He was on the outside patio smoking like a chimney when we walked in the front door of the house.

“Who is smoking!?” My wife asked.

“Oh, that’s Rick. He’s outside,” replied our neighbor.

We had just arrived at our neighbor’s house for a Christmas party. There were kids running around, presents under the Christmas tree, and a full spread of holiday food on the kitchen counters. Meanwhile, Rick was sitting outside by himself puffing away on Marlboro Red cigarettes.

“Why is he smoking? He never smokes… is there something wrong with him?” My wife asked.

“I’m not sure,” said our neighbor, “Maybe he’s under a lot of stress. I have no idea.”

I didn’t think much of it. The holidays are stressful for people and the end of the year brings a lot of realities to a head, which are sometimes very difficult to deal with. Plus, being around family (and friends) for an extended amount of time can test even the most patient of people!

As the night progressed, the usual holiday party traditions took place… One of the kids made another kid cry, someone spilled wine on the carpet, and everyone ate more than they should have. Normal holiday stuff, right?

Later on in the evening, I went outside to talk with Rick. I wouldn’t call him a close friend, but I know enough about him to understand that he is a very intelligent man. After retiring from a government job about 10 years ago, he took a relatively small amount of money he had saved and has grown it to millions of dollars by trading options.

His strategy involves selling options in the tech sector. Now, if you don’t understand how options work, that’s OK. The important thing to know is that by selling options, many traders can earn a great income. However, when things go wrong, they can go really, really wrong.

Rick told me that he has lost $4 million in the past two months.

I didn’t pry too much, as I can imagine exactly what happened. I assume that he was using the same strategy that he has used for the past ten years… which also coincides with the timing of the start, and now probable finish, of the longest bull market in modern financial history.

Put in simpler terms: Rick’s strategy to make money, that has worked wonderfully in the past, involved betting that the FANG stocks would continue to get traded higher and higher. But then his bets didn’t work anymore.

As we enter 2019, there are probably many stories similar to Rick’s. Maybe they don’t involve trading options, maybe they don’t involve millions of lost dollars, and maybe these similar stories haven’t even happened yet.

But, one thing is for sure: Things are changing.

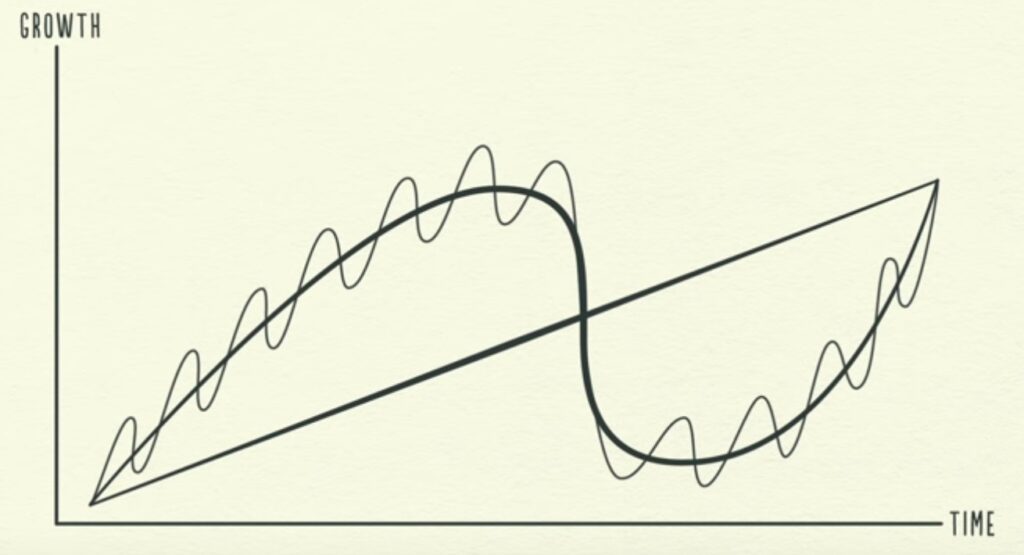

Now, that might not be the most groundbreaking news you’ve heard so far this year. However, even the most novice of investors should see what is happening before our eyes. It’s all about cycles.

The simple idea is that you should buy when things are cheap, sell when they are expensive, and then just repeat the process. Easy, right?

Well, no. It’s incredibly difficult for most people.

Here’s the problem: Most of us operate with pack mentality. We follow other’s ideas, we look to others for direction, and we rarely ever act without some sort of outside guidance.

