Hey Millennials! You Don’t Have to Buy a House

The “Trophy Generation.”

That’s what some have labeled millennials.

But it’s not a compliment. It’s a huge knock against a generation that has grown up with participation trophies for just… well… participation.

Did you finish a race last? You get a trophy!

Did you ride the bench all year on your youth baseball team? You get a trophy!

Did you get second place (you know, the first loser)? You get a trophy!

Yes, everyone gets a trophy. Everyone who participates, regardless of skill or accomplishments, gets a trophy.

And now millennials are getting the heat for being a generation of entitled brats who do nothing but sit at a computer all day while being a drag on society.

Well, I guess there is some truth to that. I mean, I fit into that category perfectly.

In fact, I remember when I was five years old and I was sitting on the trophy committee of the local soccer league I played in. Yes, it was me and four others who proposed legislation that would reward all sports players under the age of 15 to receive proper recognition for their contribution to their sports teams.

It took a lot of work. Between orange slices and grass-stained knees, we had to continually push the local soccer commissioner to hear our concerns. We wanted equal rights for all youth sports players. We even threatened to strike if our demands weren’t met. After all, we just wanted trophies for everyone.

But finally, after so many sleepless nights, we were finally able to convince the governing body (our parents) to get us trophies.

Hope you can sense the sarcasm…

We all know that this is B.S.

Here is why millennials received participation trophies:

Millennial PARENTS couldn’t stand the fact that their child was not a star. They couldn’t bear the thought of their child not sitting at the top of the podium.

Trophies are really for parents to justify that they did a good job parenting. It’s the parents that wanted the trophy for approval – not the kids.

But millennials are taking the heat.

Don’t worry, I’m not going to be a millennial apologist. I’m not going to convince you that millennials are perfect.

Here’s the reality:

The millennial generation is just as flawed as any other generation.

And the millennial generation is just as amazing as any other generation.

Here’s a fact:

Humans progress. Each generation compounds upon the last. There is an exponential amount of forward progress and millennials aren’t going to change that trend.

The baby-boomer generation has created an unbelievable platform for millennials to stand upon.

Computers, the internet, healthcare advancements, transportation, and almost anything you can think of has been accelerated by the boomer generation.

But you know what else has been accelerated?

Debt.

An enormous pile of debt and future obligations that fall on the lap of millennials.

From under funded pension systems to $20 trillion dollars of US government debt, there is a steep price to pay for all of that incredible growth.

Hey, maybe it’s been worth it. Maybe it’s worth going into all of that debt in order to progress.

So, what’s the next move? Do we keep this trend going?

Of course not. A policy of continued growth, fueled by ever-more debt is simply unsustainable.

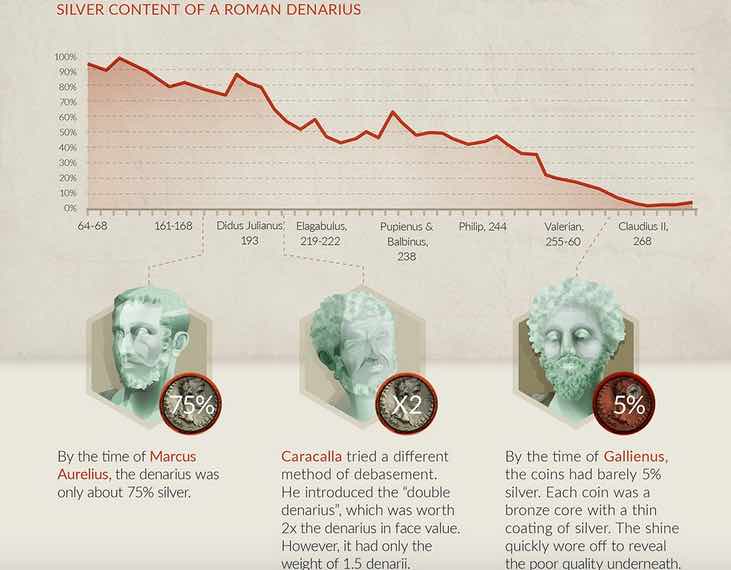

We can look back in history to see what happens when debt is over utilized. The Roman Empire is a perfect example of a civilization that eventually collapsed because of their inability to pay for their expenditures.

