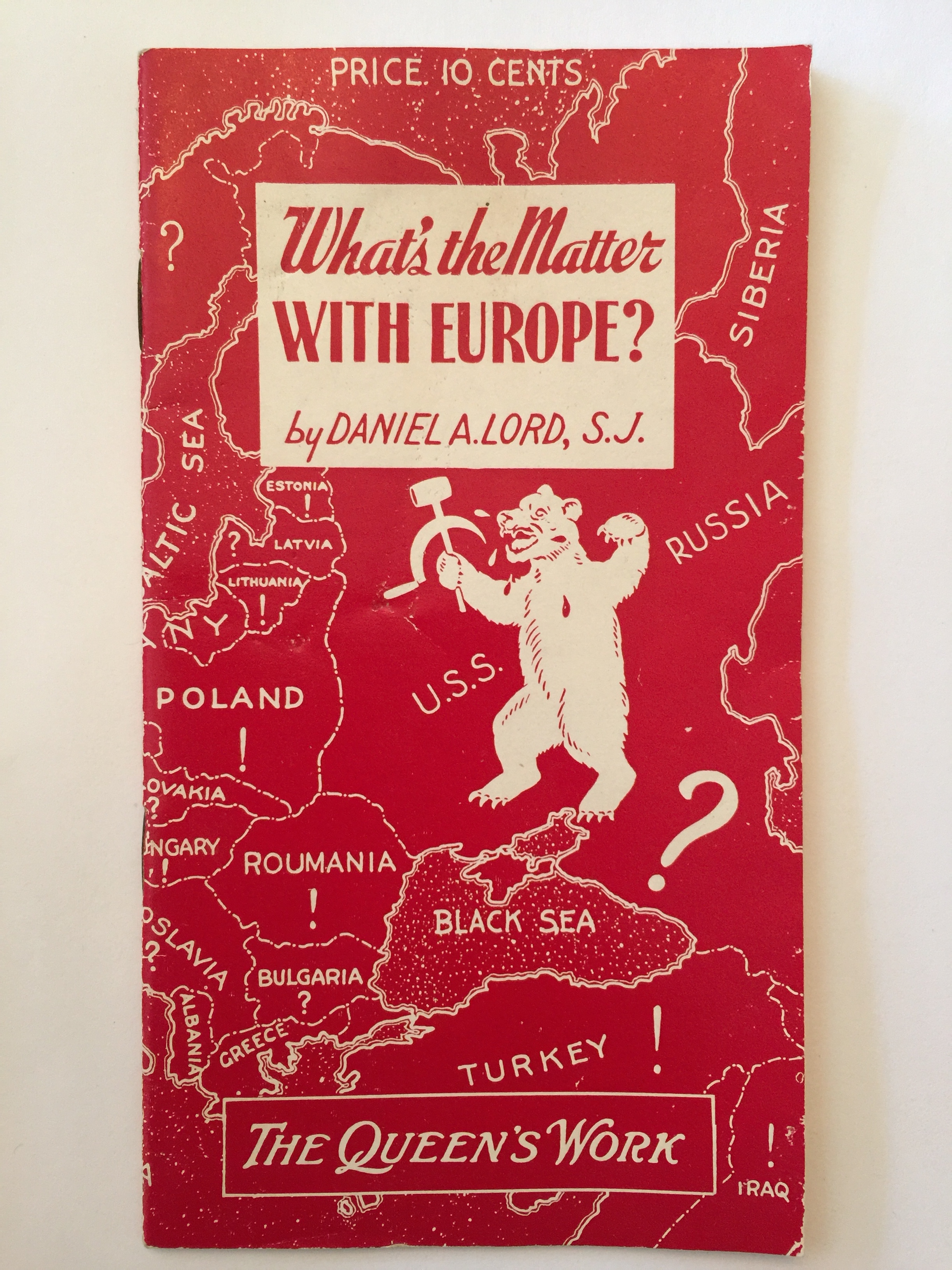

I came across a tiny book a couple weeks ago that I felt I had to share with you. It’s titled, What’s the Matter With Europe? At first I thought it was a spoof; a little book with jokes about Europe. But after I read it, I was eerily reminded about how history often repeats itself.

At first I thought it was a spoof; a little book with jokes about Europe. But after I read it, I was eerily reminded about how history often repeats itself.

Published in 1937, just prior to WW2, much of the writing sounds like it could have been written today.

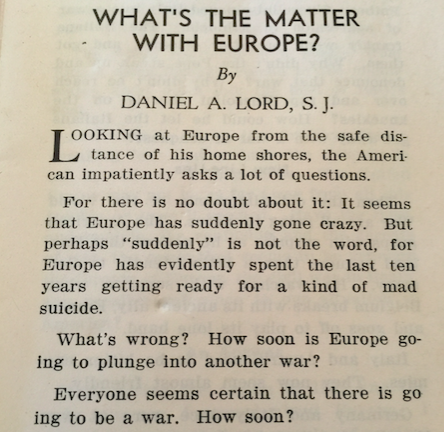

Just read the beginning of the book: Now, I’m not suggesting that Europe is on the cusp of a new war, but if we look at the financial system we can all say that “Europe has suddenly gone crazy.” Negative interest rates, banks on the brink of collapse, and future financial obligations that are unfunded are just the tip of the iceberg.

Now, I’m not suggesting that Europe is on the cusp of a new war, but if we look at the financial system we can all say that “Europe has suddenly gone crazy.” Negative interest rates, banks on the brink of collapse, and future financial obligations that are unfunded are just the tip of the iceberg.

Of course it’s easy for us to point out all the problems and be critical… but that’s not why I’m sharing this book with you.

The reason I’m sharing this book is just to show how cyclical our world is. You’ll often hear people say, “This time it’s different!” And maybe it is a bit different… we’re in a different year, there are different players, and there are different things at stake. However, the bottomline is that the cycles of booms and busts are nothing new.

This little book printed 80 years ago may have different details, but the story is almost exactly the same. Financial debt, immigration issues, social unrest, and a slowing economy are all a carbon copy to the events that lead up to WW2.

Again, I’m not predicting a war. But I am pointing to the remarkable similarities of Europe’s current situation to the time period in the 1930s.

An obvious difference today is that Europe is no longer just a bunch sovereign nations bordering each other, but instead a union; a European Union.

This European Union, which has only existed for a fraction of second in historical terms, is starting to show some cracks.

The first obvious crack was Brexit, where Britain voted to leave (exit) the European Union. This vote in itself was controversial and the actual exit hasn’t officially occurred.

However, the British pound, stock market, and real estate market were significantly impacted just days after the election results. Several months later, there has only been more volatility, especially for the British pound.

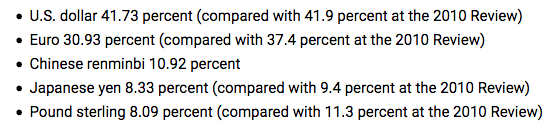

These wild swings and ‘flash crashes’ of the British pound are not isolated to Britain. If you remember, the British pound is a component of the SDR basket for the IMF.

In an article I wrote on September 28th, I explained how this basket of currencies works. But what happens when one of the world’s most stable currencies starts acting erratically?

Well, other currencies begin to get impacted. Just like Newton’s law of energy being transferred, the same theory can be applied to market sectors that begin moving wildly. Other sectors will absorb that energy and begin to act wildly themselves.

If we take a look at the recent change to the IMF’s basket of currencies, we’ll see that the British pound and the euro each dropped the most, relative to their original weighting in the basket. [Essentially, this means that the British pound and euro are becoming less important in the world economy – a bearish sign for both currencies.

[Essentially, this means that the British pound and euro are becoming less important in the world economy – a bearish sign for both currencies.

You can also see that the US dollar barely dropped at all; less than a quarter of a percent. Additionally, the US dollar has seen tremendous strengthening in relation to commodities and other currencies – a bullish sign.

Now as an investor, this should be an obvious situation that is beginning to set up. We can use strong US dollars to buy assets priced in weak British pounds or euros.

But, we’re not there yet as this trend is not even close to being done. The European region in general is in for a lot more volatility and the US dollar could see a lot more strengthening.

If you’re a British pound or euro holder, it may be time to start thinking of ways to preserve your wealth against a depreciating currency. Precious metals are an obvious hedge against this.

If you’re a US dollar holder, you can patiently wait. The strengthening of the US dollar will not last forever, but for now the upward trend is with the US currency.

A good technique to combat this situation that we’re in is called “dollar cost averaging.” This strategy consists of investing your money in assets over a period of time. So, instead of buying a bunch of gold all at once, you spread the purchase out over a longer period of time. This means that you will not always be buying at the same price and you won’t ‘put all your eggs in one basket.’

–

A last note on the precious metals market:

Because we are seeing the dollar strengthen even more, it’s possible that the precious metals market could decline in the short term (in US dollar terms).

If you’re already a holder of precious metals, don’t worry. Don’t panic sell. We may see a dip over the next month or more, but the long term trend is in our favor.

If you don’t have any precious metals, don’t feel like you have to run out today and buy some. You have a bit of time, although I would not be waiting until next year.