Getting Robbed In Broad Daylight

You’re getting robbed in broad daylight right now.

It’s happening right beneath all our noses, and hardly anyone notices what is going on.

Yes, the greatest theft of wealth in history is happening right now.

This isn’t some conspiracy where some secret society has plans to steal money from the rest of the world. This isn’t some far-out prediction or speculation. This is real. It’s actually happening.

Sound crazy? Good. It is crazy that no one sees what is going on!

Let me explain everything. I’ll show you how this is all happening…

But before I start, there are a couple of things you need to understand.

INFLATION

Inflation is a general increase in prices and fall in the purchasing value of money. Think about that.

Your money is losing purchasing value and at the same time prices are increasing. This is extremely damaging to a person’s wealth, as someone’s savings can literally become worthless.

If inflation happens slowly over time, most people don’t notice it. But, little by little, a person’s wealth is disappearing through inflation.

DEBT

Debt just means that you owe someone something. In this case, money.

Debt can be created through a variety of means, but the ultimate result is that someone must ultimately repay their debt.

If a person cannot repay their debt, then they are penalized by whoever is owed money. Usually lenders securitize debt that they give out with collateral. This means that if someone can’t repay their debt, they can get their assets seized by the lender. This ensures that the lender gets some value paid back.

Ok… pretty simple things here… inflation and debt.

Now, this is where things get interesting. Stay with me, I promise it’ll be worth it. Once you understand what is going on right now, you will be shocked. You might be able to do something about it too.

So, if you haven’t noticed, our world has been racking up massive amounts of debt. I mean, it’s like a teenage girl with a credit card in the mall. Crazy CRAZY spending.

Now, spending money is just fine if you have it. But what happens if you are spending money that you don’t have?

YOU GO INTO DEBT.

To give you an idea about what kind of debt is out there, let’s look at several examples:

- The US currently has so much debt that if you divided it up by the total US population, each citizen would have to pay over $60,000.

- Japan’s debt as a percentage of GDP is over 200%. This means that the Japanese government would have to spend over twice the amount of annual GDP just to pay off it’s debt – and that’s not including paying for it’s regular expenditures. Imagine if you as an individual did this… you’d go bankrupt real quick and be in serious legal trouble.

- Germany, like all countries, pays interest on their debt. Even with interest rates at historical lows, Germany owns almost $2,000 PER SECOND.

Sources: World Debt Clock

Clearly, there is a debt problem.

The world as a whole has over $60 trillion USD of debt.

Do you understand how big that number is? I bet you don’t.

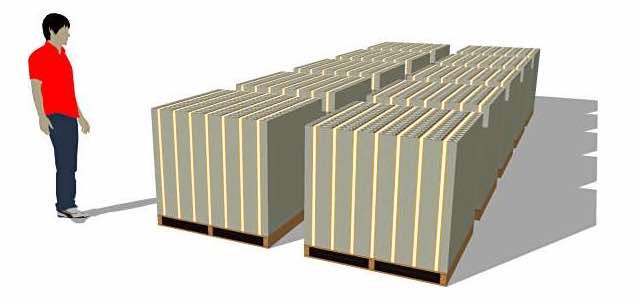

If we used $100 bills to visualize how much debt we have… it’d look something like this…

Here is $1 billion USD:

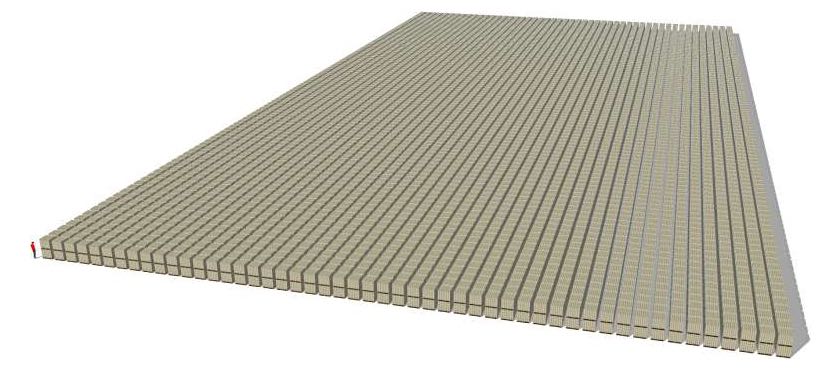

What does one TRILLION dollars look like?

What does one TRILLION dollars look like?

WE HAVE 60 (SIXTY!) TRILLION DOLLARS OF GLOBAL DEBT. THAT’S SIXTY TIMES THE AMOUNT OF THE ABOVE PICTURE!

Ok… You might be thinking, “So what? So what if the whole world is in debt? If everyone’s in debt, then it doesn’t matter. Right?”

WRONG. It does matter.

It matters because there are different degrees of debt. Different countries are in more or less debt.

In order for a country to stay competitive on an international scale, they must manipulate their economy in order to stay reliable as trading partners.

This manipulation is done through a variety of measures. Most notably by printing money and artificially controlling interest rates.

By printing money and controlling interest rates, governments can somewhat control the rate of inflation. Some governments (and/or central banks) are better than others.

If too much money is printed, then massive inflation will take place. Nobody wants this because extremely high inflation, known as hyperinflation, will make a currency literally worthless.

This has happened several times in recent history with the Weimar Republic, Zimbabwe, and it’s happening right now in Venezuela. Source: Zimbabwe dollars phased out – BBC News

Source: Zimbabwe dollars phased out – BBC News

On the flip side, if a government (and/or central bank) doesn’t print money and control interest rates, then a currency can get too strong (which means very low inflation).

When you have a very strong currency, nobody wants to trade with you because it’s just too expensive. (This is happening in the US right now with the strong dollar.)

Currently, we are in a ‘currency war’ in our world. Many countries are battling with each other through their currencies. They are printing money and keeping rates low in an attempt to stay competitive in the world market.

This is a horrible path to be on, as it’s essentially like trying to drink more beers at a party so you don’t lose your buzz.

The best solution is to stop drinking the beer so you don’t have a wicked hangover in the morning.

Now that you understand everything that is going on… let me show you how there is an enormous transfer of wealth going on right now.

Remember how governments can print money and artificially control interest rates? This is so they can influence the rate of inflation.

When a government has a higher inflation rate, they pay back their debts with a currency that is worth less.

Governments are literally trying to inflate their debt away.

Here is an example, so you can think of it in real terms:

Pretend that you take out a 30 year fixed rate loan for a house that you just bought. Your loan is for $100,000. Your monthly payment is about $500.

You must pay $500 every month for the next 30 years. No more, no less. Just $500 per month.

Now, let’s assume that governments get their way and inflation goes up. With the rise in inflation, salaries go up to match the cost of living. So, your paycheck goes up along with the cost of food, gas, entertainment, etc.

But your loan payment does not go up. It’s fixed! Essentially, your payment is getting cheaper and cheaper in value terms as inflation goes up.

This is exactly what governments want with their debt.

But guess who’s wealth is getting stolen? Because when inflation goes up, the value of money goes down.

The money that you and I WORKED OUR ASSES OFF FOR is becoming LESS VALUABLE AS INFLATION GOES UP.

There you have it. The greatest transfer of wealth in history.

Happening right now.

In front of our faces.

And hardly anyone can see this happening.