One of the ‘investing regrets’ that I have is not accumulating more cash flowing properties when the time was ripe. I think about that a lot, especially when I look back on some of the insane opportunities that were available after the US real estate crash.

Of course, hindsight is 20/20. At the time of the real estate crash, I really didn’t have enough experience or funding to be able to actually take advantage in a real way. But, if I had known how big that opportunity was at the time, I believe I would have found a way to at least make something happen.

Again, it’s easy to look back now and speculate on what I shoulda, coulda, woulda done… but, that’s the process to becoming a successful investor. You have to go through some real experiences – good and bad – that really embed the right strategies in your brain.

Today, in 2019, the real estate environment is completely different. There are certainly pockets of opportunity that are available, but in general, real estate is expensive. And if we look at select markets, both in the US and internationally, values are completely insane.

Let’s look at San Francisco for example. Currently, the median price of a one bedroom house is $840,000. That’s wild.

The generally accepted rule is that you should put no more than 30% of your income towards your primary housing. So, let’s assume that you are a single 28 year old living in the San Francisco Bay Area who is in the market for a one bedroom house.

Let’s say that you found a one bedroom house for sale that is $800,000, which is below the median. And let’s also assume that you are going to use a traditional 20% down, 30 year fixed rate loan to purchase the home.

Here is how the math would work out:

- Down payment = $160,000

- Amount financed = $640,000

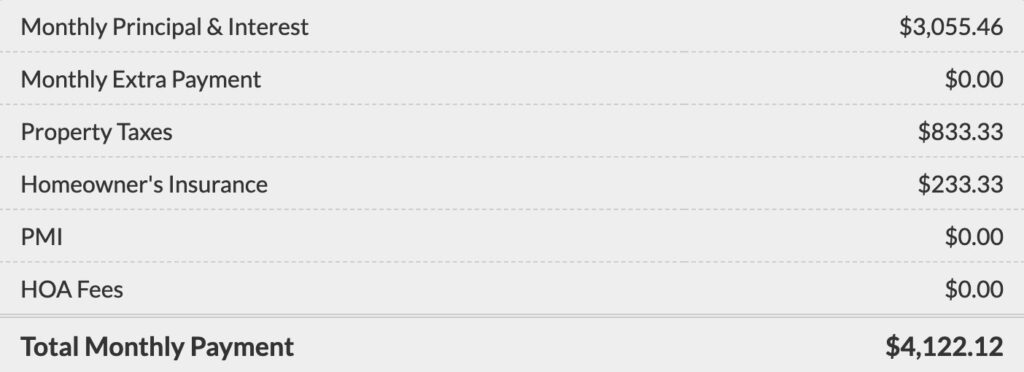

- Monthly mortgage payment @ 4% rate = $3,055

- Mortgage + property taxes + insurance = more than $4,000 per month

If we assume that you are actually spending 30% of your income on housing (and not dumping almost all of your income into housing, like a lot of people are doing), you would need to be making over $14,000 per month, which is $168,000 per year.

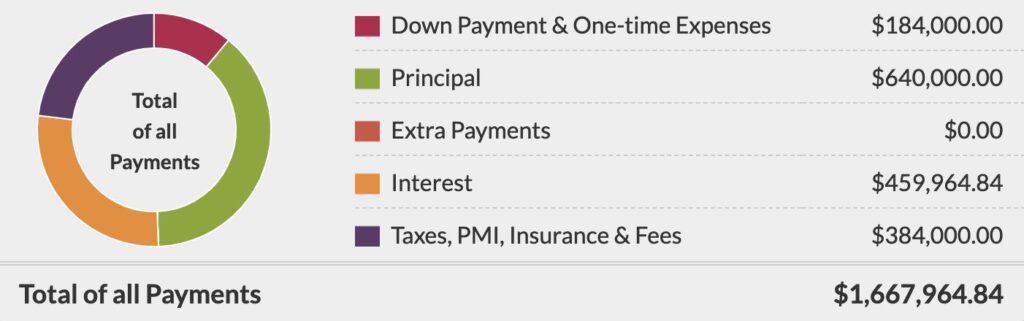

And, if you look at the total cost of the loan over 30 years, you will need to pay nearly $1,700,000. That is a pretty big number for a one bedroom house in a state that has the highest income tax rate and cost of living in the entire United States.

Now, this is assuming that you are single with no spouse or kids, and you are buying a one bedroom home. Imagine if you were married, had kids, and needed to buy a home with more bedrooms. Just to buy an average home, you’d need to be pulling in well over $200,000 and that doesn’t include the downpayment you’d have to come up with.

To be fair, high salaries are quite common in the San Francisco Bay Area, which is the reason why the real estate market there has skyrocketed in value. There is a simple cause and effect… people make more money, so they can spend more, so sellers can charge more.

But, if we look at real estate as an investment… this is NOT the market you’d want to be in. Especially if you’re trying to accumulate cash flowing properties that will actually make you money in the long term.

I’ll try to avoid the debate of whether or not it’s a good idea to buy your primary residence or not… However, it’s important to note that most wealthy individuals rent their primary residence and own real estate that they receive cash flow from. The rationale is that the house that you personally live in is an expense, just like owning a vehicle or buying food. Real estate that you own should be rented out to tenants so it can provide you cash flow.

There are lots of details that go into this concept, but the overall picture is clear. Wealthy people (especially wealthy real estate investors) usually rent their primary residence and only own real estate that is providing them cashflow.

Another thing to consider when investing in real estate for cash flow is the actual appreciation that the property will have. If you can purchase real estate that provides monthly cash flow and at the same time is also appreciating in value, that’s a great deal!

However, if you are investing in real estate that is providing low monthly cash flow yield while at the same time is losing value, that’s something you’d want to avoid. And if we look at the San Francisco real estate market, it should make you raise an eyebrow:

Source: Trulia

Will real estate values continue to increase? Maybe. But ask yourself how much upside is left? And is it a better idea to look in other markets that can provide higher yield and more upside potential?

Of course, I’m positioning this conversation to make real estate investing in San Francisco look like a horrible idea. There may be some opportunities here and there, but overall, the upside potential is much less likely compared to the downside risk.

So, where do you look?

As I mentioned earlier, there are definitely pockets of opportunity throughout the world in real estate. However, if you’re just starting out or don’t have hundreds of thousands of dollars to dump into down payments, you’re going to find it very difficult to start acquiring cash flowing real estate.

What you need to find is a location that has:

- Low barrier to entry. Basically, inexpensive real estate that can be purchased easily.

- Real cash flowing real estate. This means that the real estate must cash flow from day one. Do not plan on making money from property appreciation alone.

- Upside potential. This is the biggest variable and one that is impossible to control. However, it’s a better idea to invest in an improving market where values are going up, versus a deteriorating market, where values are peaking or going down.

When you are able to find a location that offers each of the above three characteristics, you must be able to act. This is the exact reason why I regret not investing in more cash flowing properties when the opportunity was SCREAMING in the United States.

However, one missed opportunity doesn’t mean there isn’t another one around the next corner. And that’s exactly what exists in Colombia right now. Inexpensive real estate that cash flows with huge upside potential.

We’re going there in a couple months to explore this opportunity and we’re going to show you real properties that you can buy and get you in touch with the people who can make it happen.

We already have dozens of people confirmed to join us and we will need to cap the total number of people who join for obvious logistical reasons. Register here if you’d like to join us.