Deferred Gratification – Play The Long Game For The Best Results

Earlier this year, I was fortunate enough to attend the annual Daily Journal Corporation meeting in Los Angeles.

The Daily Journal Corporation, which is traded on the NASDAQ as $DJCO, is not a particularly famous company. But the annual meeting is always jam packed. This year was standing room only.

That’s because the Chairman of $DJCO is Charlie Munger.

My view at the standing-room-only meeting.

The meeting is one of the few (maybe only?) times the public can hear Charlie talk in person on his own. And he doesn’t hold anything back.

Charlie Munger, if you’ve never heard of him, is Warren Buffett’s business partner. He’s a billionaire, the director of Costco Wholesale, and one of the most famous investors of all time.

During the meeting, Charlie touched on almost every topic imaginable. But, throughout the talk, which is very interactive with the audience, one theme kept coming up:

Deferred Gratification

He must of brought it up a dozen different times. He talked about how most investors are looking for a quick buck, but the best investors defer their gratification for larger gains that come later.

He even poked fun at all the generations after him, saying that very few people have the ‘deferred gratification gene.’

So what is deferred gratification?

Obviously, you are deferring your gratification.

The best example of this is where scientists put a bunch of five-year-olds into a room.

They sit all of these kids around a table a put a cupcake in front of them. Then they tell the kids:

“You can have this cupcake right now. It’s delicious. It’s vanilla cake with chocolate frosting. BUT, if you can wait five minutes until eating that one cupcake, we’ll give you another cupcake. So you can eat just one cupcake now. Or you can wait five minutes and have two cupcakes.”

Of course, most of the kids at the table just scarf down the one cupcake immediately. However, there is always one or two kids at the table who sit there patiently staring at that one cupcake, because they know if they wait they’ll get more gratification in the long run.

By waiting just five minutes, they are deferring their gratification. But, the ultimate reward is actually greater in the long run.

In investing this is called “the long game.”

Meaning, you are in it for the long haul. You make calculated moves that won’t come back to reward you for a long time… maybe even years. Playing “the long game” is very difficult because it requires you to have patience and forgo instant satisfaction.

You’ve got to defer your gratification.

This technique of deferring your gratification can go way beyond actual investments.

In fact, one of the most valuable deferred gratifications comes with human relationships.

Any successful investor… or rather, any successful person in general, knows that opportunities in life usually come from who you know. It’s all about connections.

But, you can’t just randomly make connections without putting in the work before hand. You’ve got to play “the long game.”

You’ve got to put in the work to be around people who will help you succeed.

And I’m not talking about going around and kissing people’s asses. I’m talking about genuinely making real relationships with people who will lift you up just as much as you lift them.

Usually, this means that you have to put real physical work into this. Making connections by email or phone is NOTHING like meeting in person. You’ve got to really make an effort to create strong bonds with people who are on the same path as you.

This past weekend, we had an Atlas 400 event in Los Angeles. For me, it was about an hour drive from where I live, so it wasn’t that difficult to get to.

But for my guest… let’s just say he put some work in.

I picked up Jay Kim from LAX on Friday afternoon and then I dropped him off back at the airport on Sunday morning.

He was here for literally less than 48 hours. AND HE FLEW FROM HONG KONG!

That’s about a 15 hour flight each way. He spent almost as much time up in the air to and from LA as he did actually on the ground in LA.

Although he did have a pretty good reason to visit… we raced a Porsche or two. Or three…[ Truthfully, that’s not the real reason why Jay came to LA.

Truthfully, that’s not the real reason why Jay came to LA.

He flew in because he understands the importance of human relationships. He knows that it takes real action for big results. And he’s willing to defer gratification for that.

But that’s not the full story when it comes to deferring gratification.

It’s not like you just recklessly meet with people in order to form bonds. You’ve got to pick and choose your priorities. You’ve got to identify the people and locations that actually warrant your effort of putting in that early work.

Jay is one of those people.

And Asia is one of those places that you should be identifying right now.

Why?

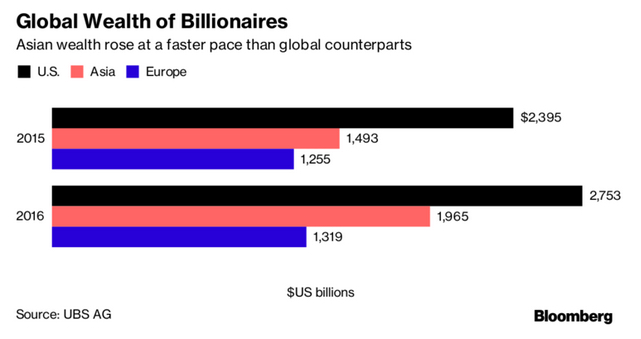

Well… look at where the world’s billionaires are:

Source: Bloomberg

The US is still the leader when it comes to total wealth.

But, Asia outnumbers the US with the total number of billionaires.

“Three-quarters of the world’s new billionaires hail from China and India. The number of Asia billionaires rose by 117 for a total of 637, with self-made billionaires seeing their wealth rise faster than those who became rich through family ties. The U.S. added 25 billionaires for a total of 563.”

“In China, one billionaire is created every three weeks…”

“Europe’s number was basically flat at 342 in part due to death and because ‘entrepreneurial companies can find Europe a difficult place to do business due to both the conservative business culture and strict regulations…” -Bloomberg

Source: Bloomberg

So, if you’re looking to build your network with successful, self-made people, then it’s time to look towards Asian.

Just remember to play the long game. Defer your gratification.

(E/P members, we’ve already got the wheels in motion for next year…)