It’s very difficult to go against the herd. Making tough decisions that are in sharp contrast to the majority is what separates extremely successful people from the average populous.

But, just going against the crowd for the sake of being different does not guarantee success. You have to know where to look and how to take action, regardless of how outsiders are trying to influence you.

Here are two ideas to think about, with each idea leading to hundreds of different investments:

- Invest in (almost) anything that is currently inexpensive in US dollar terms.

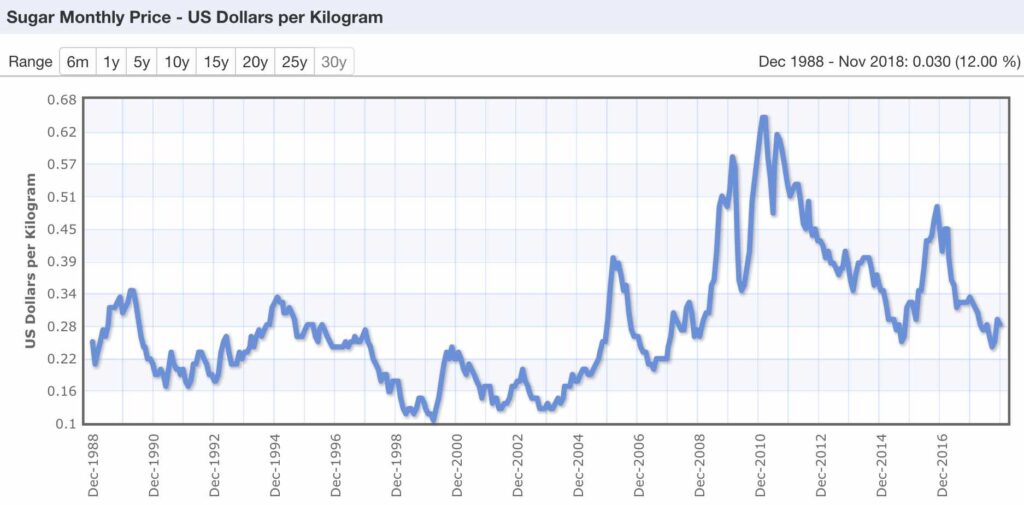

There are dozens of investments that are currently trading at, or near, historical lows. For example, just look at the price of sugar.

Which way will the price of sugar go? Well, nobody knows for sure, but there is significantly less downside risk in investing in sugar compared to the broader stock market.

The same can be said for wheat, uranium, corn, silver, and many other commodities. That’s because when the US dollar is strong, most commodities are inexpensive in US dollar terms.

(The quick explanation here is that the US dollar is used in global transactions of most raw materials. Most raw materials are grown/mined in countries outside of the US and are extremely dependent on the consumption of those raw materials by a strong global economy. So, when the US economy is strong, the US dollar is powerful, which means that prices on raw materials can be driven down. Conversely, when the US economy suffers, the US dollar loses buying power, which allows producers of raw materials to demand more US dollars for their product.)

Another great investment to look at is real estate that is priced in currencies that are weak compared to the US dollar. Currently, most weak currencies are from countries that are major commodity producers (see above explanation).

We will be traveling to Colombia to look at real estate investments from May 30 – June 2, 2019. You can email here to be put on our waiting list.

2. Avoid (or short) any companies that have significant debt.

This is a tougher investment, as the upside potential isn’t as clear. Still, the general thesis is easy to understand.

If you watched the cycles video that is linked above, then you’d understand the credit cycle. Over the past ten years, the world has seen a tremendous amount of credit creation which has in turn lead to the expansion and (sometimes false) success of many companies.

Going forward, if the cost of capital becomes more expensive to borrow, then many companies are going to run into some very difficult times. That’s because there are many companies out there right now that are surviving only because of their ability to borrow money.

In fact, some of the biggest companies in the world right now aren’t even profitable! They are literally spending more money than they are making, all in an attempt to grow as fast as possible to beat their competition.

So, what happens when they can’t borrow money anymore? And what happens when the cost of the money that they have already borrowed goes up? Big problems.

–

Looking forward to 2019, we’re going to run into some major obstacles. Exploding world debt, a slowing economy, and the ending of a cycle all point to the end of this ten year party.

However, more conflict and volatility just means more opportunity. So, for the short term, just save your money, be patient, and wait for things to come to you.

In the words of world famous investor Jim Rogers: