On the gambling spectrum, I’d put our lives on one end, while betting on whether a coin lands on heads or tails on the other. Pretty much everything in our lives is a bet, with the only difference being the degree to which we can calculate the outcome and the consequences that come with that.

We make daily decisions that will effect the outcome of whether we will live or die. Just crossing the street requires us to calculate whether or not we’ll get hit by a car. Simply put, we bet on whether or not we can make it to the other side of the street safely.

Of course this is an over simplification of the bets we make in our daily lives, but the point I’m making here is that there is a spectrum of gambles that we constantly make. Even though we might not consider a simple thing like choosing the food we eat, even that decision has an outcome where we consciously think about the end result. What kind of gamble am I making by consuming that massive burrito?

The stock market is by far the biggest betting arena on earth. Almost all investors, whether they are professionals or weekend warriors, will try to justify the stock market as some sort of platform where you get to own shares in a company. Sure, that’s true. Investing in public equities allows you to own a small piece of a company you believe has a bright future.

However, unless you are a very large investor who can shift the market or can manipulate the future performance of a specific company, you’re essentially along for the ride. You’d need to invest millions, if not billions of dollars into a single company in order to have a real influence on how that company performs in the future.

That means that nearly every investor in the stock market is making a calculated bet on whether a company will be successful in the future. It’s just a slow-motion version of a horse race, where you place your money on whoever you think will cross the finish line first.

I can already hear all kinds go grumbles about how investors make calculated decisions based on the past performance of the companies they invest in. They look at debt levels, earnings numbers, leadership history, and all sorts of metrics to make an informed decision.

But, no matter how many different sets of data you look at, eventually you’ve got to make a move by placing a bet. An investor has to put their money where they believe they will get the best return.

It’s no coincidence that venture capitalists are known as excellent poker players. There’s a reason why big investors also love to own racing horses. Those who are highly successful enjoy taking calculated bets that they believe will pay off big time. And the best gamblers are often the wealthiest.

Knowing this, through a lot of trial and error, that’s why I personally don’t actively invest in the stock market. I know that I have almost zero influence in the way a large company will perform in the future. Investing in Tesla is almost a singular bet on Elon Musk being able to pull a rabbit out of a hat (which he has been able to do, as of lately!).

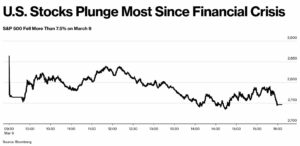

This past week has highlighted the lack of control that the vast majority of stock market investors have. Just look at Bloomberg’s headlines over the past several days:

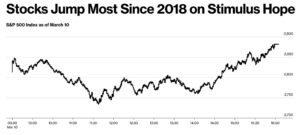

Then, the next day…

Then… the next day…

And now, as I am writing this, the market is down almost 9% on the day.

To be fair, this is basically a Black Swan event. The repercussions that COVID-19 will have on the global and domestic economies is still completely unknown. Traders are making bets on a daily basis, as they try to price in the long term effects of the constantly changing news stream.

If you’re a stock market investor who trades on volatility, then you’re probably doing pretty well right now. But, if you’re like 99.9% of all stock market investors, you’re just along for the ride with absolutely no control.

To be clear, I am not saying that you can’t make money in the stock market. I’m not even saying that someone shouldn’t be an investor in public equities. However, what I am saying, is that if you are serious about investing as a full time (or even part-time) job, then you should probably look at other opportunities where you have a lot more control. More about those opportunities soon…