some big challenges ahead. This includes the need for sustainable growth beyond tourism, managing an aging population, and navigating geopolitical tensions or a broader European economic slowdown.

Danaos Corporation – $DAC

Exchange: NYSE

Industry: Marine Shipping

Market cap: $1.5bn

P/E: 2.7

Insider ownership: ~50%

2. Colombia

Colombia’s economy is navigating through a period of cautious recovery. After a GDP growth of just 0.6% in 2023, the economy is expected to grow by 1.5% in 2024, with projections slightly improving in 2025 to around 2.8%.

President Gustavo Petro, who took office in August 2022, has pursued an aggressive agenda focusing on social equity, poverty reduction, and environmental sustainability. This included proposed reforms in health, labor, and public pensions.

However, these reforms have met with significant opposition in Congress, leading to delays. This political gridlock has introduced uncertainty, affecting private sector investment, which saw a 25% decrease in 2023.

Petro’s economic policies aim to reduce poverty and inequality, with claims of having lifted 1.6 million people out of poverty and 1.3 million out of extreme poverty in his first year.

Conversely, his approach towards the oil industry has raised concerns about economic stability and energy supply. He suspended new oil and gas contracts which is hurting the Colombian economy, considering that oil is a major export.

The direction Colombia’s economy is headed under President Petro is mixed. Political hurdles and a perceived unfriendly business environment could slow growth. The economy’s future will depend significantly on how Petro manages to balance his reform agenda with economic stability.

Recent events, such as the encounter with Trump, point to Petro losing his upcoming election. If this happens, and a new more business friendly President is elected, Colombia could see a drastic turn around.

Ecopetrol SA ADR – $EC

Exchange: NYSE

Industry: Oil & Gas

Market cap: $29.6bn

P/E: 4.8

Yield: 33% (this extremely high yield can be a value trap, so be careful)

3. South Korea

South Korea is going through a period of fluctuating growth with several challenges. The GDP growth in 2023 was a modest 1.4%, but projections indicated a slight uptick to 2.2% for 2024. This growth is driven by a recovery in exports, particularly in the semiconductor industry. Inflation has been moderating, around 2.5%.

The direction the South Korean economy is headed is uncertain, as the country does not have an active president. President Yoon Suk Yeol was impeached and arrested over his declaration of martial law on December 3, 2024, and is currently in custody. Acting President Choi Sang-mok has taken over presidential duties in the interim.

Long-term, South Korea faces structural challenges, including an aging population and low birth rates. For the short-term, the political landscape within the country needs to normalize to bring some sort of certainty and direction for investors.

KB Financial Group Inc ADR – $KB

Exchange: NYSE

Industry: Financial

Market cap: $23.5bn

P/E: 7.8

4. Brazil

Brazil shows some surprising signs of growth. Real GDP expanded by 2.9% in 2023, and growth expectations for 2024 hover around 2.8%.

President Luiz Inácio Lula da Silva, who returned to office in 2023, has significantly influenced the economic direction with a focus on social welfare. His administration has passed reforms like tax simplification, which could enhance business efficiency.

However, Lula’s approach has also introduced concerns for many investors – myself included. The government’s primary deficit widened to 8.1% of GDP in 2023, and public debt has climbed to 74% of GDP. Lula’s policies lean towards state intervention and social spending, which have led to market concerns over budget deficits and inflation management.

In terms of direction, Brazil’s economy is at a crossroads. On one path, Lula’s leadership will almost certainly lead the country towards more economic uncertainty, with too much focus on socialist policies. On the other hand, if new leadership becomes apparent for the upcoming presidential election, Brazil’s economy could come roaring back.

You can watch a video I made about Brazil here.