In addition to raising taxes, the Romans also debased their currency in order to expand the money supply, which would theoretically allow them to increase debt load. However, this eventually leads to inflation and elimination of buying power for the individual.

Source: Visual Capitalist

The expansion of the money supply can be compared directly to what is going on today. Additionally, central banks around the world have kept interest rates artificially low which has further distorted the price of many assets.

The most notable asset that has significantly increased in price is real estate.

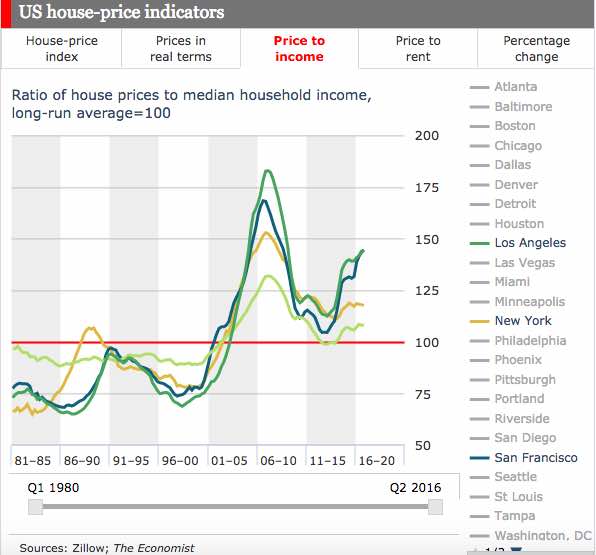

If we look at the price to income ratio of real estate in the US for the past 15 years, this ratio has been well above the historical average. This means that millennial buyers, who should be buying a home to stick with traditional trends, would be spending more than ever before.

Source: The Economist

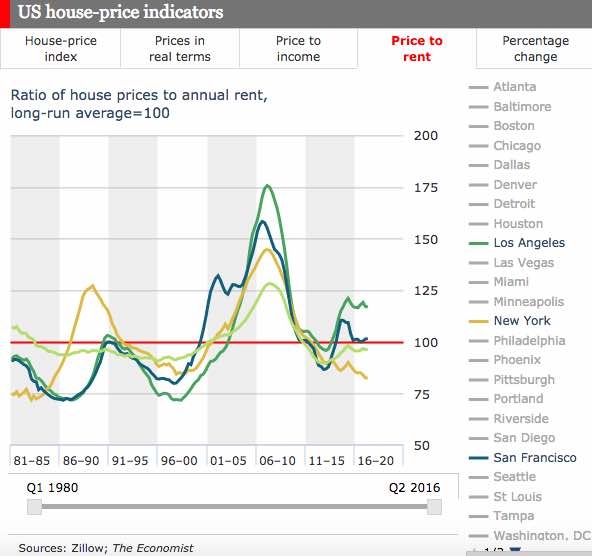

Source: The Economist

The hesitation that millennials have about entering the real estate market really has been a rational reaction to expensive housing prices.

But this rational move has not been supported by those touting traditional wealth-building strategies – which includes buying a home.

Really, buying a home is just a forced savings plan.

If you own a home for a significant amount of time (say ten years or more), you will be building equity by simply allowing the home to increase in value. And assuming that you have financed the purchase, you will also be paying off your borrowed amount.

However, you will also be paying annual property taxes and maintenance fees.

This balance of both building equity in your home while at the same time paying for non-returning fees (taxes and maintenance), may result in a net-zero gain. Or in other words, you could have made the same amount of money by simply saving a set amount of funds over the same period of time.

Now, don’t get me wrong, real estate is one of the best investments you can make to build wealth. Especially if you are utilizing leverage, tax benefits, and most importantly using tenants to pay off your debt.

But, when it comes to a primary residence, the wealth building game that once worked for the boomer generation simply doesn’t play out in the same way.

The simplest example is to take a look at the price to income chart above. A much higher percentage of one’s income currently must go to pay for real estate, compared to past averages.

The only way to justify this ratio (of using more of your income to pay for your home) would be if real estate was rising in value at an equal rate.

