Imagine you are an investor living in the U.S. in 1830 – nearly 150 years ago.

As an investor, you’re looking for the next big opportunity, the next ‘thing’ that will change the world… and you want to invest in that ‘thing’ before everyone else finds out about it.

You realize that the U.S. is massive, and that it’s expanding west. You also realize that there is going to be a need to move people, supplies, and information from one side of the country to the other.

In 1830, the only thing available – other than a ship – are horses and wagons. If you want to move across the land, you have to literally walk. It’s an incredibly slow process, which means that expansion is happening very slowly.

But, you remember what you saw the year before, in 1829: the Stourbridge Lion.

The Stourbridge Lion was the first railroad steam locomotive to operate in the United States. It was imported form Stourbridge, England and was met with the usual resistance from those who doubted new technologies.

However, you’re a savvy investor and quickly realize that this steam powered machine has the potential to change the country, and the world. So you want to invest.

But where do you put your money to work? Do you invest in the company that is building the actual train? Do you invest in the company making the track? Do you invest in the timber company making the railroad ties? Or do you invest in the steel company that will be supplying the material for the entire industry?

It’s a tough decision. Trying to find the right place to put your capital to work. You not only have to find the right industry, but you also have to identify the right portion of the industry AND the right company.

The reality is that most companies will fail and it’s very hard to pick the right place to invest in a new industry.

That’s why you, as a smart investor, would deploy your capital among a variety of different railroad companies. You’d invest in several different steel companies, several different train companies, and several different timber companies. You might even invest in a couple companies that hire workers to build the actual tracks.

You want to make sure that you’ll stay profitable, even if many of the companies you invest in end up failing.

This is how venture capitalists invest. They assume that only 10% (or less) of their investments will actually be profitable. So, they make sure to diversify.

The same concept is used with ETFs or index funds. These investment vehicles allow investors to put their money into one fund, but get exposure to many different investments. That way, the investor ends up getting the average of all the companies in the fund.

In the end, the hope is that the winners will outweigh the losers and that you, as the investor, will walk away with a profit.

Markets and industries that are very mature usually have many of these types of funds set up. For example, there is an ETF specifically for junior gold miners ($GDXJ). This ETF holds many different junior gold miners, which allows the investor to get exposure to many companies, by buying a single ETF.

Meanwhile, markets that are very obscure or new, do not usually have any funds set up. That’s because there are so few investors in the space, there is not enough capital going around to support a proper fund.

Additionally, there may be too much uncertainty in new industries, as investors are trying to figure out what to do.

Recently, we’ve seen this with the cannabis industry, where large institutions avoid the industry because it’s illegal at the Federal level. However, for many investors who were early in the space and could determine which companies to invest, big money has been made (and will continue to be made).

Now that the cannabis market is starting to mature, private funds are now popping up, and there is even a publicly traded cannabis ETF.

So, what about the driverless car sector?

Well, believe it or not, there is an ETF for that. The ticker symbol is $CARS and it trades on the Toronto Stock Exchange. (Note that it is not the same $CARS ticker that trades on the New York Stock Exchange. That ticker is for cars.com.)

Of course, you could just buy $CARS on the TSX, but why don’t we look at what the ETF actually holds?