Petroleo Brasileiro S.A. Petrobras ADR – $PBR

Exchange: NYSE

Industry: Oil & Gas

Market cap: $88bn

P/E: 5.6

Yield: 20% (this extremely high yield can be a value trap, so be careful)

5. Spain

Spain’s economy has had surprising growth, with GDP expansion projected at 3.0% for 2024. For the next two years growth is expected to slow to 2.3% in 2025 and 2.1% in 2026. This growth is driven by a combination of strong domestic consumption, a recovering tourism sector, and strategic investments. Unemployment has dropped to a 15-year low, and inflation is cooling.

Spain’s President, Pedro Sánchez, has played an important role in steering the country’s economic direction. His administration has been proactive in leveraging EU funds to stimulate economic recovery, focusing on digitalization and social reforms. Sánchez’s policies have been aimed at improving competitiveness, fostering job creation, and addressing long-standing structural challenges like housing and education.

Overall, Spain’s economy appears to be on an upward trajectory. The challenge will be to maintain this growth while addressing fiscal, demographic, and regional issues to secure long-term prosperity.

Banco Santander S.A. ADR – $SAN

Exchange: NYSE

Industry: Financial

Market cap: $78bn

P/E: 6.6

6. Chile

Chile’s economy had a slight contraction in 2023 with a GDP growth of -0.5%, while the economy is projected to grow by 2.3% in 2024. This is driven by a rebound in mining output (especially copper), lower inflation, and a gradual reduction in interest rates.

President Gabriel Boric has been at the helm of a left-leaning government. His administration has pushed for significant changes in tax policy, pension systems, and the mining sector, with an emphasis on increasing state involvement (especially in lithium extraction).

However, these reforms have been met with resistance from opposition and some business sectors, leading to political gridlock. This has slowed down investment, especially in mining.

The direction the Chilean economy is headed under Boric’s presidency is uncertain. The fiscal deficit remains a concern, alongside a rising public debt ratio. How Boric navigates the balance between his reform agenda and maintaining investor confidence will be crucial. If his administration can secure bipartisan support for key reforms, this could stabilize the economy and promote growth.

Banco de Chile ADR – $BCH

Exchange: NYSE

Industry: Financial

Market cap: $12.6

P/E: 9

7. Peru

After a contraction of -0.6% in 2023 due to social unrest and political instability, the Peruvian economy is expected to grow by 3.1% in 2024. This recovery is supported by a strong performance in the mining sector, especially copper and lithium.

Inflation has been brought under control, aligning within the central bank’s target range. The fiscal deficit, while above the target in 2023, is expected to narrow to around 2.3% of GDP in 2024.

President Dina Boluarte has been in a turbulent political environment since taking office in 2022. Her presidency has been marked by low approval ratings, frequent cabinet reshuffles, and ongoing political scandals. The political instability, coupled with social protests, has dented business confidence and investment, especially in the mining sector.

The direction Peru’s economy is headed is uncertain due to the persistent political instability. However, economic fundamentals like resource wealth, a relatively stable currency, and access to international markets position Peru for growth. The government’s efforts to attract foreign investment through infrastructure projects and agreements like the MOU with the U.S. for mineral access are positive steps.

You can watch a video about Peru’s relationship with China here.

Credicorp Ltd – $BAP

Exchange: NYSE

Industry: Financial

Market cap: $14.7bn

P/E: 11

Taking Action

While it may be tempting to immediately invest in countries and/or companies that are valued at historically low valuations, it’s important to realize that changes take time. Just as the United States has been growing tremendously for many years, other countries and companies may have contractions and slow growth for years.

That said, historic investment strategies that stick to following undervalued opportunities typically pay off in the long term. By rotating out of expensive equities into lower valued stocks, investors can set themselves up for continued future growth.

The important part to remember is that you have time to pursue any of the ideas shared above. It’s highly likely that many of these undervalued countries will rebound in the future. But that will not happen overnight.

Having the patience to monitor these markets and then slowly allocate capital to situations that are improving over time is likely the best strategy.

Personally, I am watching for political changes in most of the countries I’ve listed above as the catalyst for change. Many inexpensive markets right now are being held back by political agendas that are strangling economic growth.

Which international markets are most interesting to you?