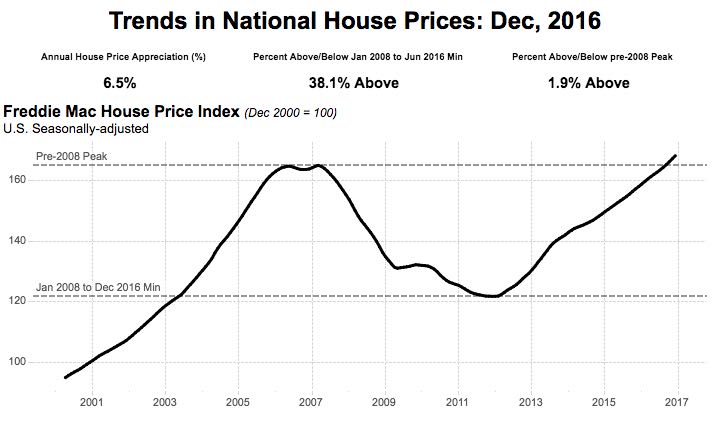

To be fair, this is actually happening right now. Real estate prices actually are rising at a high rate.

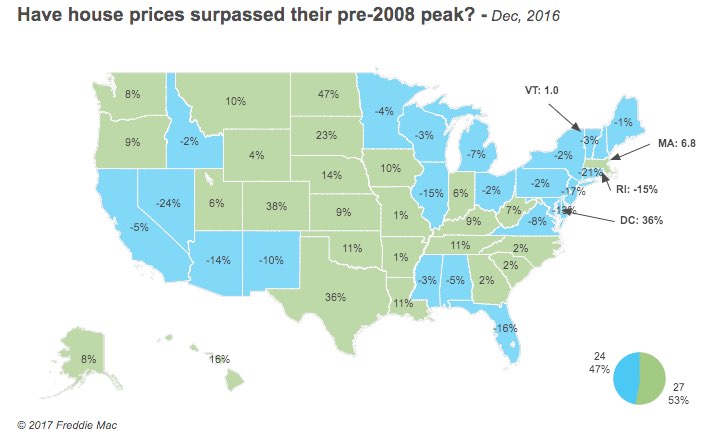

Source: Freddie Mac

But, we only have to look at what happens after 2007 on the chart.

Just as with any cyclical trend, there is a correction which erases gains. This, however, does not mean we are due for a correction. The fact that we are surpassing historical housing prices does not imply that we are days away from a correction.

In fact, there is much evidence to suggest we could see higher prices from here on out.

Source: Freddie Mac

There is a strong argument that property prices will in fact continue to go up and those who are not currently invested will miss out on gains.

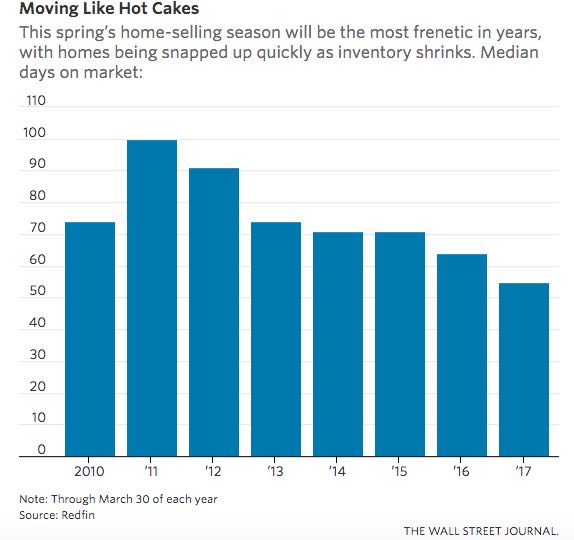

In addition to low interest rates, there is also low inventory of available homes, which further suggest higher property prices ahead.

Source: Wall Street Journal

Does that mean you should buy as soon as you can?

No!

This is the time where investors get trapped. When they feel pressured to buy into a market that is reaching new highs because of FOMO – Fear Of Missing Out.

So What’s The Solution?

The solution is simple: Be patient and don’t get sucked into a story that doesn’t make cents.

–

Real estate is perhaps one of the best investments out there. However, this is only true under the right circumstances.

Sometimes finding the best real estate investment requires that you look outside your borders. Sometimes, you have to look in the place you least expect.