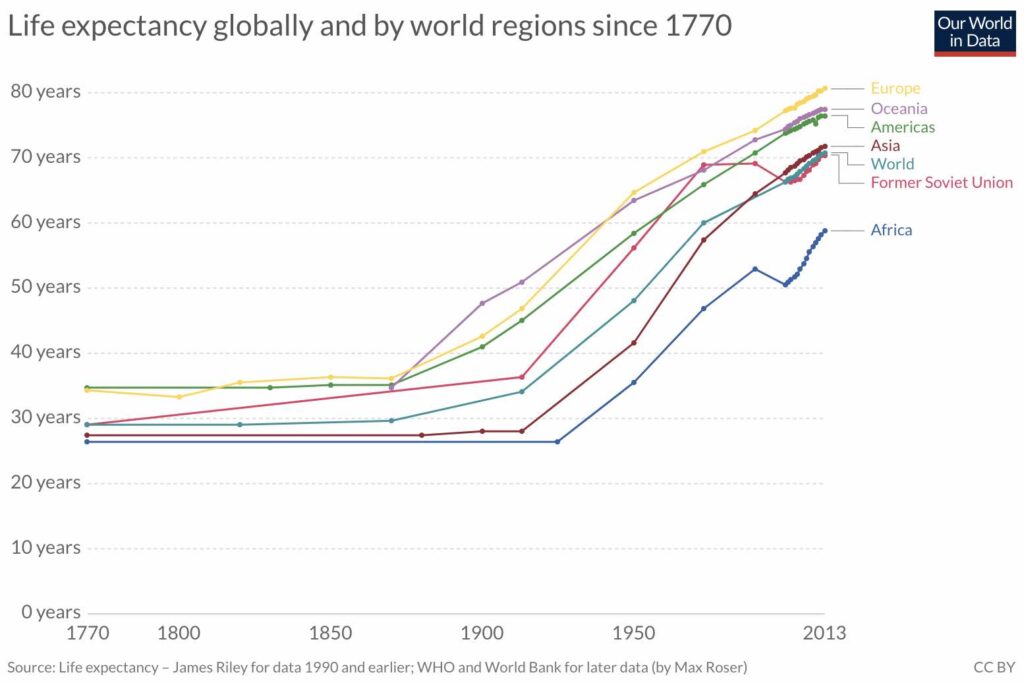

From the late 1700s to the late 1800s, the global average life expectancy was less than 35 years old. With child birth complications, disease, and war, someone who lived into their 50s was considered very old at the time.

Today, in 2019, the global average age is over 70 years. That’s twice as long as the average person lived just a century ago. We have literally doubled our lifespan in the past 100 years and the future points to people living even longer.

Even though we have been able to extend our average lifespan over the past century, the reasons behind our longer lives have to do mostly with superficial changes in our society.

What we eat, how we clean, what we physically do, and how our society has evolved have all resulted into humans living longer. We’re much more aware of what is good for our bodies and what is bad. (We finally figured out that lobotomies and bloodletting don’t work!)

However, these shifts in habits over the past century are only changes in our actual physical routines. We haven’t done anything to specifically change our biological health, but instead have only prevented harmful outside sources from negatively impacting our bodies.

We’ve taken a very defensive approach to our lifespans. It’s time to look at offensive measures.

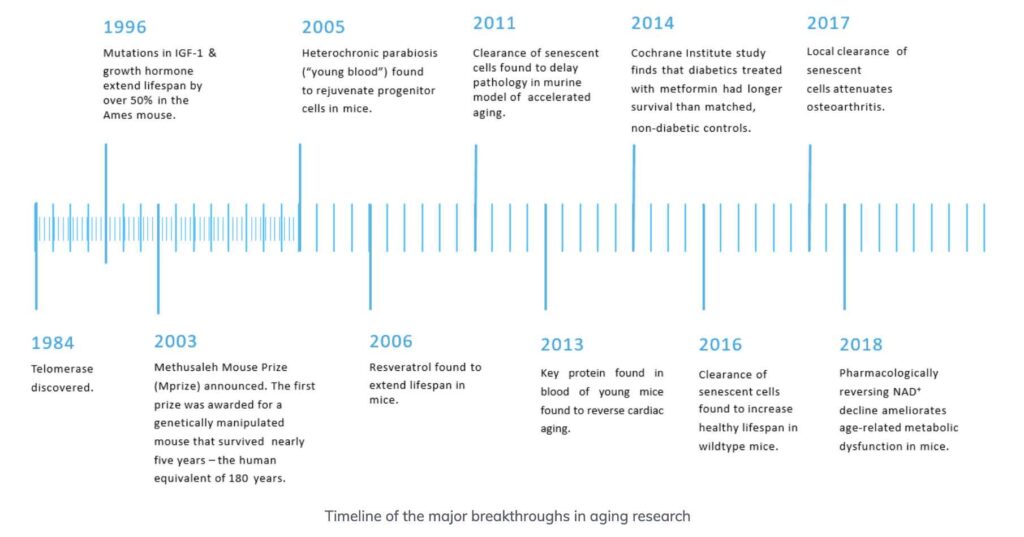

That’s exactly what companies like Calico, Unity Biotechnology, and our newest investment, Juvenescence, are doing. They are developing therapies to treat age-related diseases and increase human longevity.

Juvenescence founder Jim Mellon believes it’s one of the biggest investment opportunities of all time. “There is probably no finer investment for those who believe in the prospect of ultra-long lives than investing in the therapies that will make it happen,” he says.

Mellon continues, “Let’s put the opportunity this way: how many people, given the opportunity of living 20-30 years of extra life in a healthy state, would not take it—and more importantly from an investment point of view, wouldn’t pay 5 or even 10 percent of their incomes to make it happen? The scale of the opportunity is immense.”

How immense? Well, by 2024 – just five years away – the anti-aging market is estimated to be worth over a quarter trillion dollars ($271 billion, to be exact).

To be fair, the current anti-aging market focuses on products and services like Botox and hair restoration. However, the main point is still relevant: People will pay lots of money to appear, feel, and actually become biologically younger.

There are a variety of public and private companies currently developing technologies that address age-related diseases. However, unless these companies are well diversified, investing is difficult because you have to pick the right winner. (Juvenescence, which is still a private company, holds a variety of pipeline companies each with several unique projects.)

An easy way to get exposure to this space is by simply buying a longevity oriented ETF. Currently, there are at least two ETFs which target this industry:

- The Long Term Care ETF, with the appropriate ticket $OLD.

- Global X Longevity Thematic ETF, with the less obvious ticket $LNGR.

Unfortunately, both of these ETFs are currently trading close to their all time highs. Also, they each have relatively high expense ratios, low net assets, and low volume. But, if you’re looking to get easy exposure to this trend, these ETFs could be the right choice.

This trend is still very early, as the general population isn’t even aware that technologies are currently being developed that will help us live longer. In fact, most people can’t even wrap their heads around the idea of extending their lifespan (or even reversing aging).

But, the reality is that this is happening. Billions of dollars are currently going into this industry, which will result in the creation of many new groundbreaking discoveries that will alter the way we all live our lives. Now is the time to pay attention and get involved.