How To Beat The Stock Market In 3 Steps

Step one: Turn on your computer.

Step two: Open browser and bring up Yahoo Finance, Google Finance, or Bloomberg.

Step three: Get a baseball bat and beat the hell out of your computer.

That’s about as close as most people get to beating the market.

But seriously… let me show you why most people fail at investing… and then let me show you how you have a realistic shot at beating the market.

Where does the average person get their investing information?

Usually it’s from mainstream media sources. The Wall Street Journal, CNBC, Bloomberg, or Fox News.

Literally millions of people consume information from these media sources, so it’s not like any of the information is a secret. Because so many people consume this information, the actual content that is reported has low value.

I don’t mean the content is inaccurate, instead that it’s just not as valuable because there is no scarcity to the information.

When lots of people know something, then the actual value of that ‘something’ is diminished.

Let me give you an example…

Imagine your favorite local restaurant has the best food you’ve ever had. You love the place because it’s delicious and has reasonable prices. You go there all the time because you feel you’re getting a great value: great food at a fair price.

Now, pretend that your favorite restaurant gets featured in a huge news story. The story reports how great the food is and that everyone should visit the restaurant.

Pretty soon, the restaurant has a 2 hour waiting list, prices are jacked up, and the overall experience is completely changed. You are getting very little value compared to how it used to be.

This is because everyone has the same information about the restaurant. It’s no longer your local secret, which eliminates the value that you once found there.

Now, we can compare this to the market.

We can look at huge companies like Google, Amazon, or Verizon. These are all huge companies that produce great products and services. They will probably be very successful in the future and they are very well run.

But, they are all in the news everyday. Everyone knows what their balance sheets look like, everyone knows what new technologies they are developing, and everyone knows how much potential they have.

Because everyone knows these things, the stock prices reflect the future potential values. Will those stocks go up? Probably. But, the point is that as an investor, you are no more privy to information that the investor sitting next to you.

If you invest in just those companies you have a chance at beating the market. You also have a chance of not beating the market. Most likely you’ll be getting average returns, similar to the broader market. That’s because you are investing with everyone else – you are doing the same thing that everyone else is doing.

The reason why most people invest with the crowd is because it’s comfortable. It’s human nature to stick with the herd. People like to do the same thing that other people are doing because it means safety.

That’s how we’ve evolved and the idea of staying in the herd has literally kept us alive. It’s just like a herd of antelope running from a cheetah. The antelope that strays from the herd doesn’t have a very good chance.

But investing is not like a heard of antelopes getting chased by cheetahs.

It’s more like a flock of sheep…

Let’s imagine that you’re a sheep and you’re roaming around a huge field. Most of the sheep are bunched together for protection, grazing on grass.

While you’re grazing, you’re literally shoulder to shoulder with other sheep. It’s hard to find nice grass to chew on because everyone is trampling it and eating it. Plus everyone is taking a dump everywhere, so you’ve got to avoid their poop too.

Then there’s the black sheep that has strayed from the flock. All of the regular sheep in the big group are looking at the black sheep thinking, “What an idiot! He’s gonna get eaten by the wolf!”

Meanwhile, the black sheep is just mowing down all kinds of nice long green grass. There’s no piles of poop, the grass isn’t trampled, and there’s no competition.

That’s a little more like investing…

Of course, there is danger out in the open. When you stray from the crowd you are taking a risk. But, in investing, you are not going to die. There is no cheetah, wolf, or raptor that’s going to come eat you.

Investors who beat the market are overwhelmingly investing in areas that the crowd is avoiding. That’s the whole point, to invest where value can be bought for cheap.

In the crowd everything is expensive.

The key is to find those areas that are cheap. It’s definitely a lot of work to find these areas, but the returns are certainly worth it.

The hardest part about finding these undervalued areas is fighting your own mind. You must go against how your brain is programmed. You have to go against everything that your instincts are telling you to do.

You have to stray from the crowd and discover value on your own. That’s how you find value and beat the market.

–

If you’re thinking this is impossible, then let me show you something…

I didn’t go to school for finance, I never worked on wall street, and I am not certified by any financial institution.

I’m just good at finding value in obscure places.

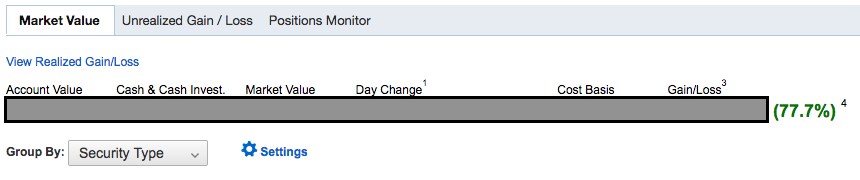

Here is my 2016 portfolio return:

Honestly, it was the best year I’ve ever had… but I’ve had many years of beating the market by a significant number.

And guess what stocks I invested in? Probably none you’re very familiar with.

Of course not all of them are winners. I’ve had some big losses too. But, there have been more wins than losses… something that you want in all parts of your life!