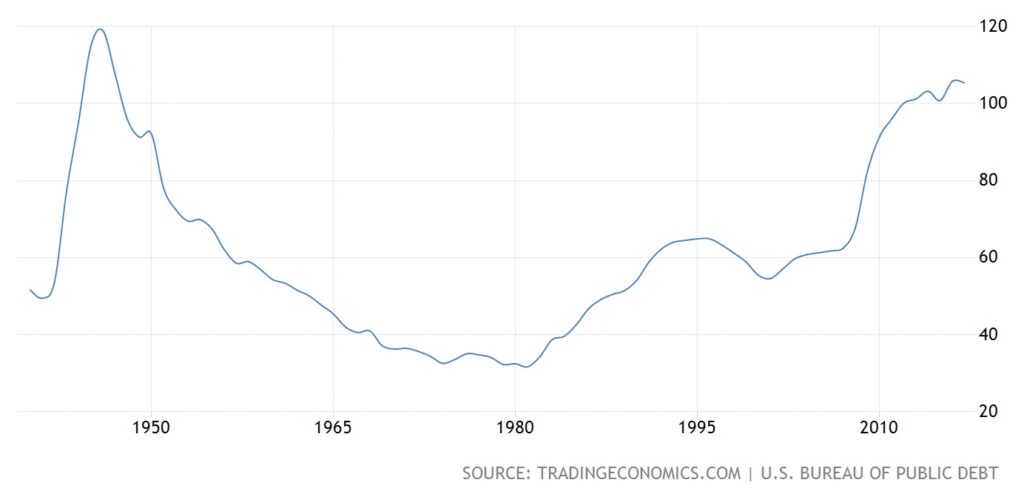

As you might have seen in the news, the US national debt just passed the $22 trillion mark. That adds up to nearly $200,000 of debt for each US tax payer, which appears to be a number that will never be paid off.

But, does that even matter?

I’m not for a second going to encourage any person, company, or country to look at a debt as a good thing. However, the truth is that utilizing debt in the right ways can add significant leverage to most financial situations.

Back to the debt burden that the US has created… $22 trillion is a number that is literally impossible to comprehend. Our brains cannot properly quantify a number that large as we can’t imagine a physical representation of that amount.

Even though the US debt situation sounds bad, do you know the total value of US assets? That number is over $150 trillion, which is a number that is even more difficult to visualize.

Source: TE

My point with all of this is that there is much more that goes into the simple debt number. Just like any company, there are liabilities, assets, interest on debt, income, and dozens of other metrics that need to be looked at when understanding the ‘true’ value.

And, when we look at these numbers for countries, there are even more variables to take into account. Things like population growth, average age, life expectancy, and social service liabilities all determine what the future of a specific country looks like.

Many of the world’s leading countries (in terms of GDP) have older populations with lower birth rates, which suggests that future generations will not be able to create as much. Conversely, many struggling countries (in terms of GDP) have very young populations with higher birth rates, which suggests that there will be a larger work force that will be able to create more. (Younger populations with higher birth rates also statistically have more conflict and war.)

Everything that I’ve mentioned above is a perfect example of why we just don’t know what the future will hold. There seems to be an infinite amount of data points that one can point at and say, “Oh, this country is in trouble because they have massive debt.” Or, “This country is going to be successful because they have a well educated population.” (For example, Cuba has the one of the highest literacy rates in the world, implying that their population is financially successful.)

And while we don’t know what the future will hold, we do know what the past looks like. By observing trends of recent history, we can strategize what opportunities look best for the future.

How likely is it that the United States will collapse next year? I mean a full-on total collapse where there is no law and order, no food, and everyone is at war… what are the odds of that? Pretty low, right?

That’s because the US has an incredible amount of systems, organizations, and structure that work relatively well. If you go into a supermarket in the US, you can pretty much buy anything you can think of at a very reasonable price. If you go to a government office to get things done, you’re going to have to wait in line, but you’ll generally get things done without having to bribe someone. The chances of these types of things changing in the immediate future are very low.

If we look at other countries, like China or the rest of Asia, there are very similar trends that won’t be ending any time soon. A hard working labor force, massive production capacities, leading technology innovations, and incredibly efficient export channels are all not going to change tomorrow.

The same can be said for areas of the world that are in trouble. Change doesn’t happen over night. It takes time.

We all like to hear stories about how Brexit is going to make the UK disappear, or how Trump is going to turn the US into a third world country, or how China is going to collapse. Are any one of those things possible? Sure, anything is possible.

But, what is most likely going to happen?

Things take time to change and the current trajectory of most countries is going to be consistent for the foreseeable future.

That is why I am personally extremely bullish on investing in Asia. With the world’s largest and fastest growing middle class, there are massive opportunities for investors and entrepreneurs to become extremely successful. Demographic trends take generations to change, and the current trends throughout Asia are blatantly clear.

Even if all of Asia had a massive financial crisis, people still need to eat, use transportation, consume goods, and be entertained.

All of the noise that we hear everyday about the US trade war with China is just that – noise. Do you think in 10 years the population in the US or China will change their living habits because of a trade war? Maybe there will be little things… but people in the US will still buy clothes to wear and people in China will still buy food to eat.

Our world today has the longest life expectancy ever, the highest quality of living ever, the lowest rate of conflict ever, and the fastest rate of technological advancement – EVER.

Invest in those ideas. Not the noise that gets jammed down our throats by entertainment news outlets.