Italy’s Vote Will Start a Banking Crisis & Trump Saves America. Or Not.

I spent several hours yesterday talking with friends in Italy. As most of you are aware, the country has a major vote this Sunday, December 4th.

Essentially, Italians will be voting on constitutional reform. If “no” prevails, Prime Minister Matteo Renzi has said he will resign.

This will mark the 64th change in government since 1945. Now that’s some change!

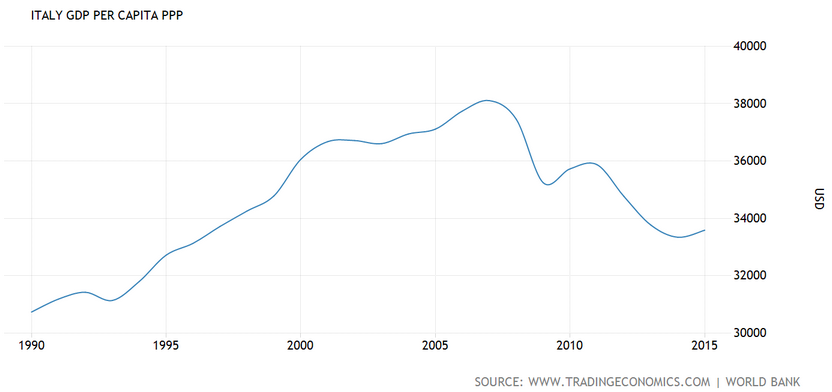

But… not much has changed. In fact, current Italian GDP per capita is at pre-2000 levels.

Clearly, people are not happy about this.

It’s a world-wide trend. The discontent. It’s the same story with Brexit, the US presidential election, and the numerous other EU referendums coming in the future.

Depending on the outcome of the Italian election on Sunday, there could be major repercussions.

Many political and economic analysts have predicted an all-out banking crisis if the “no” side of the vote wins. The idea is that already endangered Italian banks would be pushed over the edge until they collapse.

This collapse would send shock waves through the international banking system and also wreck havoc on the EU and the euro.

I spent most of last night and this morning on the phone with a couple different traders who, with me, were trying to figure out a way to profit from this whole event.

Unfortunately, I could not find a ‘simple play’ that would provide low risk with high reward. But, sometimes just avoiding risk all together is reward.

I understand that many of you reading this don’t care much about Europe (you should). And I also understand that many of you in Europe don’t care much about the US (you should). Finally, there are those of you in Latin America, Australia, Asia, the Middle East, and even Africa that are looking at all of this with glazed eyes.

The reason why people from all parts of the world should understand what is happening is not to fluff everyone’s feathers.

Rather, it’s to make sure that you understand that a simple event on the other side of the globe can effect your wealth and your lifestyle.

A banking crisis in Europe can have immediate and direct results to many banks throughout the world.

But, I’d like to address an equally important topic.

It’s the US dollar and the current state of the US economy.

This November has been the best trading month in five years, which surprised almost everyone.

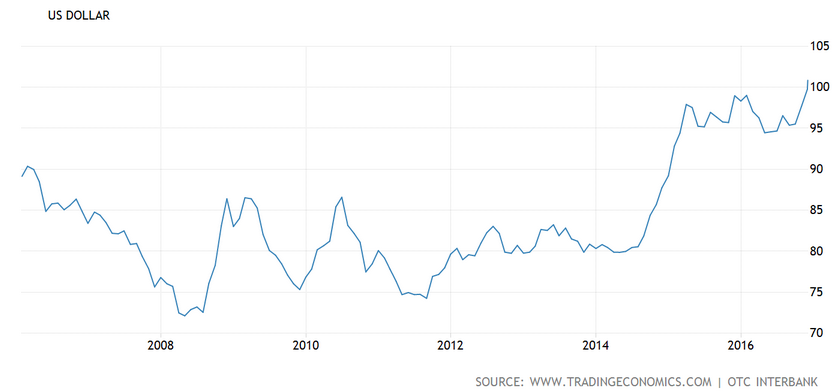

The US dollar has also been on a tear, marching right past 14-year highs.

But this market ‘exuberance’ makes me cautious.

“Bond God” Jeff Gundlach predicted, “The dollar is going to go down, yields have peaked and will move sideways, stocks have peaked as well and gold is going to go up in the short term.”

I agree. As the dollar strength will eventually succumb to the cyclical nature of the market – sooner, rather than later.

Gundlach continued that, ”People want something real… No more on this ‘man behind the curtain’ stuff [in reference to the Fed and other financial authorities manipulating policy]. Industrials, materials … people are tired of tweets. They want cement.”

Bank of America also issued this statement, “[T]he post-election bounce in Wall Street sentiment could be the first step toward the market euphoria that we typically see at the end of bull markets and that has been glaringly absent so far in the cycle.”

Bill Gross, the other ‘Bond God’ said, “An investor should move to cash and cash alternatives, such as high probability equity arbitrage situations.”

Here is a quick rundown of great places to invest:

- Do nothing. Just wait a bit until we have a better vision.

- Buy gold and/or silver.

- Buy food commodities. Grains look attractive. $JJG is a great ETF.

- Prepare to buy gold/silver miners.

- Keep an eye out on the Euro, as Sunday’s vote can be a turning point.