For some strange reason, many investors line-up to buy IPO’s. They can’t wait to sink their hard earned money into the next hot thing. But, do they know what they are actually buying?

Now-a-days, I don’t think they do.

Let me give you a little background… I’ve talked about this before.An IPO is an initial public offering, and is the first time that the general public can buy shares in a company.

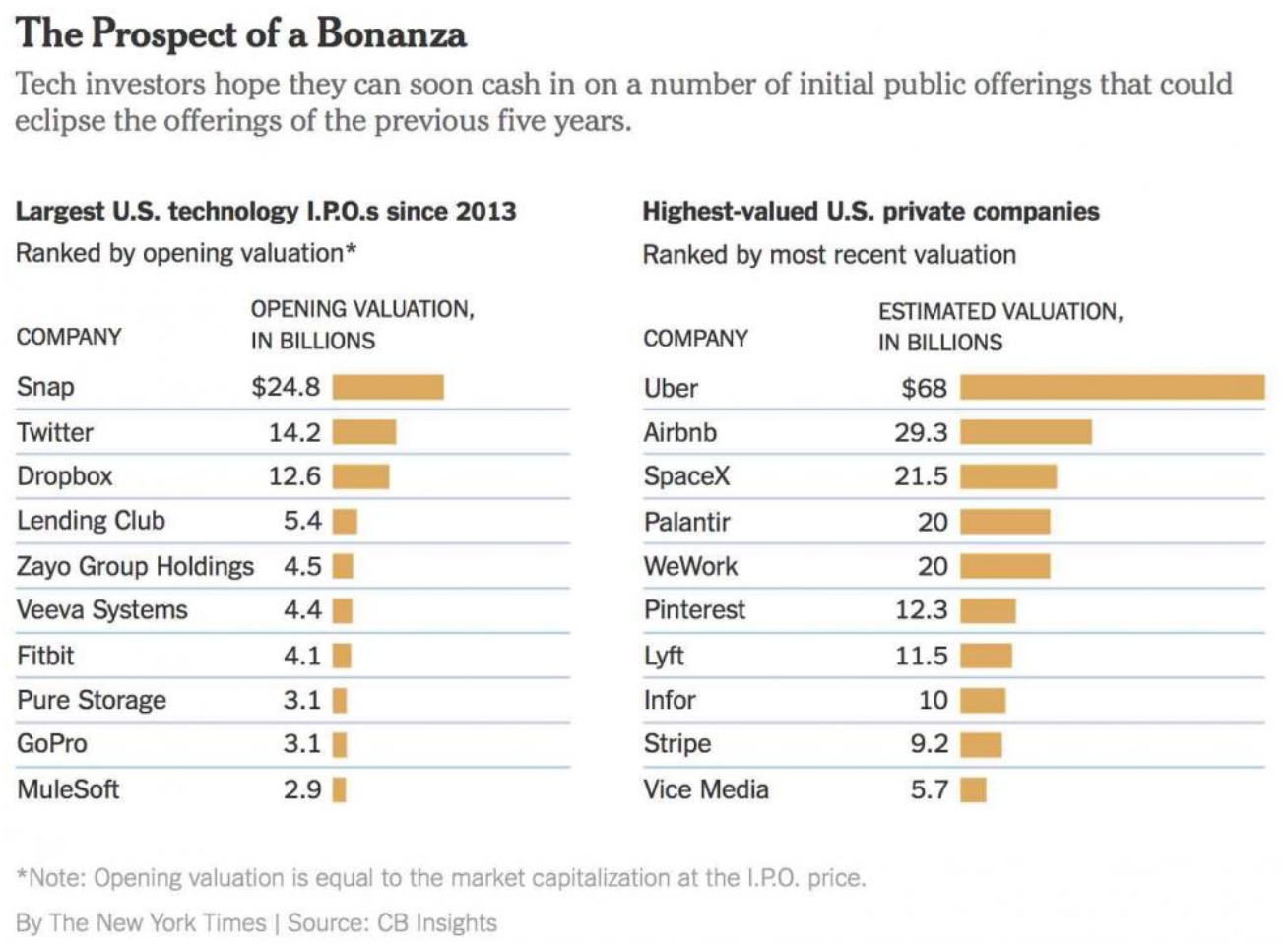

For the public, this sounds like an exciting thing. There are many private companies today that investors can’t wait to invest in, like Uber and AirBnB.

But, think about why a company would want to go from private to public. Why would they do that?

Going public involves a mountain of paperwork, auditing, and ongoing reporting requirements. And that’s not even including the millions of dollars it takes to go through the whole process.

