If you ever want people to stare at you strangely, just walk through the DFW airport with a surfboard.

It’s not the first time I’ve done it, but I guess the Texas mind cannot comprehend that their state is home to one of the best wave pools around.

However, Texas will not hold this title for long. Around the world there are over 70 wave pools under development and there are huge investment opportunities for those who understand the bigger picture.

I made a video to explain why an investment into a wave pool is very interesting.

Just think, golf country club with enormous annual membership dues and super fancy real estate… except replace golf with surfing.

Wave pools will never top Mother Nature’s big unpredictable waves… but I was still able to pull off a turn or two in Waco.

Anyway…

The reason I was in Texas was to speak at the Passive Investor Event, which is put on by my buddy Keith. There were about 200 HNWI’s in attendance which I’m sure will double in size next year.

That’s because the event was so well run and attracted such high quality people… And because we’re planning on some really exciting additions for next year’s 2025 event, which already has reserved dates (Oct 24, 25, 26).

In addition to my presentation on international investing (which I will share once I have the video), my friends Swen Lorenz and Chris Pavese also took the stage.

Swen (of Sarnia Asset Management) and Chris (of Broyhill Asset Management) shared a similar, and stunning, observation with me…

The event attendees were shockingly under allocated to inexpensive stocks. In fact, some people who owned millions of dollars worth of real estate had zero exposure to stocks at all!

Now, to be fair, there are sayings about ‘staying in your lane’ and ‘investing in what you know.’ Typically, the best investors focus almost exclusively on themes that they have a deep understanding of.

However, considering how undervalued many equities are right now – especially in contrast to US real estate – I think it’s CRAZY to be in a single asset class.

During my presentation, I shared dozens of investing ideas that I think are super compelling right now.

Two such examples are coal and platinum.

I made a video about coal that gives all of the details (short explanation = coal is rediculously cheap right now, has super high yield, and has known demand far into the future).

I’ve also talked about platinum in the past (short explanation = platinum somehow got decorrelated from gold about a decade ago, which means that platinum needs to nearly triple in price to catch up).

Moving on, keep an eye on this:

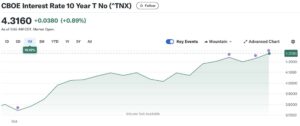

The 10 Year Treasury Note is up over 15% in the past month!

This is despite the Fed lower rates by 50 bps, AND media narratives that have been projecting a lower interest rate environment.

It has long been my opinion that interest rates will continue to be higher for longer. That’s because the long term trend of lowering rates (from 1980 – 2020) have reversed course after bottoming in 2020.

The answer to how high rates will go: Yes.

Cheap, ignored, forgotten, and cyclical assets are set to BOOM.