“The market is going to crash within the next six months.”

I think we’ve all heard someone say that for the past 3 years. Some people will say it to scare you into buying something… and some people say it to make the headlines.

Obviously, we should all be skeptical of someone who is saying the market is going to crash, especially if they have ulterior motives with the message.

To be fair, there is quite a bit of evidence that the market will crash within the next six months. Here are just some of the popular facts that are easy to point to:

- Stocks are trading at all-time highs with insane valuations.

- We’re in one of the longest (if not the longest) bull markets in modern financial history.

- Central banks have pumped up markets by injecting massive amounts of fiat capital.

- Historically low interest rates (that have been artificially suppressed) have created a debt monster that is going to eat companies alive.

- There is a currency war going on around the world that may turn into a contagion of inflation.

- There is a trade war going on that may spur some countries to retaliate in unexpected ways.

- Speculative manias in tech stocks, cryptocurrencies, and now marijuana stocks have created a group of investors who only trade based on selling to the greater fool.

- The list could go on…

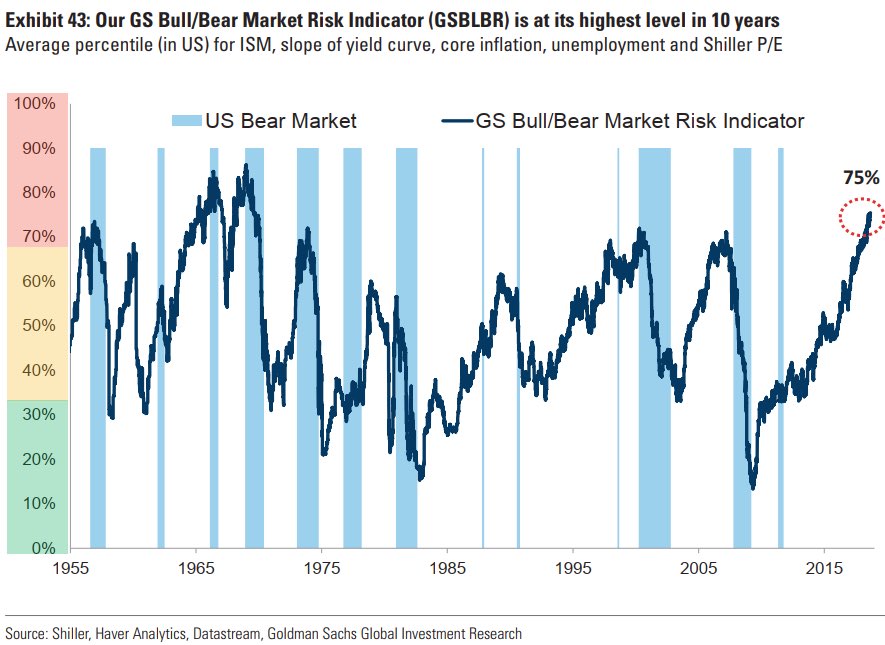

On top of all of that, there are numerous statistical metrics out there that are screaming, “The market is going to crash!” Just look at Goldman Sachs recently published bear market indicator, which has been incredibly accurate:

On the other hand, maybe we have several more years of market euphoria. Maybe tax cuts, trade tariffs, low unemployment, and incredible technological advancements will continue to fuel the world economy.

No one knows for certain.

But, what’s the harm in preparing for the time when everything does in fact crash? Just as you buy insurance for your car and home, you should definitely make investments that act as your insurance policy for your wealth.

Here are four ‘insurance policies’ for your wealth:

Cash

Cash is usually a pretty bad investment. If you were to just leave all of your money under your mattress, eventually that money is going to be worth significantly less due to inflation. The best way to preserve your wealth is to hold assets that match inflation, so your wealth doesn’t slowly melt away.

The problem is that you need cash to buy things. You can’t always have your wealth tied up in illiquid assets. This is especially true in turbulent times. It’s very difficult to sell things in a market crisis, as everyone is trying to sell. For buyers, who have cash, this is a dream. Everything is literally on sale and if you have cash, you’re in a powerful position.

