Currency Arbitrage – Make Money for Free

Currency arbitrage is just a fancy way of saying, “Buy something here and sell it over here for more.” You should start to take advantage.

Currency arbitrage is one of the easiest ways to make money, but it can also be extremely confusing. Basically, it’s taking advantage of the value differential of two different currencies.

Let me give you a real world example.

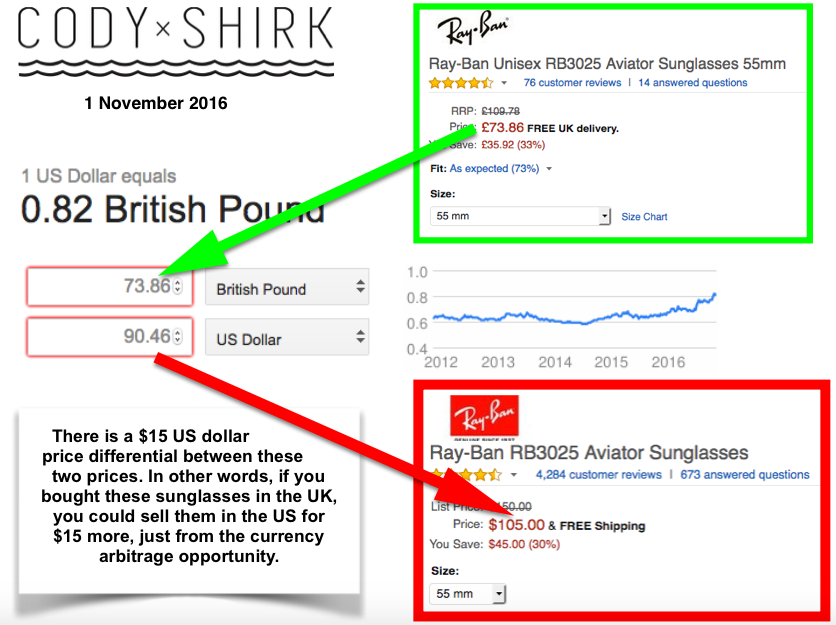

Ever heard of Ray-Ban sunglasses? They are probably one of the most famous eyewear makers… here is one of their models, the RB3025 Aviator:

You’re thinking, “So what?” The British pound has always been stronger than the US dollar.

You’re thinking, “So what?” The British pound has always been stronger than the US dollar.

But… do you remember that event called Brexit? It’s where Britain voted to exit the European Union, and since then the British pound has plummeted in the currency market.

Here is what those glasses look like priced in US dollars: And, here is a full-size layout so you can see the real opportunity here (click for full size)

And, here is a full-size layout so you can see the real opportunity here (click for full size) Now, this is an example we can all clearly see and understand. But, we’d have to sell a lot of Ray-Ban sunglasses to really make a significant amount of money. Plus, if we did buy a whole bunch of sunglasses in the UK, we may be sitting on inventory we can’t sell – the ‘carry-fee’ would mean our money would be sitting in sunglasses that aren’t earning yield.

Now, this is an example we can all clearly see and understand. But, we’d have to sell a lot of Ray-Ban sunglasses to really make a significant amount of money. Plus, if we did buy a whole bunch of sunglasses in the UK, we may be sitting on inventory we can’t sell – the ‘carry-fee’ would mean our money would be sitting in sunglasses that aren’t earning yield.

Let’s take this example to the next level, with Colombian real estate. You could replace the word ‘Colombia’ with many different countries such as Mexico, Chile, South Africa, or even Australia.

All of these countries are major commodity exporters, but have seen their currencies decline in value because commodity prices are so low. The US dollar, on the other hand, has seen significant strength and offers a buying opportunity for anyone holding US currency.

If we look at the five year chart of the Colombian peso to the US dollar, then we can see a low of about 1700:1 and a high of about 3400:1. Those two ratios coincide almost exactly with commodity prices.” From this information we can assume that the opposite will be true – when commodity prices become more expensive, the US dollar will lose strength. Or said the other way around, when the US dollar loses strength, commodity prices will become more expensive.

From this information we can assume that the opposite will be true – when commodity prices become more expensive, the US dollar will lose strength. Or said the other way around, when the US dollar loses strength, commodity prices will become more expensive.

However you look at it, the Colombian peso may go back down to 1700:1.

If we bought an apartment in Colombia for $100,000 when the exchange rate was 3400:1, but then we sell the same exact apartment when the ratio goes back to 1700:1, then we could double our money, even if the apartment itself doesn’t appreciate in value at all.

Additionally, the entire time we are waiting for the currency exchange rate to change, we are collecting yield from renting out the apartment – that’s our ‘carry-fee.’

Here is what the exchange rates look like when you are shopping with US dollars:

Recent Exchange Rate (when commodities are cheap and USD is strong) = 1USD : 3400COP

Apartment cost = 100,000 (USD) x 3,400 (COP) = $340,000,000 Colombian pesos

Historical Exchange Rate (when commodities are expensive and USD is weaker) = 1USD : 1700COP

Apartment cost = 100,000 (USD) x 1,700 (COP) = $170,000,000 Colombian pesos

BUT, here is the catch. See the cost of the apartment when the exchange rate was at 1:1700? The apartment cost $170,000,000 Colombian pesos. When the Colombian peso started to weaken, home sellers didn’t increase the price of their real estate because they are primarily selling to Colombian nationals.

That means that even though the current exchange rate is close to 1USD to 3400COP, that property would NOT be priced at $340,000,000. It would probably be priced at about $200,000,000 COP, which is about $60,000USD. So you would end up buying that $100,000USD apartment for only $60,000USD.

If you are holding US dollars, you can come in and buy Colombian real estate at a significant discount, just like the sunglasses example. And you get paid (the ‘carry-fee’) while you are waiting to sell the apartment when the currency exchange rates revert back to the mean.

This real estate example is much more confusing than the sunglasses example, but it’s essentially the same exact concept.

There is certainly risk in this type of investment, but there is also significant money to be made.

These are the situations I look for in investing because the average investor is either clueless as to what’s going on in international markets or too nervous to pursue a venture such as this one – whatever the case is, there is almost zero competition for me. The same applies to you, if you actually pursue these opportunities.