So, why would a company go through all of that trouble? If a company is successful, it probably means that everyone within the company is making money, right? Why would they want to sell off part of their business to the public?

Well, there are a variety of reasons. The major reason is so the company can get liquidity… or rather, so the early company founders and investors can get liquidity.

“…the basic business of finance is buying low and selling high, and it is sometimes hard to resist the secondary cynical explanation for going public, which is that you do an IPO to top-tick the market for your stock and sell at the very high point of hype.” -Bloomberg

Think about that for second, if you are buying an IPO. As an investor, you are literally putting money into the pockets of those early founders and investors.

That isn’t always a bad thing. There are many, many companies that have gone on to be very successful after their IPO. Investors who bought those companies are very happy, as those stock prices have continued to go up.

But, there is another side. How do you know why a company is going public? Is it so they can get more capital into the business so they can continue to expand? Or is it because they are simply trying to cash out at the public’s expense?

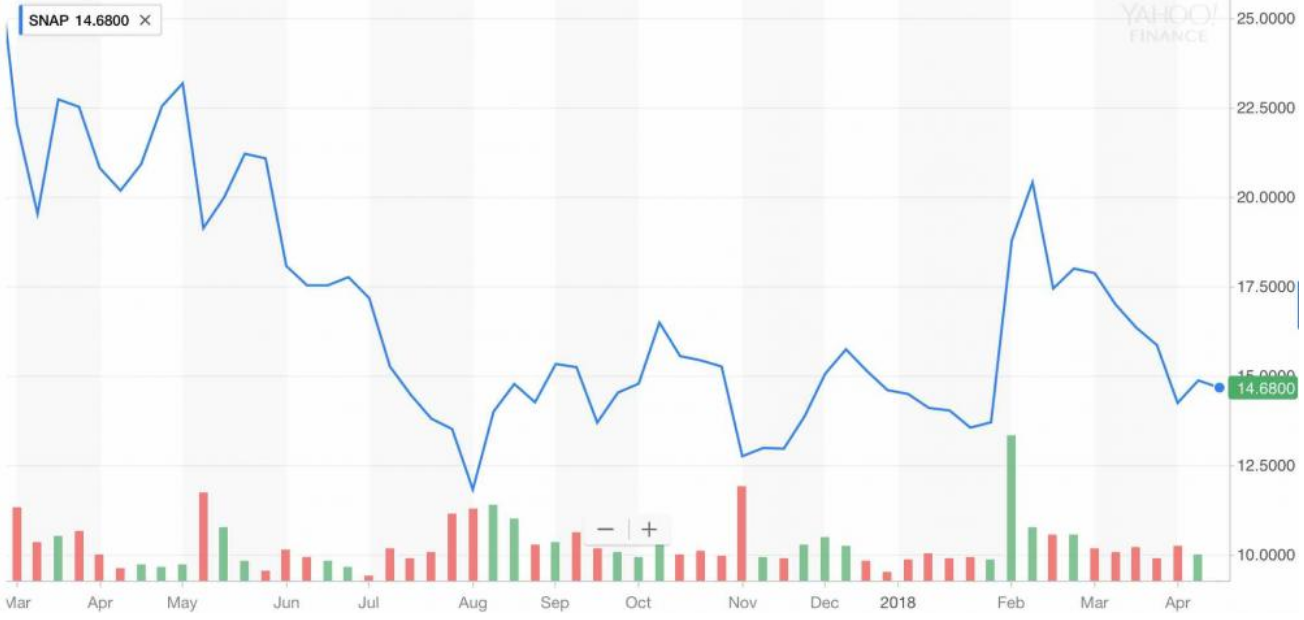

Let’s look at tech company $SNAP as an example.

Since IPO’ing in early 2017, the stock has been a complete disaster… but not for the founders. CEO Evan Spiegel was awarded $750 million in stock, just for getting the IPO done. That doesn’t include all the other equity that he owned… and the $272 million of stock he sold in the IPO. (That’s over $1 billion that he earned because of the IPO.)

Maybe $SNAP will recover. Maybe Spiegel will be able to justify his massive liquidation event in a couple years. Or maybe he’ll just walk with a mountain of money… we shall see…

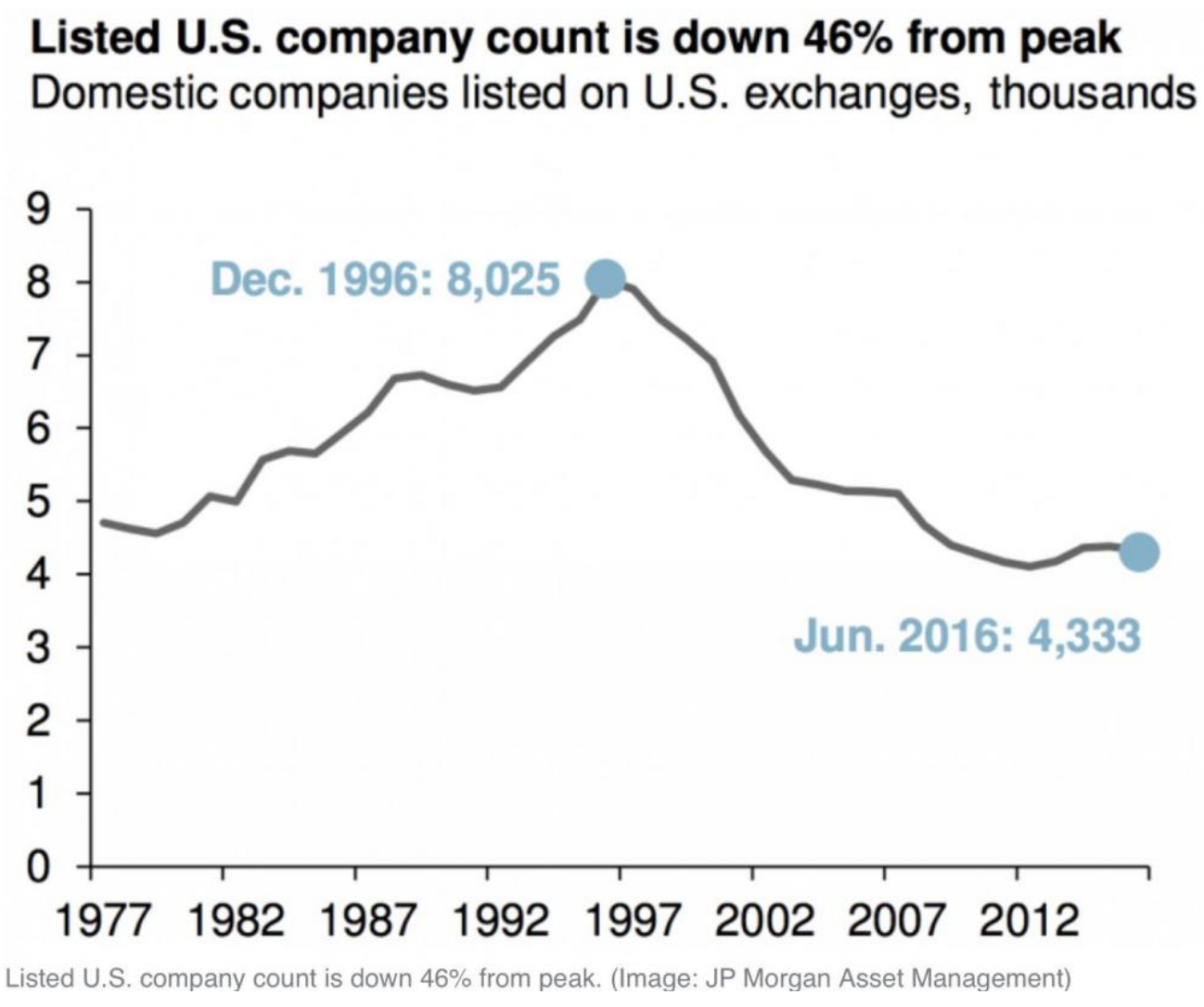

Now, there are not too many other recent examples similar to $SNAP’s. And that is mostly because there haven’t been as many IPO’s.

In addition to regulatory burden, companies have been able to raise significant money in the private markets because of low interest rates and private investment firms being flush with cash.

However… “That finally may change. Investors, bankers and analysts said they expected a wave of initial public offerings to bring some of the most highly valued and recognizable start-ups to the public market over the next 18 to 24 months — and billions of dollars in returns to their executives and investors. The potential bonanza would follow years of waiting as a few dozen companies amassed valuations without precedent in the private market.” – NY Times

As our economy gets further into this record-long bull market, private companies will know that it’s ‘now or never’ when it comes to their IPO. They understand that they need to go public in order to get their liquidity event. They need to offload!

Of course, the public will be there to provide that exit. Traditional investors will line-up out the door to own shares in tech behemoths who have only been available to exclusive insiders.

For you, as an investor, you need to ask yourself something: Are you investing in a company that has a lot more upside? Or are you investing in someone’s big exit?

If a new wave of IPO’s does in fact start to materialize, you’ll know exactly what is happening. Private companies will be trying to get money for their wild valuations before the environment of easy money disappears.