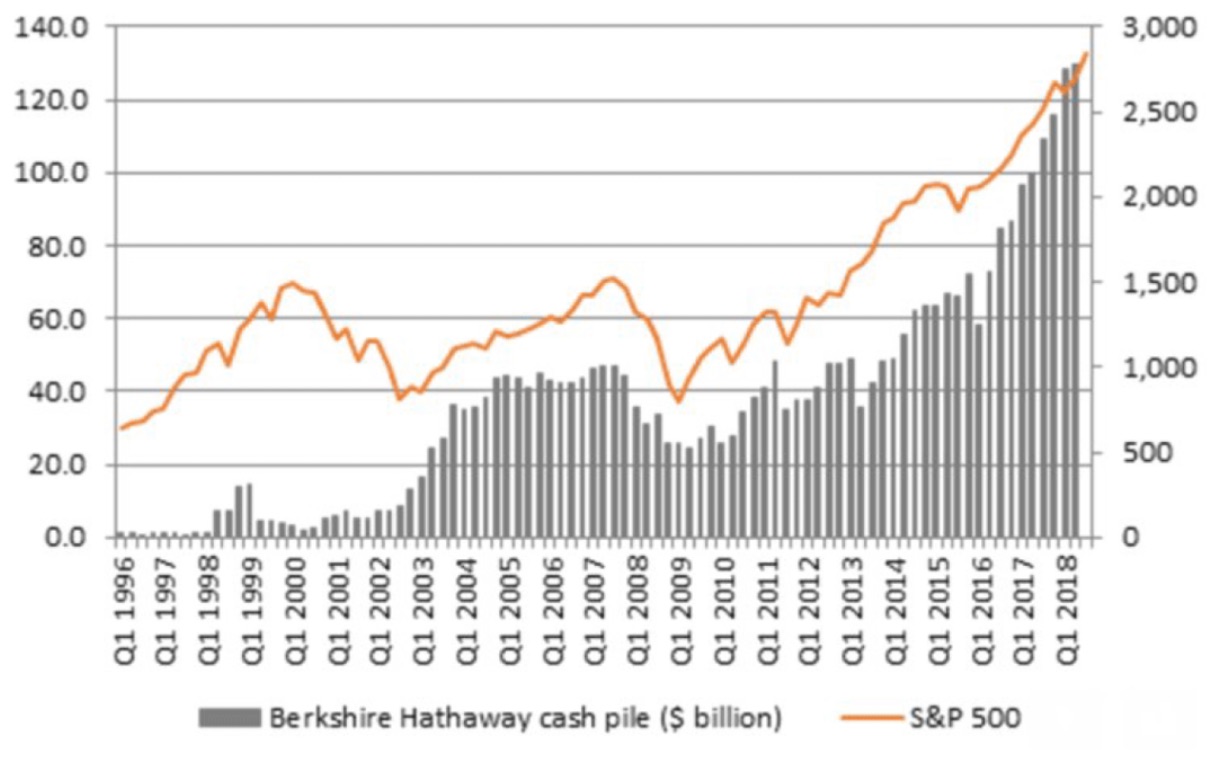

Maybe that’s why Warren Buffett is holding more cash than he ever has.

Precious Metals

You’re either a gold bug or you’re not.

Some people can’t wrap their head around putting their money into rocks (gold/silver), as they don’t do anything productive and don’t throw off any yield.

That’s pretty much true. Gold and silver don’t do anything. People who trade in and out of precious metals are basically speculating on the emotions of the market, instead of the fundamentals of the asset.

However, if we look back into history, precious metals have been an excellent store of wealth. Nearly every single person on earth knows what gold is and they also agree it has some value.

In times like today, when the market is red hot, investing in precious metals is boring and looks very unattractive. That is literally the best time to buy.

If you don’t own any physical precious metals, go buy some today. Start out with just a little bit. Get comfortable with the buying process and understanding what it means to hold wealth in a rare metal.

Cryptocurrencies

From a pure value based investment, cryptocurrencies – just like gold – don’t make any sense.

Yes, you can speculate on them and HODL until moon… but nobody really knows what cryptocurrencies will be valued at in several years.

However, if we look at countries that are in crisis, like Venezuela, we can see exactly why it’s a good idea to have at least some exposure to cryptocurrencies.

With no ability for central banks to artificially manipulate a blockchain ledger, cryptocurrencies are theoretically the best form of currency to transact in.

Whatever you think about cryptocurrencies, even if you hate them, you should own just a little bit. You never know.

Foreign Real Estate

This is by far the most difficult asset to purchase and maintain. Cash, precious metals, and cryptocurrencies take almost zero management and are easily bought and sold.

Real estate, especially foreign, is very difficult to buy and keep up. But the rewards can be enormous.

Foreign real estate checks a lot of boxes:

- Diversifies your wealth out of your home country.

- Diversifies your wealth into a different currency.

- Can offer an attractive yield. 10%+ is very common.

- Can be purchased very inexpensively if you are holding a strong currency and buying in a country with a weak currency.

- Allows you to hold an asset that cannot be seized by your home country.

- Gives you a physical location that you can use for pleasure, or in times of crisis.

How many ‘insurance policies’ do you have on this list?