Who doesn’t like an investing fortune telling session?

I mean, that’s what the entire investing newsletter industry is built upon, right? People want to know the future, and that’s especially true when it comes to the ability to make more money.

But I’m going to let you in on a little secret…

Most investing newsletters are written by people that have little to no skin in the game. In fact, most major financial newsletter writers are forbidden from investing in what they write about and what they recommend.

Supposedly, it’s a conflict of interest (so they don’t pump their own stock recommendations).

Skin in the Game Investment Predictions

I look at investment analysis from the other way around: I want to hear about investments and different perspectives from people who actually have skin in the game.

It’s something that I’ve tried to stick to over the past decade. Only focus on investment themes that I am personally pursuing. This strategy makes me much more cautious about what I discuss, as I’m on the hook for anything I get wrong.

Plus, I don’t want to waste any of my own personal time researching topics that I don’t intend on exploiting.

This process has taught me a lot of lessons. Probable the most important being: It’s much easier to get a long term macro investment correct rather than a short term situational trade.

On top of that, investing with short time horizons will make you nuts. You’ll end up stressing yourself to the maximum and become addicted to monitoring your positions.

Gamblers Anonymous has seen a huge increase of investors joining due to new investment platforms providing 24/7 market access. Source: WSJ

Just like most things in life, but especially when it comes to investing, one must learn this the hard way. That’s why, despite there being an unlimited amount of investing education from the world’s best investors, most people still fail to beat the market.

The best investors typically have the most experiences – good and bad.

2025 Macro Investments

Part of investing in macro trends successfully is accurately capturing the actual trend. There’s nothing worse than seeing an entire sector go up in value while your specific investment tanks.

Here’s an example: I recommended buying the uranium ETF ($URA) several years ago. Over the course of 5 years, we made about 40% annualized returns. In general, we captured the uranium trend relatively well with the ETF.

Conversely, I know many investors who were chasing individual uranium mining stocks. Some small companies ended up producing enormous gains – much larger than our $URA investment. However, many other uranium miners went completely bust, leaving investors holding an empty bag.

So, if you’re investing in a large theme make sure you’re not too focused on a specific company within that theme.

At the end of each section below, I provide one broader strategy to catch the general theme topic. Let’s jump into the 2025 macro investment predictions…

Bitcoin Continues to Surprise

I’ve been writing about Bitcoin for over a decade. I’m not going to try to convince you to buy for enormous upside – I think that ship has sailed quite a while ago.

However, I do think that Bitcoin will continue to outperform many traditional assets over the long run.

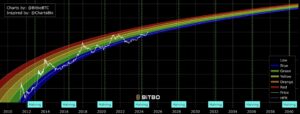

Rather than make the traditional argument about why you should own Bitcoin, I want to share two charts to give some perspective on possible future outcomes.

First is the Bitcoin Rainbow Chart (this one is calibrated to account for the halving price regression). This chart is pretty self explanatory and is a great way to visualize “you are here” in the Bitcoin timeline. You can read all the details about this chart here.

Source: Bitbo

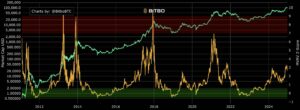

The next chart shows the MVRV Z-score. This one is a bit technical, as it takes into account the market value (MV) to relative value (RV) and how many standard deviations the current MVRV is from its historical mean.

More importantly, this gives perspective on where we are in the historical Bitcoin cycle.

Source: Bitbo

Of course, neither of these charts should be your only tool for deciding whether to invest in Bitcoin, or not. Instead, these are helpful to understand the track record of Bitcoin as it transitions into its 15th year of existence.

Over the past several years, I have made a variety of presentations to big and small groups of private investors. I always end these presentations with a slide that says, “Money printer go brrrrr, buy Bitcoin.”

The actual last slide in my presentations.

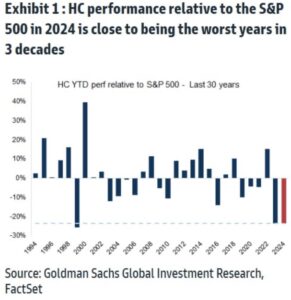

Healthcare Bottoms

Making a list of explanations as to why healthcare has under performed over the past two years would take quite some time. A large portion of that list would fall into the “healthcare in the United States is broken” category.

Regardless of how we got here, the demographic timeline still marches on.

By 2030, ALL baby boomers will be over the age of 65. This is the largest age group in human history to reach this milestone (by a long shot), and still outnumbers every single other age group in the world, other than the millennials (boomer’s children).

It doesn’t take a rocket engineer to forecast enormous future healthcare demand. Really, it’s already happening.

With an annual management fee of 0.09%, The Health Care Select Sector SPDR Fund ($XLV) is probably the easiest way to get exposure here.

Incredibly, this ETF has only returned 1.6% over the past three YEARS! I expect this flat return trend to change in the future.

There’s no immediate rush to get into this investment trend, but you should definitely keep an eye on this sector.

With a US government that is likely to completely overhaul the healthcare industry, combined with massive non-discretionary spending from an aging population, this is an industry that will certainly bounce back.

The U.S. Dollar Weakens

I like to call the U.S. dollar the ‘healthiest horse in the glue factory.’ Despite the enormous debt load and financial mismanagement that is still underway, I project that the dollar will still reign king of the currencies for a long time to come.

