BTFD – How Is ‘Less Bad’ Actually ‘Good?’

Last week wasn’t looking too good.

While the Caribbean and Florida were getting walloped by Hurricane Irma, the rest of the world was looking at the North Korean nuclear threat.

Fast-forward to today and things have gotten MUCH better.

Instead of hundreds of billions of dollars in damage, Hurricane Irma may only cost tens of billions.

And North Korea has postponed their nuclear holocaust plans.

So with all of this fabulous news, the US stock market rocketed higher today… AND volatility crashed by 10%.

I’ll repeat… The stock market went higher and volatility declined on LESS bad news.

The front page of Yahoo! Finance today.

If you are an investor, this should make you shake your head.

The market is rising not because there is good news, but because things aren’t going as badly as expected.

This reminds me of investors buying ETFs. They don’t know what the actual ETF holds, but they’re buying anyway.

Investing like this – buying without any regard for actual value – is how market bubbles form. Investors are entering the market with the expectation of selling to the next sucker.

There is a new term for this: BTFD.

Buy The F*^king Dip.

Seriously. It’s a tongue-in-cheek joke, which has actually turned into a real strategy. Every time the market dips, investors treat the opportunity as a way to invest more.

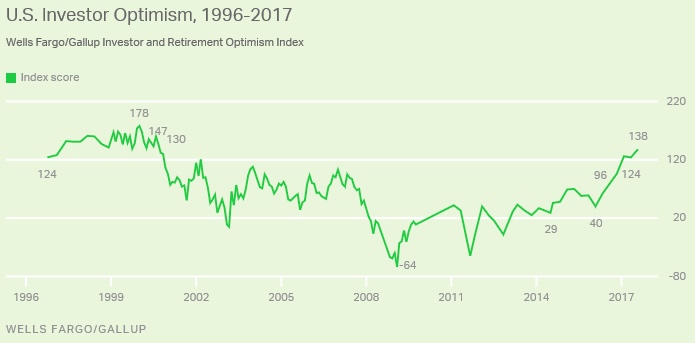

Source: Gallup

Of greatest concern to me is from that same Gallup poll:

“Optimism has risen considerably more among retired investors this year than among nonretired investors.”

That means that the people who are most susceptible to a market correction and should be the most cautious (retirees) are the most bullish about the stock market.

The time to be cautious is when others are greedy and the time to be greedy is when others are cautious.

Proceed with caution. (Especially if you are a retiree on a fixed income that is correlated to the market’s performance.)