“Aren’t you afraid that you’ll lose your property?”

That’s the number one thing I hear once people find out about our international property investments. This makes sense, as most people associate upside opportunities when it comes to topics they know a lot about. Conversely, those same people associate risk when it comes to topics they know nothing about.

Americans are especially negative about doing business outside of their borders. On the surface, it makes total sense. The US is the world’s biggest economy, has a very sophisticated and efficient business market, and there are opportunities everywhere you look.

However, what most US residents miss is that their local economy is also extremely competitive and expensive. That means the level of success you can achieve gets significantly more difficult with every rung of the ladder you climb.

Personally, I am a huge fan of doing business in the United States. It’s where I’m from and where I currently live. But, I’m also rational when I look at facts. I know right now, that when it comes to real estate investing, there are opportunities in foreign markets that look significantly more attractive. (I’ll explain more about that in the near future – we are currently remodeling a 13 unit building in Colombia which has very attractive yield and capital appreciation.)

Let’s circle back on the comment, “Aren’t you afraid that you’ll lose your property?” What do most people think when they ask this question? That every country outside of the US just randomly takes away people’s homes?

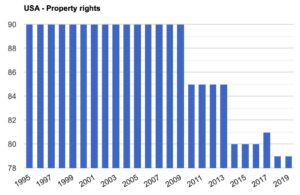

Did you know that the United States doesn’t even rank within the top 25 countries in the world when it comes to property rights rankings? In fact, if we look at global rankings, the US has been dropping for the past ten years while many other countries have been climbing the list.

Source: The Global Economy

Again, I am a huge fan of the US. And when it comes to investing in real estate, there are all kinds of tax incentives, efficient investment vehicles, and plenty of areas that make sense for certain investors.

But, if you are someone who looks at investment returns by the numbers… there are many foreign markets that offer significantly higher yields on your money. Furthermore, with these markets increasing in popularity, the investment can appreciate significantly in addition to the already great yield you will receive. And, this is all after tax returns, so more of an apples to apples comparison.

Still, investing in foreign markets can be extremely intimidating and there are are plenty of areas where a novice investor can get in trouble. In addition to language barriers, there are currency conversion challenges and legal practices that differ from the US. Also, just like any investment, if you don’t check in often, things can go wrong quickly.

That’s why it’s so important to have on-the-ground partners who not only know how to do local business like a pro, but also have skin in the game. This is by far the biggest mistake that investors make when purchasing foreign property. They expect to be able to manage and maintain a property they own, as if they were logging into their online brokerage account to check the status of everything.

Investing in foreign real estate can provide much more than simple yield on your invested capital. Diversifying your investment portfolio, currency arbitrage, and of course, a fun investment you can actually enjoy and use yourself.

But when it comes to things you should be concerned about, losing the property should be towards the bottom of your list. Ensuring that you have a trustworthy local management team and that you can rely on experts to guide you through the purchase process must be priority number one.