I’ve explained this at length in the past. The reality is that the world still views the dollar as the best way to store wealth, compared to other currencies. And there just isn’t any other realistic competitor.

But the U.S. doesn’t want a dollar that is too strong. And that’s exactly what is happening right now, as currencies around the world are the weakest they’ve ever been. Whether it’s Brazil, Australia, Canada, or even India, most country’s currencies are struggling to hold power against the USD.

That’s a great feeling for those holding U.S. dollars, but this trend will reverse at some point. The simplest reason is that the U.S. needs a weaker currency in order to be a competitive trading partner.

Now is a great time to consider purchasing assets to preserve your wealth. Gold, silver, Bitcoin, and even platinum look interesting right now. Also energy…

Energy Becomes a Safe Haven

If you asked someone in 2005 what the price of oil would be in 2025, I don’t think anyone would answer “the same.” But that’s exactly what it is – $70 a barrel – the same price as 20 years ago.

The reasons are numerous and range from the fracking revolution to record oil discoveries in new markets.

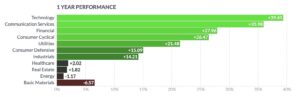

This has recently resulted in a unique situation where energy, in general, is CHEAP.

There are obvious narratives, such as the incoming Trump administration pushing for more oil drilling, which are suppressing energy prices.

But there are also other obvious factors to counter that suppression, such as record energy demands from data centers and general electricity consumption increases around the world.

That’s why it’s surprising that oil prices are the same as 20 years ago NOT inflation adjusted. This is despite the U.S. dollar losing 38% of it’s value in that same time.

The easiest way to allocate capital to the energy sector is through The Energy Select Sector SPDR Fund ($XLE).

While most energy is cheap, I’m glad we traded out of our uranium play:

An A.I. Play Bursts

I recently sold out of my Palantir ($PLTR) position even though I still love the company. With a 300%+ gain in less than a year (and nosebleed valuation metrics), I’ve learned from past mistakes that you never lose money by taking a profit!

There are many other A.I. themed companies that are also trading for unbelievable numbers right now.

While I don’t have any specific forecasts as to which company will go bust, I do believe there are huge risks with entering into any A.I. themed investment right now. This is especially true when you contrast other opportunities, like energy or emerging markets…

Certain Emerging Markets Shine

I’ve been investing in international markets for two decades. Real estate in Latin America, venture capital in Asia, private placements in Europe, and even business in Africa.

What I’ve learned over and over again is that the United States is, by far, the best place to invest.

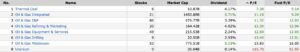

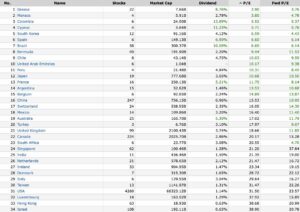

But that doesn’t mean there isn’t opportunity in other places, which is more true now than ever before. That’s because global valuations have gotten so incredibly low, especially compared to the U.S.

I think there are some once-in-a-lifetime situations staring right at our faces.

Greece, Brazil, the UK, and Canada look especially interesting to me right now because of likely momentum changes that will be unfolding in those countries in the coming years (Greece has already started).

Brazil in particular has reached a level of negative sentiment I have not seen for any country, maybe ever. With a P/E of 7 and a yield of 10%, the iShares MSCI Brazil ETF ($EWZ) looks interesting.

But, as I’ve mentioned before, there is no rush to get into any position here. Take your time, DCA into markets that you think are especially compelling, and be very patient.

U.S. Valuations Begin to Normalize

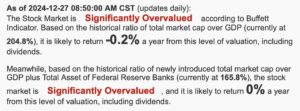

‘Valuations begin to normalize’ is a polite way of saying that things have to get cheaper, or else U.S. markets are going to get way too far over their ski tips, if they haven’t already.

With a P/E of 40 in the NASDAQ, and 30 in the S&P 500, US markets are extremely expensive and would require enormous annual growth for many years to come to justify today’s valuations.

Even the Buffett Indicator is blinking red lights.

But, as I mentioned with the U.S. dollar, the United States is still the healthiest horse in the glue factory. There may be some small economies that could do well in the coming years, but none of the bigger players have a chance of outperforming the U.S.

China has serious internal financial and demographic issues; India has tremendous demographic tailwinds, but a challenging economic environment and relatively expensive markets; the entire EU is in trouble, for so many reasons; Russia’s GDP is about the same as Texas, but Texas GDP per capita is five times that of Russia.

Here’s the bottom line: The U.S. is extremely expensive right now, but for good reason.

Invest in the Future, Not the Present

Where will the world be in five years? Ten?

I’d be willing to bet a lot of money, which I am, that several of the above forecasts will come to fruition.

What about you? Where will you be? And how are you going to change your life for the better?

Join me, and other adventurous and curious investors at one of my dinners sometime this year. I always have one planned, which you can see at the bottom of each of my newsletters.

These gatherings allow you to compare notes with other successful investors, in real time. I’ve ended up doing business and investing with so many of you over the years… it’s truly been incredible and extremely lucrative! Plus, you never know who I’ll have as a guest…