David Kotkin, known as David Copperfield, is one of the most famous magicians ever.

He is the highest grossing solo performer in the world, with a total of over $4 billion in ticket sales. That makes him one of the top entertainers to have ever lived.

So how does he make so much money?

He tricks people.

Copperfield performs complex illusions that leaves the audience completely confused. Most viewers don’t know what to say other than, “That’s magic!”

Of course, we know that Copperfield is just a master of directing the audience’s attention to a certain area. While the audience is misdirected, he can make things appear or disappear.

Copperfield has developed his performances to be larger than life. But, at the foundation, everything is based on sleight of hand.

Sleight of hand is what we’ve all seen in close up magic performances. It’s where someone shows you a card trick with one hand, while at the same time, their other hand is taking off your watch.

Your attention is on the card trick, so you completely ignore the fact that your watch is being taken off.

Now, if I tried to do this, I would fail. You would notice me trying to take your watch off. Only the best performers (or thief’s!) can pull off these sleight of hand maneuvers.

Copperfield performing a levitation illusion on the Today Show.

What about investors? Can they pull off sleight of hand tricks?

Absolutely!

Some of the biggest, most successful investors in the world can completely shift markets based on what they say.

For example, Warren Buffett could say that he hates Coca Cola, which would probably send share prices crashing. Then when Coca Cola’s share price is down, he can go buy a bunch more.

Of course, that is an over-simplified example, as most major investors who do this are much more strategic with how they can manipulate markets.

But, essentially these big investors are doing the same thing as a magician. They are saying one thing while doing another. They are tricking you to focus on something, while they are taking advantage of something else.

Nowhere is that more apparent now, than with Asia.

(And specifically China.)

If you added up the populations of North American, South America, Europe, and Africa, it would be less than the population inside that red circle!

We hear all kinds of bad things about Asia. They’re currency manipulators, they make bad products, their government is corrupt, and on and on.

Is some of that true? Maybe.

But, the actions of some investors speak differently…

In no particular order, here are some major moves that are being taken right now:

- Ray Dalio’s hedge fund, Bridgewater Associates, is raising a large new China fund. Bridgewater is the largest hedge fund in the world.

- Jim Rogers, who co-founded the Quantum Fund with George Soros, has moved to Singapore. He says that China will be the most important country of the 21st century.

- Peter Diamandis, of XPRIZE, Singularity University, Planetary Resources, and Human Longevity Inc. fame, says that China is the next tech superpower.

- Gary Vaynerchuk, prolific entrepreneur, angel investor, and media giant, is just starting to make a big push into Asia.

- Venture funding has just reached over $15 billion for 2017 from investors outside of Asia, who are looking to deploy capital in early growth companies in Asia.

Are these investors pulling a sleight of hand trick on us?

No. Not directly. There’s nothing secret about what they are doing.

But… while many of us are hearing one thing, the reality is another.

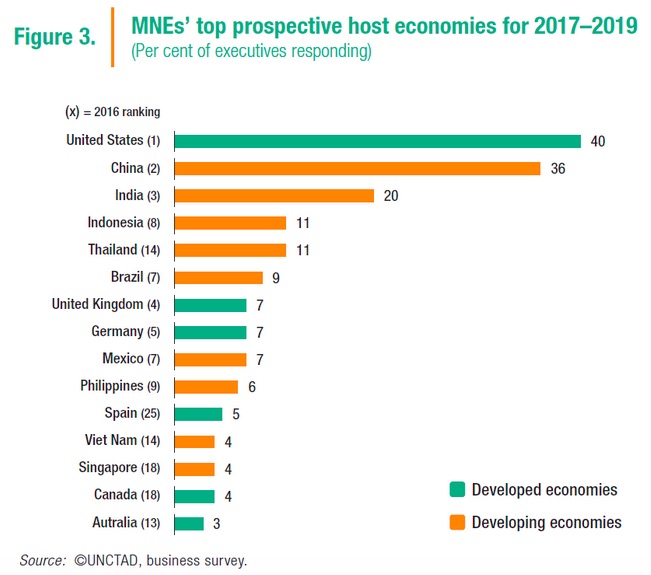

Source: WIR

MNE = Multi National Enterprise

Asia takes four of the top five MNE’s top host economies for 2017-2019. That’s saying something.

So what can you do? What should you do?

We’re still in the early stages of this trend, but the major players are already making their moves.

As an individual investor, if you simply start learning about investing in Asia now, you will be light-years ahead of the average investor.

Also, airfare to Asia (from North America and Europe) is unbelievably cheap right now. From Los Angeles, you can currently get a round-trip flight to Beijing for the same price as a round-trip flight to New York. That’s crazy!

If you want something more affordable (FREE!) then you should be attending the:

How to Invest in Asia Virtual Summit

Again, it’s free, and you can attend the summit virtually (i.e. from your own home). The lineup of speakers is unbelievable. But, the summit started today… so check it out now!