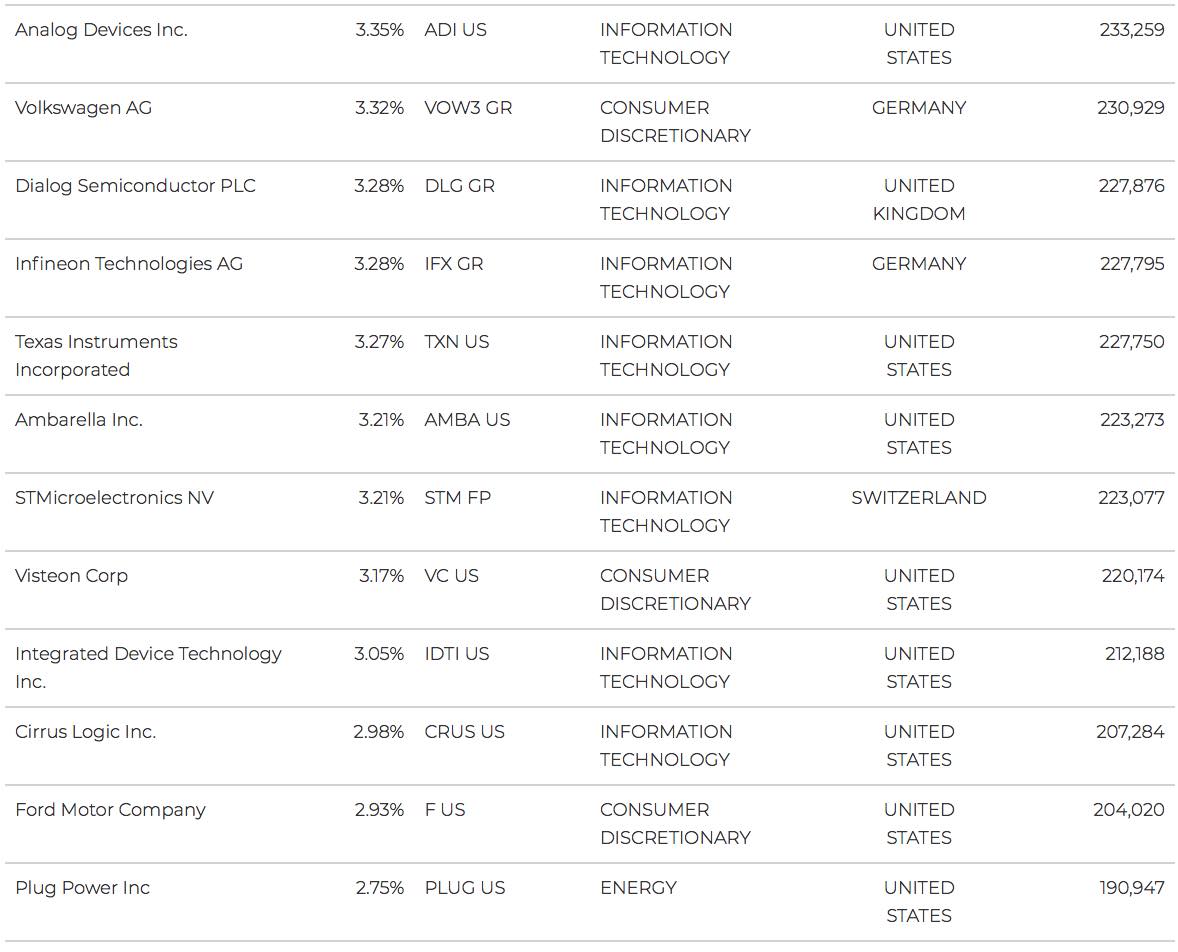

Here are the 29 current holdings:

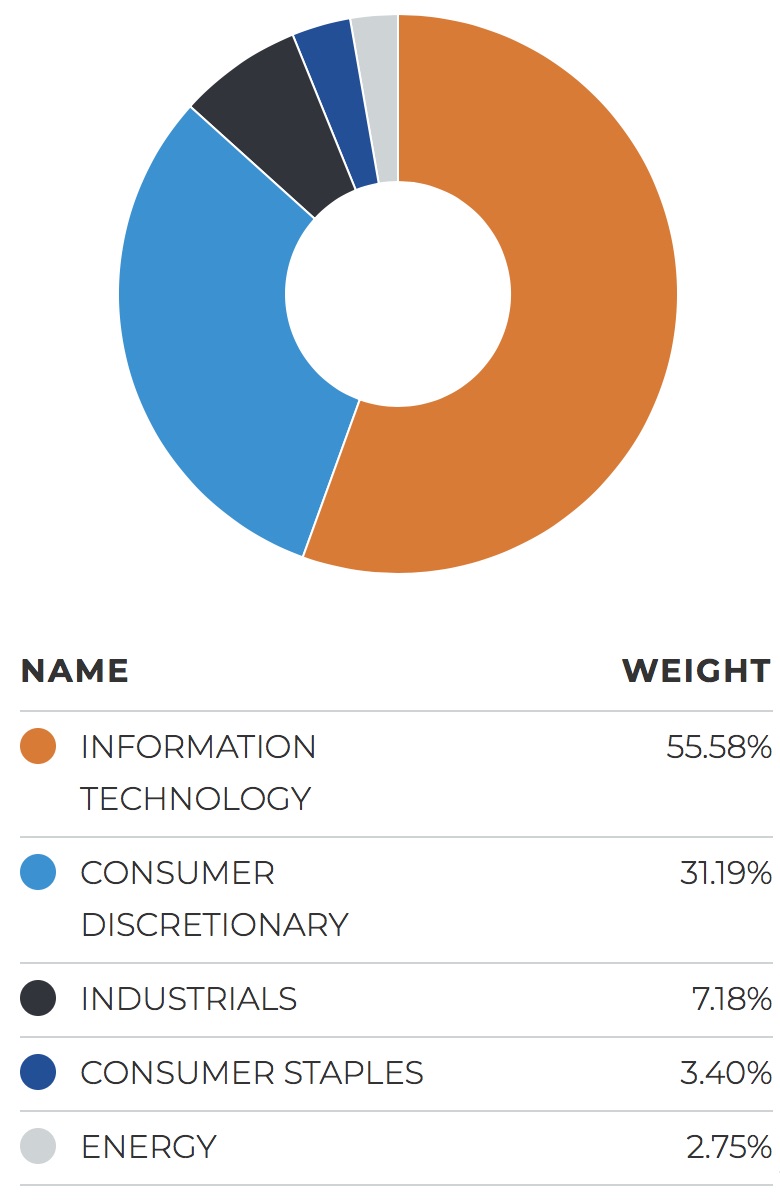

And they are distributed across these industries:

Again, you could do the easy thing and just buy that ETF… or you could get creative.

If you really wanted to do a deep dive, look at each one of those holdings and then look at similar companies. So, if you found three similar companies for each of the 29 holdings, you should be able to come up with well over 100 companies.

The reason why that would be valuable is because I’m sure that you will find many companies that will have a huge impact on driverless cars, but do not seem apparent today.

Perhaps the most exciting thing about investing in the driverless car sector is that most people don’t think it’s going to happen.

Most people cannot fathom the idea of a car driving itself. In addition, the average consumer today can’t understand why you’d want a car to drive itself. (The up and coming generations can’t wait to have a car that is purely for transportation, while freeing up time for passengers. Time is the one asset we can’t get more of… right?)

When there is a large portion of the crowd that thinks that something isn’t going to happen, that means that the minority has an outsized profit potential.

Think about sports betting when two teams play each other. If 90% of the bets are with one team and only 10% of the bets are with the other, then the payout for the underdog team to win will be much larger.

That’s the same concept with investing in sectors that do not have the support of the masses. Because if everyone agreed that something was valuable, the price will go up. If only a few people think something is valuable, the price will stay low.

That’s not to say that there won’t be major changes and uncertainties in the coming driverless car revolution.

But for those who see it coming, and start to position themselves now, there is a huge opportunity.