Baked In The Cake – Investing With Certainty

‘Baked in the cake’ is a term in the investing world that suggests something has already been accounted for.

For example, if we knew that Apple was going to release a brand new game changing product next month, then Apple shares would probably shoot up before the product’s release. This is because investors are valuing the company in the future, based off the information they know.

Similarly, this past week, many Italian bank shares fell sharply before the Italian referendum. A ‘no’ vote was very much expected and that was in fact the result.

Conversely, we’ve had unexpected events, like Brexit, which shocked the market. The British pound tumbled within hours of the vote. The Brexit vote was not baked in the cake.

Investment returns correlate to how much something is expected. People who shorted the market in the expectation of a Brexit vote made large returns, as their short was against the common opinion.

These types of trades are what investors look for. Large returns based off of an outcome that few are expecting.

Sometimes there are outcomes that are baked in the cake that few expect. This situation is a great investment. If you are relatively certain that something is going to happen, but the market thinks otherwise, you can make lopsided returns. Invest a little and make a lot, all with little risk.

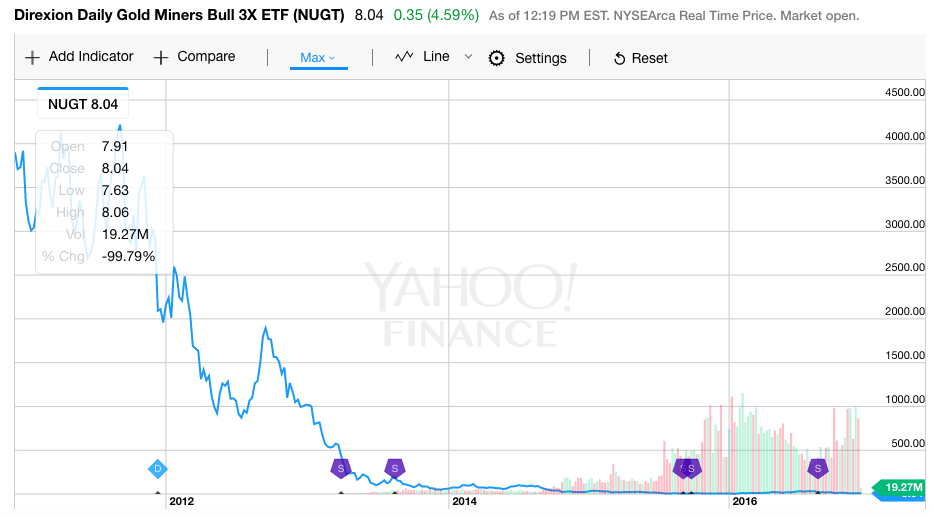

First, I want to show you a little something about leveraged ETF decay. It sounds complicated, and it actually is. But, the results are easy to see and understand.

The basic premise is that leveraged ETFs will lose value over a long period of time. There are lots of complex mathematical explanations for this, although these charts illustrate the results best.

Here is the chart for $NUGT, which offers 3x the return on gold miners: We can clearly see that $NUGT is a horrible long term investment.

We can clearly see that $NUGT is a horrible long term investment.

But, what if we did the inverse of $NUGT? Meaning, what if we invested in a 3x leveraged short of gold miners? There is a stock for that too. It’s called $DUST, and it attempts to provide the exact opposite of $NUGT.

But, let’s look at the historical chart for $DUST: Over the long term, you’ll get the same horrible results. You can look at many other leveraged ETFs and see the same outcomes. This is due to the ETF decay effect.

Over the long term, you’ll get the same horrible results. You can look at many other leveraged ETFs and see the same outcomes. This is due to the ETF decay effect.

But, we can use this to our advantage. And there is one specific stock that looks particularly interesting to me.

The leveraged stock $URR attempts to replicate, net of expenses, the Double Long Euro Index.

But, if you’ve read my thoughts on the euro… I am not exactly positive on the long term outlook for the European currency.

So, if we understand the decay effect and we believe that the euro is going to decline even more… then shorting $URR seems like a no brainer.

It’s baked in the cake.

Even if the euro doesn’t lose value, we can simply look at the historical chart for $URR and see where it’s headed. If we look hard enough, these types of investments are everywhere. We can find outcomes that are baked in the cake and take full advantage.

If we look hard enough, these types of investments are everywhere. We can find outcomes that are baked in the cake and take full advantage.