Sir John Templeton is one of the most famous investors to have ever lived. His claims to fame include everything from buying stocks at the bottom of the great to depression to shorting the dot com bubble.

At the time of each of his investments, people thought he was crazy. Templeton pursued opportunities that most people were avoiding, which resulted in him making huge returns in the long-run.

Templeton has been labeled many things. Value investor, contrarian, and fundamental analysis investor were just some of the many categories that people tried to put him into.

While it’s true that he fit into each of those categories, his investing techniques can be summed up in a much more generalized way:

John Templeton knew when to swing hard when he saw a fat pitch.

In the investing world, a ‘fat pitch’ is exactly what it sounds like. It’s an opportunity to make enormous gains from an investment that is very compelling. It’s also usually an opportunity that most people are avoiding or just not noticing.

One of his most noticeable fat pitch investments happened at the very end of his career, when he shorted the dot com bubble and profited $80 million. (Which he unfortunately did not live to see the full result.)

He used a variety of different observations to finally realize that shorting the US stock market in the late 1990s was a fat pitch. Three of the most obvious things he noticed were:

- Valuations. Many internet company stocks were trading for astronomical valuations, which led to the entire market eventually being valued beyond a reasonable level.

- A new type of investor was coming to the market. Just as those internet companies started to become popular, many consumer investors started to trade stocks online. This meant that there was a very big investor group (who knew very little about how to value a public equity) that all of a sudden was buying every flavor-of-the-month with a couple clicks of a mouse.

- Insiders were going to liquidate. Near the height of the dot com bubble, there were companies going public everyday. These companies had many insiders (founders, executives, and employees) that owned a lot of stock in their company. Most of these people would sell their stock as soon as their six month lock-up period ended. That means that there would be a massive amount of selling all within the same time frame, which would flood the market with too many sellers and not enough buyers.

There were many other indicators that Templeton looked at, but at the end of the day he decided that this was a fat pitch, so he took a swing.

Of course, all of this is easy to see in hindsight. At the time, it was very difficult to understand what was going to happen. The internet (and everything that came with it) truly was a game changer. People thought that it really was ‘different this time.’ In the end, we know that it wasn’t.

Today, the obvious question is, “What’s our fat pitch?”

Well, there are a lot of them… you just have to know where to look, and most importantly, not be afraid to go against the crowd.

But, there is one fat pitch that is available right now that doesn’t involve going against the crowd… you just have to go against the government.

Cannabis, marijuana, pot, weed, or whatever you want to call it is our fat pitch.

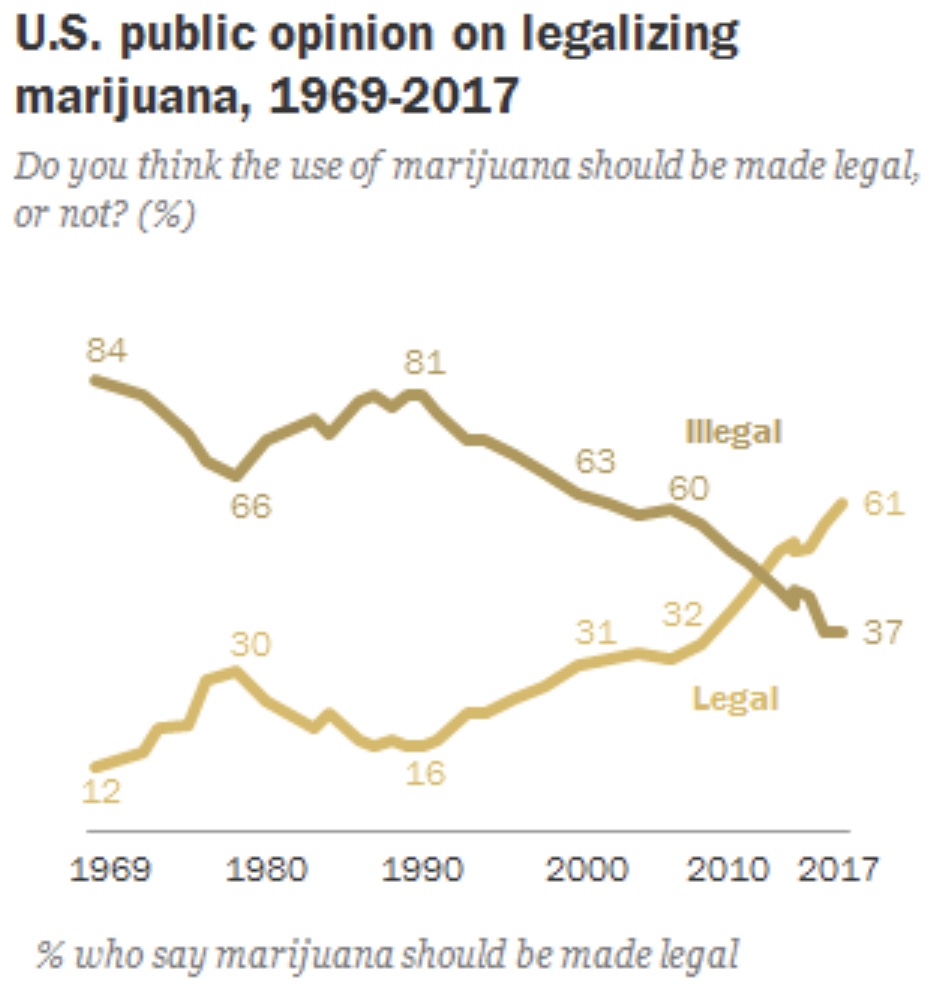

We know that public sentiment is shifting. We know that legislation is changing. We know that major deals are being made right now.

And we also know that institutional investors have not entered the market yet.

That means that you can invest right now in many different cannabis companies that have huge upside potential.

So, ten years from now, will you look back on this time and say, “Hmmm… I knew it as going to happen! Why didn’t I get involved?”

Or, are you going to say, “I am so glad I took a swing at that fat pitch!”